This is Swisslife most flexible and popular Assurance Vie saving account/investment product. It is an Assurance vie so it has all the advantages regarding French inheritance law, death duties and income tax.

- Who can invest in it: Anybody who is a French resident (and Monaco) and above 18 years old.

- How much can you invest in it: The minimum is 3 000€, no maximum.

- How is it invested: As you wish, all secured or all risky or a bit of both, it is up to you. The secure part is called Fond Euro and the interest of the secured part is given on the 31st of December each year. The rate on the secure part is around 0.8% and pretty much the same for every company. Shares/Funds can go up or down!! You can decide how much you want on shares so it could be all of it if you wish so. This assurance vie has more than 400 funds/shares available so loads of choices on investments.

- Investment socially responsible: Swisslife has a variety of funds which are classed as ISR which mean they have to follow some criteria based on 3 factors ESG:

Ecology: Management of waste, Reduction of greenhouse gas emission, Prevention Of environmental risk.

Social: Prevention of accident, Training of employees and equality of chances, Respect of employees’ rights and social dialogue, respect of subcontracting chain.

Governance: Independence of the board of directors, Quality of the governance of the company, remuneration of directors, effort in anti-corruption.

So, you can either choose some funds yourself that are ISR or choose the Gestion piloté which is Swisslife that choose and managed the ISR funds for you.

- Garantied death extra: This contract includes an insurance so that if you die before you are 80 years old, Swisslife gives to your beneficiaries at least the amount of the value of your contract when you invested (minus the amount you withdrawal yourself and maximum 1.5 million euro). This is automatically included in the contract. Egg: You invested 200 000€ on your account in 2018 and only have 174 800€ when you died (because your shares lost money), then Swisslife will give 200 000€ to your beneficiaries (minus fees and social charges) so reimburse the 25 200€ So, if the market crashes, you are sure that your heir will get at least what you wanted them to have.

- Options available:

- Securisation des performances: This is a very good option that means that when your shares/funds go up by 1 000, this gain is automatically transferred to the secure part of your Assurance vie. You can choose between 10% and 100% of gain but the gain has to be at least 1 000€. This is very good and some of my customers have appreciated this option when the market has crashed back in March 2020 (Covid). Indeed, the gain they made the previous year had been transferred to the secure part of the Assurance vie so the loss was less.

- Dynamisation progressive du capital: Some of you might be not too keen to invest all your eggs at once in case you are investing it all just before a crash (so at its highest) so Swisslife has come up with an option in which your capital is invested over a period of your choice :6, 9,12,18 or 24 Months. So that you are investing at different stages of the stock market value. This option is also available when you make another deposit, not just when you open the investment. This is free.

- Arbitrage: This is the French word for switching from one fund to another. With Swisslife you are entitled to one free per year but can do as many as you want. So, if you are not happy with a fund, you can switch at any time you want.

- Gestion piloté: If you are not willing to trust me or yourself to choose your funds, you can let Swisslife manage it for you. You can choose between 6 types of investment between very low risk to high risk. Swisslife re-adjust the investments following their own expert advisers, so you have nothing to do. You can also choose to have both, meaning some part of your investment on “gestion piloté” and some on Gestion libre (as you wish).

- Securisation du capital: You can choose to make sure that your beneficiaries will get at least the amount you have invested to start with so 100% or 120% of what you have invested. So, if the market crashes, you are sure that your heir will get at least what you wanted them to have or more! You invested 100K but lost 10K, you die, then your beneficiaries still get 100K and not 90K.

- Stop loss option: This is an option that means that when your shares/funds go down by at least 1 000€, the fund is automatically transferred to the secure part of your Assurance vie. You can choose between 10% and 100% of loss but the loss has to be at least 1 000€.

- Fees:

- Entry fees: The entry fee is normally 4.75% of the amount invested but I am very nice, so I negotiate. If you invest at least 30% in shares, there is 0.5% entry fee! whatever the amount. If no shares at all, 2.5% entry fee.

- Management fees:65% of the investment per year on the secured part (Fond euro). And 0.96% on the investment made of shares/Funds.

- Option fees:

-0.70% per year for the Gestion profile option (0.70% on the shares amount).

-0.1% of the amount transferred + 15€ administration fee for the securing of the performances.

-0.1% of the amount transferred + 15€ administration fee for the stop loss option.

-0.20% of the value of the shares/fund for switching shares/funds + a 30€ administration fee. Note that you are entitled to one free per year, so the fee is only taken if you have done one already.

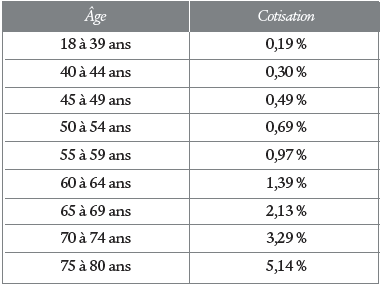

- Garantied death extra: The fee is calculated Monthly (end of each Month) and it is a percentage (depending on your age) of the capitaI loss. If we take the same example as per paragraph 4 and you have a capital loss of 25 200€. You are 50 years old, then the fee is 25 200×0.69% divided by 12=14.50€. This fee is then taken at the end of the year. This fee is only taken if the capital is at loss. Here are the percentages per ages:

- Adding money to it: You can add money to it at any time but a minimum of 1 500€.

- Regular withdrawal: You can set up Monthly, quarterly, twice a year or once a year automatic withdrawal which go directly to your bank account. This is free.

- Regular deposit: You can choose to do regular deposits (Monthly, quarterly, twice a year or once a year) so the amount you choose to add to your assurance vie is taken automatically from your bank account. The amount is 100€ min per Month.

- Availability: The present amount on your assurance vie is always available. So, the money is never blocked. There are no penalties for taking your money out, but tax may apply if you have made a capital gain. Note that there is a 30 days cooling period when you open an Assurance vie (same for every companies) so no money is invested for the first 30 days.

- French law: When you open a new assurance vie, there is always a 30 days cooling period before your money is invested.

Conclusion: The advantages of the Assurance vie savings account are well known and it is no secret that it is the preferred investment for French people not only because of its advantages but also for its flexibility. But even if Assurance vie investments offer the same envelop with every company (same advantages in regard to French inheritance law and tax and income tax), it is important to notice the little differences and therefore shop around before making a decision. They can be different from one company to another and not just the entry or management fees!

And remember to check out our web site www.bh-assurances.fr/en for all my previous articles (“practical information”) and register to receive our monthly Newsletter. You can also follow us on Facebook: “Allianz Jacques Boulesteix et Romain Lesterpt”

And don’t hesitate to contact me for any other information or quote on subject such as Funeral cover, inheritance law, investments, car, house, professional and top up health insurance, etc…

Contact us !

In order to discuss and meet your need as best as possible, feel free to contact us with a mail, phone call... We can also schedule a meeting in one of our four agencies... Or directly to your home !