Like any other top up, premium is simply based on age, level of cover and postal address. Yes, for some reason, it is more expensive if you live in Paris or Bordeaux compared to Angoulême!!

There is no health questionnaire. You get a Tiers payant card (piece of paper in fact) that prooves you are insured. You can check your reimbursment, send quotes and bills and reprint your card directly from your Allianz online customer account.

I have on the spreadsheet below detailed 5 types of cover and premium for someone born in 1953 so 69 years old and living in the Charente. This example includes a 10% discount as a customer (meaning this person already has another contrat with us, either car or house, etc). Other level of cover are available!

ECO COVER

What does it cover: This cover is the basic cover at pretty much everything at 100% of the CPAM set price. It is the cheapest basic cover as it does not include the 100% santé reform.

What it does not cover: Well, it does not cover surcharges, medicines that are only reimbursed 15 and 30% by CPAM and other perks such as individual room, alternative medicine, etc. Also, it might not be enough cover to reimburse fully your glasses and teeth treatment if these are complicated. It also does not include the new reform of 100% santé so if you want hearing aid, glasses or crowns covered by the new reform, do not choose this cover.

CONFORT COVER

What does it cover: This cover is the basic cover at pretty much everything at 100% of the CPAM set price and also include the 100% santé reform so covers hearing aid, crowns and glasses.

What it does not cover: Well, it does not cover surcharges. Also, it might not be enough cover to reimburse fully your glasses and teeth treatment if these are complicated and above the new level of cover set by the French government via the 100% santé reform. It does include the 100% santé reform.

LEVEL 2 COVER:

What does it cover: This cover is basically either 125% or 145% cover on mostly everything.

What it does not cover: Surcharges made by consultants and specialist (if above 125 or 145%). Also, it might not be enough cover to reimburse fully your glasses and teeth treatment is those are complicated and above the new level of cover set by the French government via the 100% santé reform.

SERENITE HOSPITAL COVER

What does it cover: This cover is the best cover for hospital and also up to 125 euro per day for an individual room and 100% for the rest plus some perks.

What it does not cover: Surcharges made by consultants and specialist (for consultations). Also, it might not be enough cover to reimburse fully your glasses and teeth treatment is those are complicated and above the new level of cover set by the French government via the 100% santé reform.

GOLD COVER

What does it cover: This cover is the best cover for hospital and everything else.

What it does not cover: Not much really!! Although you still might have to pay surcharges on tooth implants.

| This quote is presented by Allianz via BH Assurances. The guarantees include the reimbursement paid by the Social Security. | Someone Born in 1953 | ||||||||

| ECO | CONFORT | LEVEL 2 | SERENITE | GOLD | |||||

| Hospitalisation | Level 1 | Level 1 | Level 2 | Level 1 Strenghten | Level 4 Strenghten | ||||

| Contribution to hospital accommodation expenses (forfait journalier) | Real cost | Real costs | Real costs | Real costs | Real costs | ||||

| FEES | |||||||||

| Flat-rate contribution | Real cost | Real costs | Real costs | Real costs | Real costs | ||||

| Medical and Surgical fees | |||||||||

| – Doctor part of the approved convention | 100% | 100% | 145% | 400% | 400% | ||||

| – Doctor not part of the approved convention | 100% | 100% | 125% | 200% | 200% | ||||

| Cost of stay in hospital (surgery, psychatric, maternity…. Wards) | |||||||||

| Daily hospital charge | 100% | 100% | 125% | 400% | 400% | ||||

| Private room (per day) included day-in surgery | 30€ / Day | 40€ / Day | ay | 125 € / Day | 125€ / Day | ||||

| Patient Transportation | 100% | 100% | 125% | 400% | 400% | ||||

| Surgical procedures as an outpatient | |||||||||

| – Doctor part of the approved convention | 100% | 100% | 145% | 400% | 400% | ||||

| – Doctor not part of the approved convention | 100% | 100% | 125% | 200% | 200% | ||||

| Cost through accompanying the patient (limited to 20 days per hospitalisation) | 10€ / Day | 15€ / Day | 40 € / Day | 40 € / Day | |||||

| TV/telephone/WIFI (limited to 20 days per hospitalisation) | 5 € / Day | 5 € / Day | |||||||

| Treatment or Procedure | Level 1 | Level 1 | Level 2 | Level 1 | Level 4 | ||||

| Radiology, medical procedures, blood test ( Doctor not part of the approved convention) | 100% | 100% | 125% | 100% | 200% | ||||

| Radiology, medical procedures, blood test ( Doctor part of the approved convention) | 100% | 100% | 145% | 100% | 300% | ||||

| GP and specialists consultations (Doctor not part of the approved convention) | 100% | 100% | 125% | 100% | 200% | ||||

| GP and specialists consultations (Doctor part of the approved convention) | 100% | 100% | 145% | 100% | 300% | ||||

| Medical auxiliaries and diagnostic tests | 100% | 100% | 125% | 100% | 300% | ||||

| Ambulance (Outside hospitalisation) | 100% | 100% | 125% | 100% | 300% | ||||

| Vaccination | 100% | 100% | 100% | Real costs | Real costs | ||||

| All supplies and devices reimbursable by social security ( Orthopedics…) excluding optical and auditory. | 100% | 100% | 125% | 100% | 300% | ||||

| SPA therapies covered by the Statutory Scheme | 100% | 100% | 125% + 75€ | 100% | 200 % + 200€ | ||||

| Medicines reimbursed by the SS at 65% | 100% | 100% | 100% | 100% | 100% | ||||

| Medicines reimbursed by the SS at 35% or 15% | 100% | 100% | 100% | 100% | |||||

| Complementary (alternative) medicines not reimbursed by SS | NO | YES | YES | YES | YES | ||||

| Medically-prescribed medicines | 50 € | 60 € | 50 € | 70 € | |||||

| Alternative treatment: Etiopathy, nutritionist, acupuncture, osteopahy, chiropody, pedicure, psychologist, homeopathy, ergotherapist, physiotherapy, cryotherapy) | 100 € | 100 € | 100 € | 100 € | |||||

| Tests, radiology, ultrasound (ex: amniocentesis) | 50 € | 50 € | 50 € | 50 € | |||||

| Prescribed sports / health application subscripition/connected devices ( bracelet, tensiometer, glucometer) | 30 € | 30 € | 30 € | 30 € | |||||

| Prescribed vaccination | Real costs | Real costs | Real costs | Real costs | |||||

| Optical** | Level 0 | Level 1 | Level 2 | Level 1 | Level 4 | ||||

| (**) Maximum reimbursement in the limit of one optical equipment (lenses + frame) : -Per two year period, -Including the maximum reimbursement for the frame at 100 € Except for under 16 and in the event of a change in vision defect for those over 16 (in these two cases, the period between two reimbursements is reduced to one year) |

|||||||||

| Equipment 100 % Health scheme (class A) | |||||||||

| Lenses from class A | 100% | Real costs | Real costs | Real costs | Real costs | ||||

| Frame from class A | 100% | Real costs | Real costs | Real costs | Real costs | ||||

| Equipment from class B (outside the 100% health scheme) | |||||||||

| Frame | 100% | 30 € | 40 € | 30 € | 60 € | ||||

| « Simple correction » lense (price is per lense) | 100% | 35 € | 55 € | 35 € | 95 € | ||||

| « Complex or very complex correction » lense (price is per lense) | 100% | 85 € | 95 € | 85 € | 120 € | ||||

| Contact Lenses (approuved or refused by the SS) | 100% | 100 € | 150 € | 100 € | 250 € | ||||

| Adjustment service | – | 100% | 100% | 100% | 100% | ||||

| Advantage « Santéclair partner » Bonus per year of insurance for lenses | 25 € | 25 € | 25 € | – | |||||

| Cover limit (outside the 100% health scheme) per insured person and per year of insurance for the optical equipment and contact lenses( incuded Santéclair bonus) | 30 € | 350 € | 300 € | 450 € | |||||

| Surgery to correct myopia, astigmatism, hyperopia and implant for the cataract : lump sum per eye | – | – | 150 € | ||||||

| Hearing Aids | Level 0 | Level 1 | Level 2 | Level 1 | Level 4 | ||||

| Maximum reimbursement cover for one device per ear every 4 years. | |||||||||

| Equipment 100 % health scheme (class I) | 100% | Real costs | Real costs | Real costs | Real costs | ||||

| Device from class II (outside the 100 % Health Scheme) | 100% | 1 € | 200 € | 1 € | 400 € | ||||

| Batteries | 100% | 100% | 125% | 100% | 300% | ||||

| Advantage « Santéclair Partner bonus » on the device from class II (from the 01/01/2021) | Real costs within the limited Sale price of the Class I | Real costs within the Limited Sale Price of the class I | Real costs within the Limited Sale Price of the class I | Real costs within the Limited Sale Price of the class I | |||||

| Dental | Level 0 | Level 1 | Level 2 | Level 1 | Level 4 | ||||

| Treatment and protheses (crowns) from the 100 % health scheme | 100% | Real costs | Real costs | Real costs | Real costs | ||||

| Treatment | 100% | 100% | 125% | 100% | 200% | ||||

| Protheses such as crowns | 100% | 125% | 150% | 125% | 250% | ||||

| Orthodontics covered by the Social Security : | |||||||||

| – Treatment per semester | 100% | 100% | 100 € | 100% | 300 € | ||||

| – Retention : maximum reimbursement per year of insurance | 100% | 100% | 50 € | 100% | 150 € | ||||

| Dental care not reimbursed by SS | |||||||||

| Implant, Periodontic, Orthodontia and other dental dentures | – | 100 € | 300 € | ||||||

| 1 implant from our « Santéclair dentist » per insured and per year of insurance | – | 1 200 € | 1 200 € | ||||||

| Monthly premium | 50,94 € | 71,74 € | 83,68 € | 80,67 € | 134,82 € | ||||

| Annual premium | 611,24 € | 860,88 € | 1 004,21 € | 968,08 € | 1 617,80 € | ||||

FAQ:

When does the cover start: Straight away. Although the level of garanty for HOSPI and SERENITE is limited the first 6 Months (200% instead of 400% for transport, Medical and surgical, 80 euro instead of 125 for the individual room).

What about pre-existing conditions: There is no health questionnaire, so they are covered.

Can I upgrade or downgrade the level: Not the first year but any time after that, yes.

Does the top up cover me abroad: Only if CPAM does. It is a top up not a private health insurance.

How do I cancel it: On the anniversary date each year or if you leave France, we need proof of your address abroad. Or now with new law at any time once the first year has passed.

If you already have a top up but not with us, we will do the cancellation for you, so you have nothing to do.

When you have your carte vitale: When you visit your GP or other medical professionals, you first give them your carte vitale and then you pay. The reimbursement is then automatically done by CPAM and Allianz is linked with CPAM by the “télétransmission” so the top up from Allianz follows within 10 days of CPAM reimbursement.

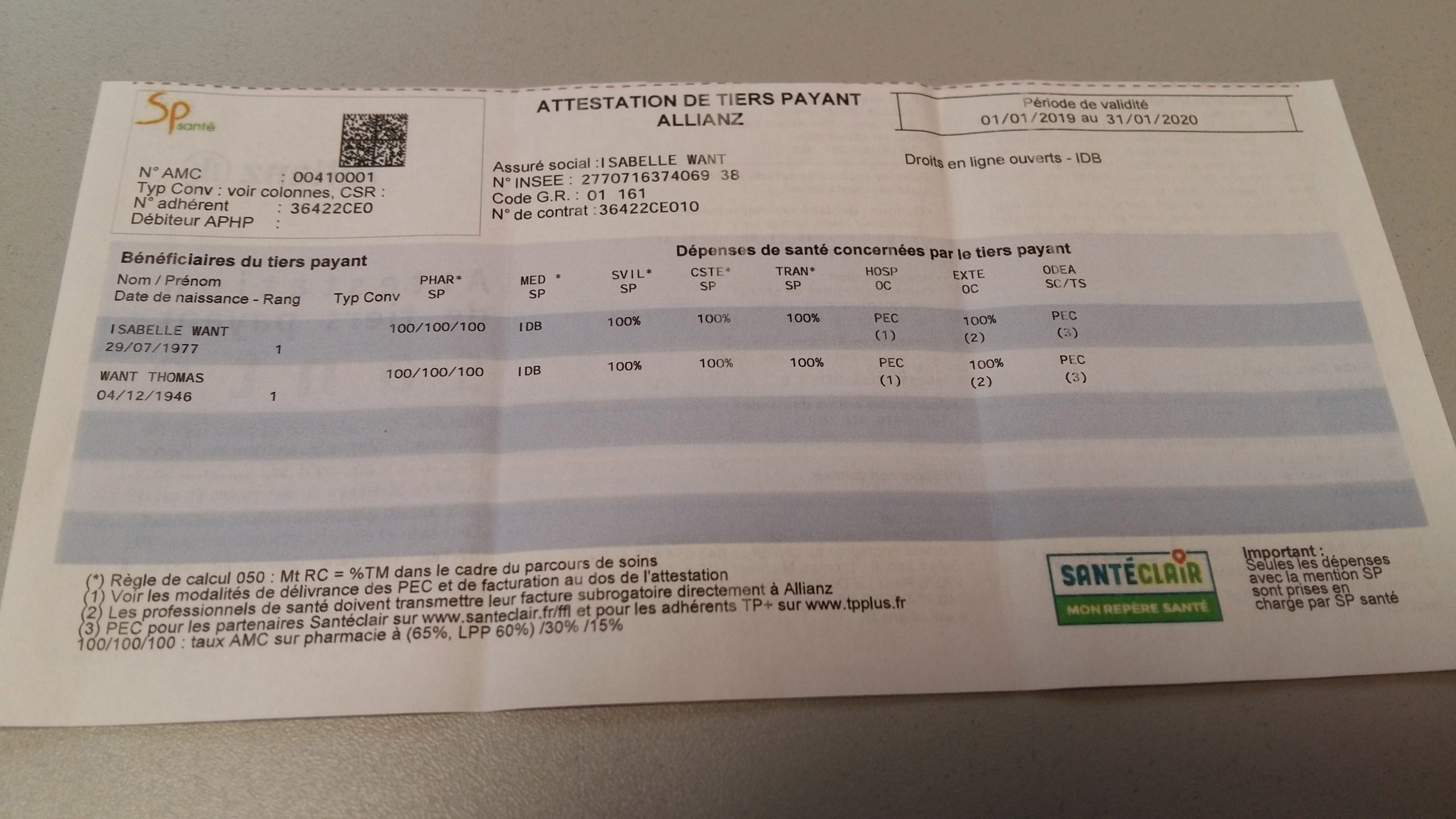

Tiers payant card: That is your top up card. This card does not show your level of cover. It simply proves that you have a top up and gives information to the medical profession in case of a “prise en charge”- this is when the top up pays instead of you.

You can download it from your Allianz customer account.

Contact us !

In order to discuss and meet your need as best as possible, feel free to contact us with a mail, phone call... We can also schedule a meeting in one of our four agencies... Or directly to your home !