- This is an assurance vie created by Allianz for people who have less than 30 000€ to invest or want to put some money into it every Month. It has the same advantages as an assurance vie regarding death duties and income tax.

- Who can invest in it: Anybody who is French resident between 18 and 85 years old.

- How much you can invest: You can invest as little as 100€ per Month or as little as a lump sum of 5 000€.

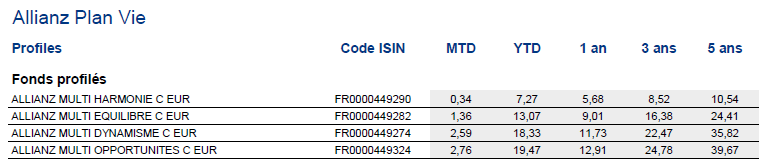

- How it is invested: They are 4 main funds available from the more Prudent (3 of out 7 in the risk scale) to the riskier (5.5 out of 7 in the risk scale).

You can change from one fund to another at any time. And you can also mix one or more funds like 20% on low risk and 80% on medium to high risk.

- Performance: As of the 29th of February 2024 the lower risk has made +3,59% in the past 5 years and the higher risk +20,58% in the last 5 years. Allianz Multi Equilibre has made +11,23% in the last 5 years. Performances of the past are no promises for the future! And we have experienced quite a big loss in the market in 2022 so look at the long-term performances.

- Accidental death extra: This contract includes an insurance so that if you die in an accident before you are 85 years old, Allianz gives to your beneficiaries half the amount of the value of your contract on top of the value of your contract (maximum 1 million euro). This is automatically included in the contract and it is free. E.g.: You have 10 000€ on your account, then die of an accident, then Allianz will give 15 000€ to the beneficiaries named on your contract.

- Fees: Entry fee of 4.50% negotiable of course + 12€ admin fee!! And yearly management fees of 0.93%.

No fees or penalties for taking the money out.

- Availability: The money is available at any time. You can add to it whenever you want and make partial withdrawal (even regular Monthly or yearly) or total withdrawal whenever you want. You can access/monitor your investment online via your Allianz personal customer account. Even make the withdrawal yourself online.

With interest rates being at their lowest ever, it is imperative to look at alternative investments that would bring more income. Especially if the inflation goes above the % of interest you get. If this happens, you actually lose money without realising it! This product is good for people who want to take advantages of the Assurance vie savings account but do not have automatically a big lump sum to invest yet. Maybe just want to put money aside for your future pension or leave some money to grandchildren.

Allianz has a solvability ratio that is one of the best on the market at 174% for Allianz France and 200% for Allianz Group so do not hesitate to contact me for any further information regarding our very large range of investments.

And remember to check out our web site www.bh-assurances.fr/en for all my previous articles (“practical information”) and register to receive our monthly Newsletter. You can also follow us on Facebook: “Allianz Jacques Boulesteix et Romain Lesterpt”

And don’t hesitate to contact me for any other information or quote on subject such as Funeral cover, inheritance law, investments, car, house, professional and top up health insurance, etc…

Contact us !

In order to discuss and meet your need as best as possible, feel free to contact us with a mail, phone call... We can also schedule a meeting in one of our four agencies... Or directly to your home !