Most of you know that, in France, your children are only entitled to 100 000€ tax free on your death and that to increase this amount you can invest an additional 152 500€ in an assurance vie account. But did you know that the French government, to encourage people with wealthier assets to invest in the French economy has given an extra allowance for special Assurance Vie contracts?

- A small recap of the advantage of the Assurance vie saving account: I can hear some of you saying “2015 change of law!!” Well think again! As the changes of August 2015 will allow you to be able to choose the inheritance law of your country of birth (instead of French) BUT the tax will always be French tax so if you decide to leave some money to your nephew instead of your rightful children, your nephew would have to pay 55% after an allowance of 8 000€!

The assurance vie allows you to leave money to anyone you want and as much as 152 500€ per beneficiary! They are then taxed at 20% on what is above the 152 500€ euro instead of the % taxed otherwise (55% for nephews and nieces or 60% for others). Note that amounts above 700 000€ are taxed at 31.25%.

This is the perfect solution if you want to leave something to unrelated beneficiaries such as friends or step children, who would otherwise pay tax at 60%.

But this is also a good solution for leaving money to children as they can only receive up to 100 000€ each before death duties so with the Assurance vie, they can receive up to 152 500€ on top of the 100 000€.

Do bear in mind that if you are French resident, all movable assets come under French inheritance law so your savings in the UK will be subject to French inheritance tax and law.

Finally, note that it is better that all the money is put in before you are 70 years old as the tax advantage for the money invested after 70 is then 30 500€ for all beneficiaries combined instead of 152 500€ per beneficiaries.

- What is the bigger tax advantage with Allianz Vie Generation: This assurance vie gives an extra allowance of 20% of the total amount invested on top of the allowance of 152 500 euro per beneficiaries. See below example for an assurance vie with 1.5Milllion invested and 2 beneficiaries:

| Normal Assurance Vie | Allianz Vie Generation Assurance Vie |

| 1 500 000€ invested | 1 500 000€ invested |

| 750 000€ per beneficiaries | 750 000€ per beneficiaries |

| Still 750 000€ taxable | -20% allowance so -150 000€ (750 000*20%) so now 600 000€ taxable |

| -152 500€ allowance so 597 500€ taxable | -152 500€ allowance so 447 500€ taxable |

| Tax is 20% of 597 500€ so 119 500€ tax to be paid | 447 500€*20% so 89 500€ tax to be paid |

In this example the gain is 30 000€. Obviously, the bigger the amount invested, the bigger the gain. The gain is also higher if you only have one beneficiary. It’s basically double the gain.

- How is it invested: This Allianz Vie Generation assurance vie has to match certain criteria. First of all, it’s not secured, meaning all is invested in Funds. And at least 33% of the funds must be invested in

- Shares contributing to finance social housing

- FCPR (Fond Commun de placement à Risque- Funds that are not invested on the market)

- PME or ETI (Middle size entreprises)

- Shares in social care and solidarity

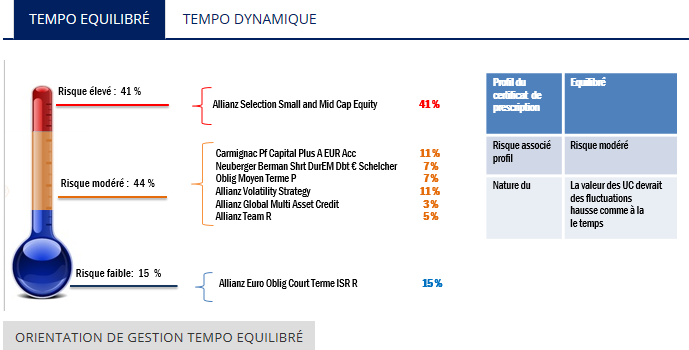

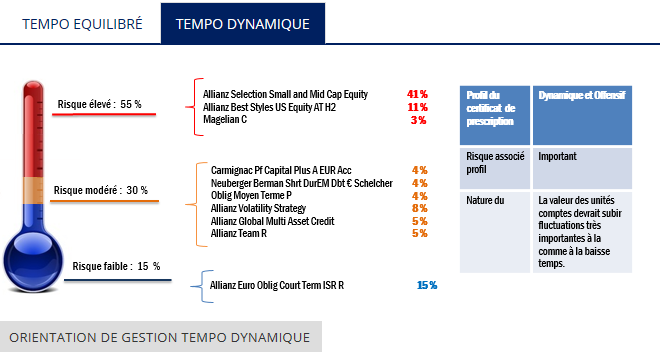

It is invested in two different managed funds; Allianz Tempo Equilibré and Allianz Tempo Dynamique. The second one being riskier than Equilibré -See below:

- Performances: Since the creation in 2014 Equilibré has made +26.70% and Dynamique +33.94%. In 2017 the return was +10.20% and +13.40%.

Criterias and fees, etc: Being a French resident and below 70 years old and having at least 200 000€ to invest. Entry fee is 0.50% plus a 12€ administration fee. 1.005% of yearly management fees. You can add money at any time and withdraw money at any time also. The money is not blocked (no fee for taking money out). You can even set up regular withdrawal from it (Monthly, quarterly or yearly). You can also change your beneficiary clause at any time.

Note that if you already have an assurance vie opened with more than 152 500€ in it, then the allowance is still 20% of the amount invested but without the 152 500€ allowance that you have already used on the other assurance vie.

To conclude, if you were always wondering how to reduce your death duties even more, this is definitely an investment to look at. So, don’t hesitate to contact me. Advice is free!

And remember to check out our web site www.bh-assurances.fr/en for all my previous articles (“practical information”) and register to receive our monthly Newsletter. You can also follow us on Facebook: “Allianz Jacques Boulesteix et Romain Lesterpt”

And don’t hesitate to contact me for any other information or quote on subject such as Funeral cover, inheritance law, investments, car, house, professional and top up health insurance, etc…

Contact us !

In order to discuss and meet your need as best as possible, feel free to contact us with a mail, phone call... We can also schedule a meeting in one of our four agencies... Or directly to your home !