In this issue :

- Isabelle Want’s Article of the Month

- Product of the mont

- This month’s recipe

- Agenda for December & Living in France

- What happened in France & Association of the month

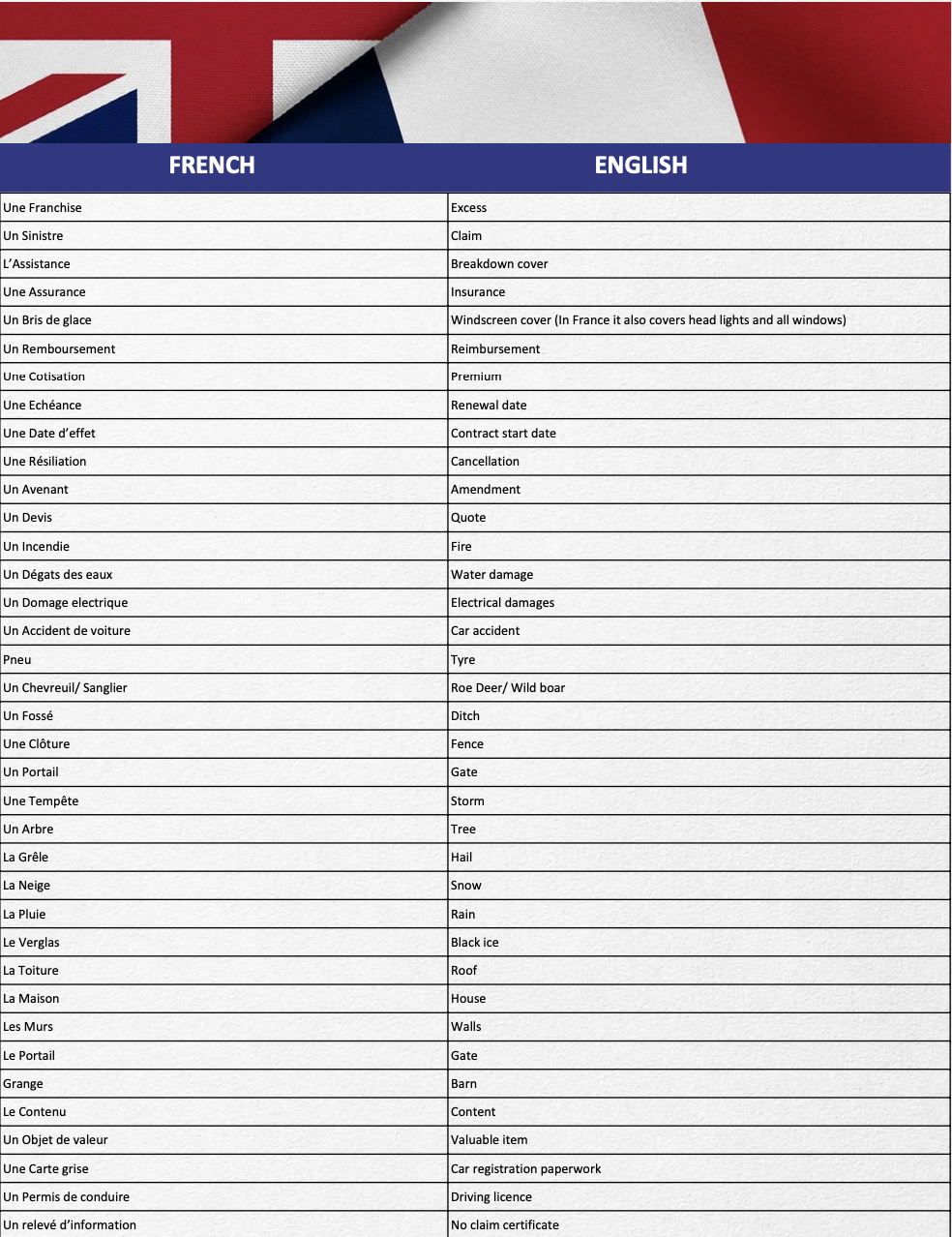

- Insurance French Vocabulary

ARTICLE OF THE MONTH

ETAT DE CATASTROPHE NATURELLE ET TECHNOLOGIQUE

YES! It’s that time of the year again when we start receiving the dreaded income tax form to fill in (from mid-April to Mid-May)! Despite monthly payments taken at source (prélèvement à la source), you still have to fill in a form!!

As the forms were not available at the time of writing this article, I have decided to give you a prelude

on French income tax. I will be explaining who must fill in a tax form, what revenue you have to declare, how the double taxation treaty works between France and the UK and lots of other information.

Next month, when the new forms are available, I will explain how to fill them in, in detail.

Who has to fill in the tax form:

Basically, everybody who is a French resident (lives in France more than 6 months per year) whether you are employed, self-employed or retired and even if you are obliged to pay taxes in the UK!

Also, non-French residents who have rented property in France.

If it is your first time, you have to go to the Trésor public office (tax office) and ask for the forms, which are available from the first week of May. Or you can download them from the tax office web site.

The reason we still fill in a form is because of tax advantages such as children, employing a cleaner, etc. If you have children or a spouse earning much less than you it will lower your taxable income as you are taxed as a family not an individual. Adults count as 1 point, the first 2 children as ½ point each and the

third child and so on as 1 point. You then divide the total revenue of the family by the number of points you have, to know what your taxable income is. Unmarried couples (and not pacsed) must fill in a tax

form each!

When:

You fill in a tax form one year after, meaning you declare your revenue of 2023 (Jan to Dec) in April-May 2024. So, if you have officially moved to France before July last year (2023), then you fill in your first

French tax form in April-May 2024 on which you declare your revenue of 2023.

If you moved to France after July, then you were not a French resident in 2023 (in France less than 6 months) and therefore, you will have to fill in your first French tax form in April-May 2025 for your revenue of 2024.

Since 01/01/2019, we are now taxed at source (Monthly amount taken from our current account or percentage of salary) and the amount was determined by the tax paid in 2023 for year 2022. The

form we fill in this year will determine if we have paid the right tax in 2023 and the new amount which will be taken Monthly from 01/01/2025. If you paid too much, they will reimburse you or

reduce your monthly payments, if not enough they will increase the monthly payments till the end of the year!

If you have moved to France in 2023, you will pay two years of tax: 2023 & 2024!! You will pay a bill for 2023 at the end of August in one go and have another bill for 2024 which will be taken monthly from September to December (amount of 2023 tax bill divided by 4). Then from 2025, monthly amounts (2023 tax divided by 12). You can fill in a form now to start paying those amounts monthly from now instead of from September (form 2043) which you can download from the tax office

website. Only do it if you think you will pay tax. For your information, the tax threshold for 2023 for a couple was around 25 000 euro.

Deadline to send or deposit your paper tax form is the 20th of May 2024. The online declaration deadline is the 25th of May 2024 for Departments 1 to 19 (Charente is 16), 1st of June 2024 for

Departments 20 to 49 and 8th of June 2024 for Departments 50 and above (Deux Sevres is 79 and Vienne 86).

What forms:

Hopefully if they have not changed them again this year, these are the forms you might need:

2047: This is the pink form on which you enter your revenue from abroad and you then transfer all those revenues on the blue form called 2042.

2042: The blue form that everyone has to fill in.

2042C Pro: The one to fill in if you are self-employed or if you rent a gîte or chambre d’hôte.

2042C: This is the form you need to say you have an S1 form and avoid paying social charges on interest and to enter the amount of income taxed in the UK (Civil servant pension, Government pensions, rental income from UK- Box 8TK).

2042RICI: To declare tax credit like using a cleaner or gardener or children attending college, lycee or university.

2044: If your rental income is more than to 15 000 euros per year, that is the form to fill in.

3916: To declare your bank account abroad. Failure to do so could carry a fine of 1500 euro per bank account not declared, much more (10K per account) if the account was in Gibraltar, Isle of man,

Panama, basically countries not agreeing to financial transparency. All they want is the name and address of the bank and the account number.

The exchange rate for 2023 is 1.15 (that is the average of last year). Your local tax office can give you an exchange rate, but you don’t have to use it. Use it if it is lower than 1.15!!

If your pension has been directly transferred in euros to your French bank account, just add up all the figures.

What income:

Pensions (even if they are taxed in the UK like army, police, civil servant), salary, interest on savings (even ISA, which are not tax free in France), rental income, dividends, bonds, etc. Basically, anything that has been earning money or making money for you.

Double taxation:

There is a treaty between France and the UK meaning that you cannot be taxed twice.

To avoid being taxed twice, you must fill in this form: United Kingdom/France Double Taxation Convention (SI 2009 Number 226), which you can download from the internet.

However, you can only fill in this form once you have been taxed in France as you must put your French tax reference on the form. Indeed, once the form is filled in, you take it to the French tax

office, they stamp it and either they send it to Paris, who send it to the UK or give it back to you to

send yourself to HMRC (depends on the office). Then 6 months later, you get reimbursed the tax you paid in the UK since you arrived in France and stop being taxed at source in the UK.

Note that ex civil servants, police and military are taxed in the UK for their pension related to that government job! But when they fill in the French tax form, they fill in that pension revenue on a

special section which gives them a tax credit equivalent to what the tax would have been on it in France

Avis d’imposition :

This is a very important document not to be lost! As it proves you are a French resident, and it also proves your revenue. If you want to get some social help in France (ACS, CAF, RSA, etc), you must show them this document. Some ISA savings account (LEP) is only available if you can show this

document to your bank as it is only available for people with low income. It is the bill of your income tax and you receive it in August.

This is the official web site of the French tax authorities. You can download tax forms, fill in your tax

form online and also set up monthly direct debit for your taxe d’habitation and taxe fonciere. You can also adjust your income tax Monthly payment from your personal account. Note that the Monthly

amount is determined by your income without the tax deduction so some of you probably should not have paid. Note that you can go online and change it if you think you should not be paying as much or nothing at all. This is often the case for people who have rental from UK or Civil servant pensions.

Note that since 2019, everybody must fill in their income tax form online. You cannot do this if it is the first time you fill in a form.

Help:

Free help for filling the tax form for all my customers will be on the 14th & 16th of May all day in Ruffec (not lunch hours!! And yes 2 full days as it has become too popular!) and on the 15th of May all day again in Chasseneuil sur Bonnieure.

Conclusion:

It is an obligation! So, if you live in France, you must fill in a French tax form!

Next month, when the new forms are available, I will explain how to fill them in and give you dates and places where I will be available for free help so do not panic yet!

PRODUCT OF THE MONTH

WEALINS LIFE

Most of you by now know about the savings account called Assurance Vie which is an investment

with tax advantages (revenue and inheritance tax) and many of you have asked me in the past if you could do an Assurance vie in British Pounds so you did not have to suffer from the Liz Trust effect!! Well, I have finally found one for you but it is not for everyone!

Who can invest in it: Anybody who is a French resident or non-French resident and above 18 years old. Preferably below 80 but we can make exceptions!

Who is it invested with: Wealins wealth insurer is a company based in Luxembourg. It is part of Foyer group founded in 1922 and has a solvability ratio of 309,6%. For comparison, Allianz has a

solvability ratio of 212%. Plus, this assurance vie is based in Luxembourg which guarantees the total value of your investment (in France, the government only guarantees up to 100K per person per

establishment).

How much can you invest in it: The minimum is 250 000€ or the equivalent in British Sterling (other currencies are also available). No maximum. That is why I stated that it is not for all of us unfortunately!

How is it invested: This is an investment in stocks and shares. This assurance vie has more than 500 funds/shares available so loads of choices on investments. The minimum invested per funds is 10000€. You can choose low, medium or high-risk funds or a mixture of each.

Fees: Well, yes, I don’t work for free all the time! Entry fee is normally 2.50% but unfortunately, I always negotiate and never take that. Contact me to negotiate! Obviously the bigger the amount, the lower the entry fee. If very big, I even take 0!

Management fee per year is 1%.

Switching funds: you can switch funds for free once per year.

If you do more than one switch, there is a 0.5% fee of the value of the shares/fund (maximum fee is 500€).

Adding money to it: You can add money to it at any time but a minimum of 25 000€. Entry fee every time you add of course.

Availability: The present amount on your assurance vie is always available. So, the money is never blocked. There are some penalties for taking your money out in the first 5 years but only if you take more than 15% of the amount. So, for the first 5 years, you can withdraw 15% of the amount

invested per year at no cost. If you withdraw more than 15% the first year, there is a fee of 0,5% on the amount above the 15% on year one, then 0,4% on year 2, 0,3% on year 3, 0,2% on year 4 and 0,1% on year 5. No fees after that. Note that the 15% that you can take out is per year and not cumulative so if you do not withdraw 15% of the amount on year 2, it still be 15% on year 3, not 30%.

Cooling period: When you open a new assurance vie, there is always a 30 day cooling period before your money is invested.

Money laundering: because of the amount invested, I need proof of where the money comes from so if you are a terrorist or got this money illegally, do not contact me to invest it!

Conclusion: The advantages of the Assurance vie savings account are well known and it is no secret that it is the preferred investment for French people not only because of its advantages regarding income and inheritance tax but also for its flexibility. But you might not want to transfer your money into Euros and suffer the burden of losing on exchange rate so here is the solution for you

INSURANCE FRENCH VOCABULARY