All of you would have by now received their income tax bill and some of you had the bad surprise to have been charged social charges on UK rental income.

Well, as you know, this income is taxed in the UK and even though it has to be declared in France, it is not taxed. You had to put in section 6 on the 2047 and line 8TK on the 2042 (also line 4BE and 4BK). If you have done that correctly, on your income tax bill (called Avis d’imposition 2018) you would have notice that the French government tax you on it and then reimburse it to you a bit below (this is on the second page). I know it sounds odd, but this is how they do it. Basically they calculate how much the French tax would be on it and then reimburse you this tax.

On the third page, you will see “prelevements sociaux”. Those social charges can be taken on your “capitaux mobiliers” which is your interest on savings from outside France (if you have any). This is correct.

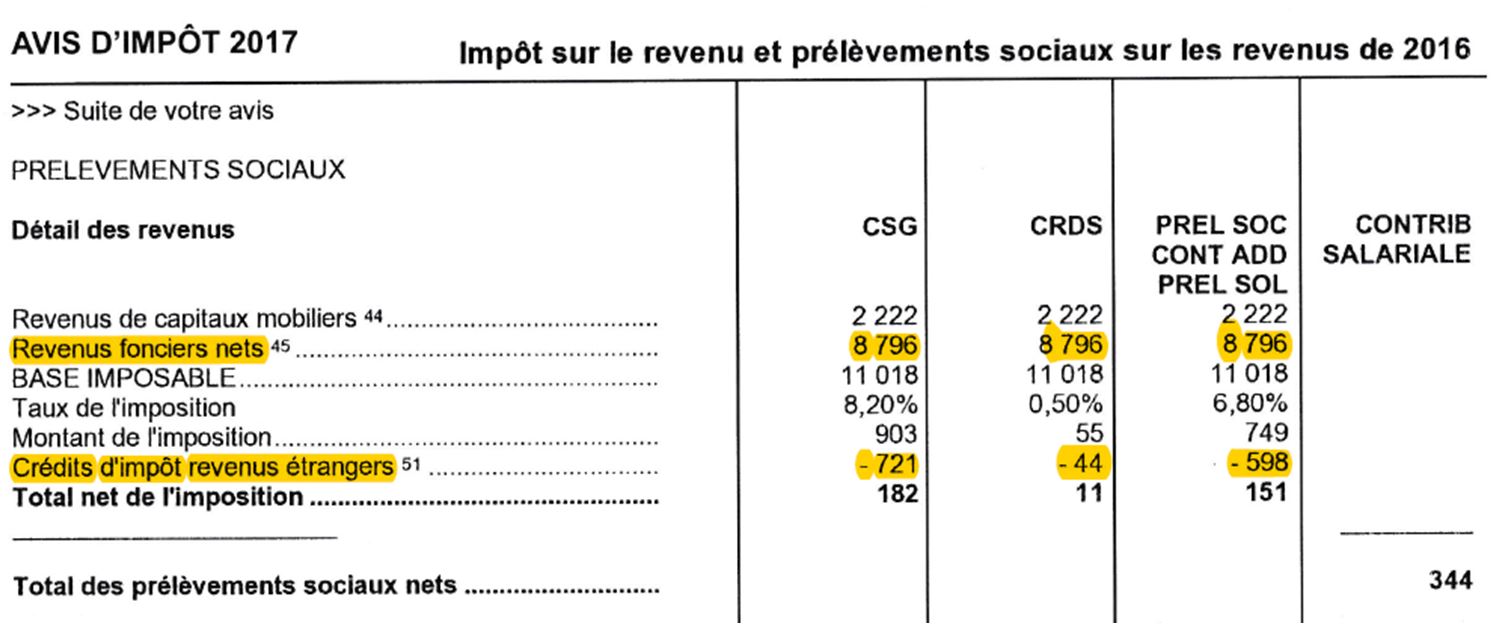

If you have rental income from the UK, you should also see a line called “revenue fonciers” and as per the income tax, they charge you prélevements sociaux on it and just below give it back to you.

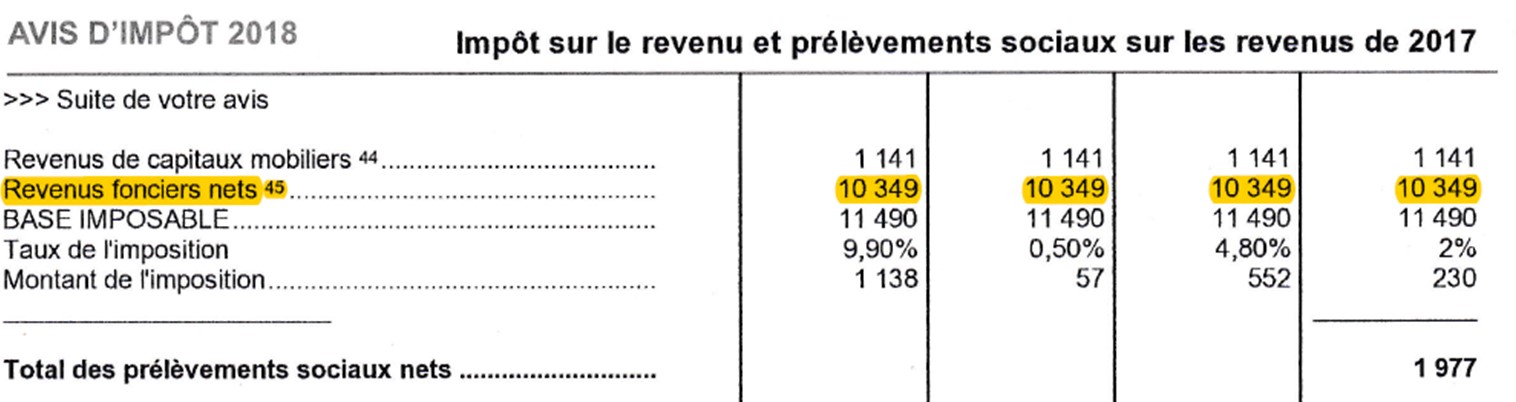

If they don’t give it back to you, they have made a mistake and you can claim it back.

If you are not sure, send me a scanned copy of your income tax form and I will double check for you.

Here is what it should look like:

This is how it should not look like:

So, if you have been charged social charges on your UK rental, you can send them this letter and you will get reimbursed:

Madame, Monsieur,

Nous venons par la présente demander le remboursement de notre taxe de prélèvements sociaux sur nos revenus fonciers pour l’année 2018 sur les revenus de 2017(voir ci-joint).

En effet, en accordance avec le bulletin officiel des impôts N°67 du 10/08/2011 (14 B-1-11) sur la convention fiscale signée avec le Royaume Uni, nous ne devons pas payer ces taxes sur nos revenus fonciers car ceux-ci se situent au Royaume Uni.

Suivant l’article 6 et 23 de ce bulletin, nos revenus fonciers ne sont imposables qu’au Royaume Uni.

L’article 6 décrit bien le fait que la CSG et la CRDS font partis des impôts concernés dans l’article 23.

L’article 23 confirme que comme l’immeuble nous rapportant des revenus fonciers est situé au Royaume Uni, nous ne devons être imposé sur ces revenus qu’au Royaume uni et donc pas payer de CSG CRDS sur ces revenus.

Dans l’attente d’une réponse favorable de votre part, veuillez agréer Madame, Monsieur, nos salutations les plus sincères.

And when you get your money back, think of me! I love wine!

Don’t hesitate to contact me for any other subjects such as inheritance law, tax, savings, funeral cover or quote on any insurances. And check out our web site www.bh-assurances.fr/en for my previous articles on the “practical pages” and register to my Monthly Newsletter.

Contact us !

In order to discuss and meet your need as best as possible, feel free to contact us with a mail, phone call... We can also schedule a meeting in one of our four agencies... Or directly to your home !