In this issue :

- Isabelle Want’s Article of the Month

- Product of the mont

- This month’s recipe

- Agenda for December & Living in France

- What happened in France & Association of the month

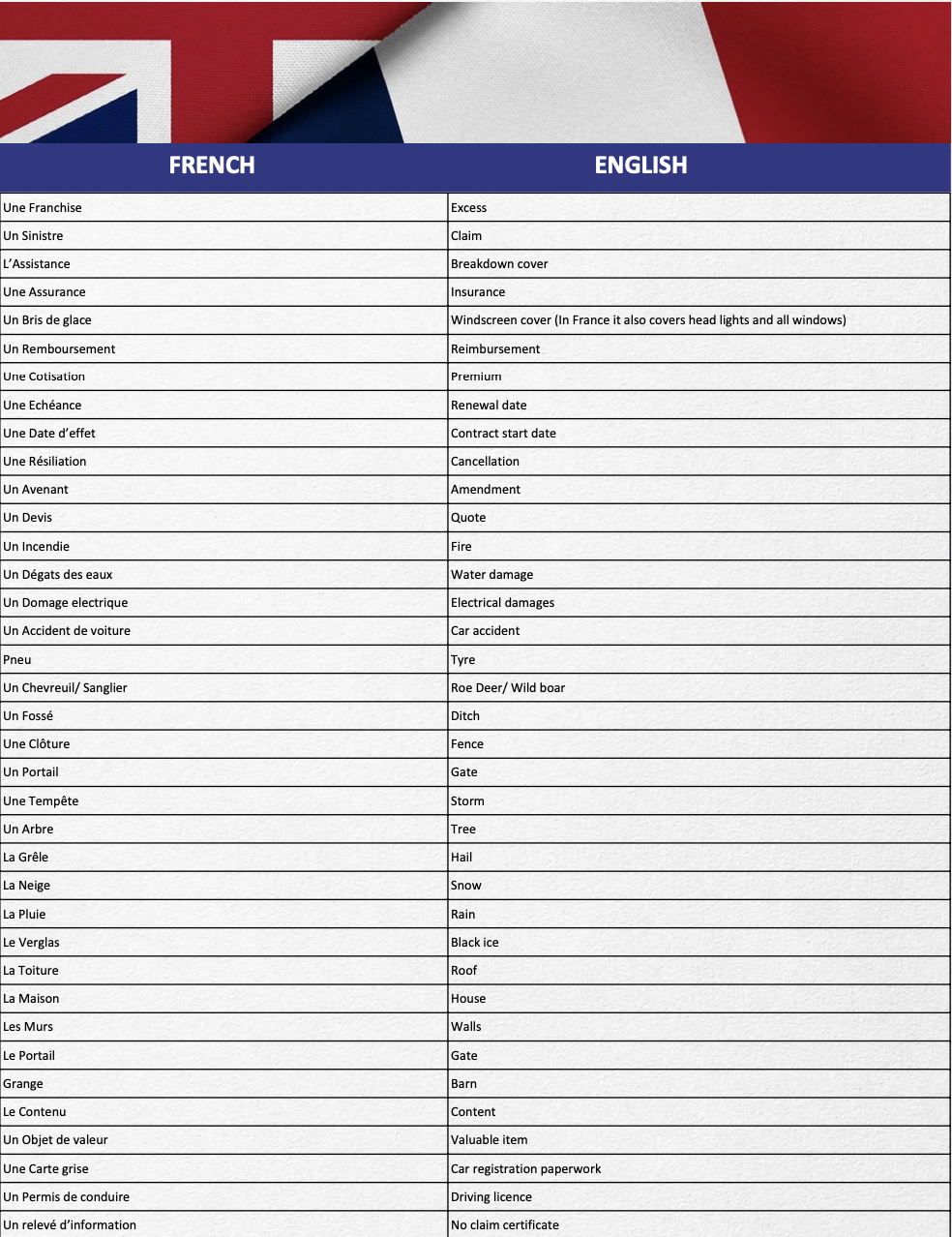

- Insurance French Vocabulary

ARTICLE OF THE MONTH

CESU : Cheque Emploi Universel

CESU is basically a system which enables you to employ someone at home without having to do a pay slip and all the other paperwork that having an employee would enroll. This system was introduced back in 1994 to stop the practice of employing people on the black, but also to facilitate people who work for different clients doing things such as ironing, gardening, cleaning, handy work, helping with homework, language teacher, etc. Those people doing those jobs would not particularly want to be self-employed and therefore prefer to be paid by CESU, so they have all the advantages of an employee (holidays, sickness cover, retirement plus no need to declare to URSSAF themselves, etc).

HOW DOES IT WORK ?

You create your account on the CESU web site: https://www.cesu.urssaf.fr/info/accueil.html . The employer and the employee both have to create an account on the CESU web site. You need your bank details and the social security number of your employee. If your employee does not have an account, he or she will receive a link to create one once you have entered his or her details when you created your account.

The salary you decide to pay your employee must follow a few rules: It must be at least equal to the legal minimum salary in France, including 10% for holiday, etc. All rules are on the web site.

Once you know their NET salary, you then must pay on top of that their “contributions sociales” which are like ‘stamps’ in the UK. For instance, you employ someone at home and decide on 10 euros per hour salary (includes the 10% for holidays), then you would have to pay your employee directly 10 euros and 8,42 euros to URSSAF for your employer contributions, so in total it will cost you 18,42 euros per hour. If you are over 70 years old, you get a 2-euro deduction so only 16,42 in total.

There is a simulator on the website so you enter the salary and it tells you how much the contributions are. Contributions are for health, unemployment, retirement, sickness, etc. Just like on a salary slip: there is the gross salary on the top of the page and, funnily enough, much less at the bottom, once all the contributions have been taken. My employer pays all the contributions and I get the Net salary.

You have to declare the salary that you have given to your employee every month (before the 5th of the following month) and the CESU web site (URSSAF which is the Union de recouvrement des cotisations de Sécurité sociale et d’allocations familiales so the organism which collect the contributions) take the money from your bank account. You have given your bank details when you created your account.

How do you pay the salary?: Up to you really. You pay your employee directly: cash, cheque, bank transfer or via the CESU web site using CESU + service and the employee gets paid by CESU.

TAX ADVANTAGES :

Automatically on your tax form 2042 that you have to fill in every year will already be entered the amount you have paid your employee plus contributions and you get a tax discount or tax credit of 50% of the amount to the limit of 12 000 euros per year so you can get a tax reduction of 6000 euros!

WHY USE CESU :

Well, you avoid the risk you would be taking if you employed someone on the black. If you get caught employing someone on the black, the sanction is up to 3 years in prison and up to 45 000 euros fine. Plus, if the person you employ is on the dole, he will lose his unemployment indemnity and any other financial help he or she gets from the French state. Furthermore, if the person you employ on the black has an accident while doing some work for you, CPAM (if they find out) can ask you to reimburse the medical costs and daily indemnity.

CESU or Self-employed :

Well, in my view, no difference really for the person who pays the work. Except, the self-employed person gives you an invoice (you need this to claim for your tax credit) and they are the one declaring their income to URSSAF, but if it is CESU you do the work by entering the wage every month on the site.

My aunt worked with CESU as a cleaner because she did not want to have to create an Auto entrepreneur account and have to deal with all the paperwork (also insurance, advertising, separate bank account, etc) and she has 6 different employers. But I know another cleaner who is self employed and also has many customers! No idea if one is better than the other. All depends on what you personally prefer.

INSURANCE :

Well, any damages caused by your employee at your house is not covered by your house insurance (just like damages you do yourself to your house or content), neither by your employee on their house insurance. So, if he or she breaks a vase by accident, nothing you can do. And it is illegal to pay them less to reimburse the damages. If you use a self-employed person however, they are obliged to have a professional liability insurance which covers any damage they cause to you.

CONCLUSION :

The site is easy to use, and it makes it all legal to get some help at home so why not try it. All you need is the social security number of the person you will employ. And if you pay a self-employed, make sure he is insured.

PRODUCT OF THE MONTH

ALLIANZ PER-I

This is an assurance vie created by Allianz to comply with the new law PACTE created by the government in 2021. This law relates to pensions in France and in order to encourage people to save themselves for their pension, they have come up with the “PERI: Plan Epargne Retraite Individuel”. Most British people will recognise it as pretty much the same as any pension plan in the UK.

WHO CAN INVEST IN IT :

Anybody who is a French resident between 18 and 62 years old. This product is mainly for people who want to put aside for their retirement.

HOW MUCH YOU CAN INVEST :

You can invest as little as 50€ per Month or/and as little as 600€ as alump sum. Note that you are capped by the French government on how much tax advantage you get. It is capped to 10% of your income. On your tax form, the maximum amount which gives you a discount is written on page 3.

Well, this is the good thing! Putting money into it gives you a tax advantage. So, if you put 100€ per Month into it for instance which is 1 200€ per year and you declare 30 000€ income per year, then you will be only taxed on 30 000- 1 200= 27 800€.

If you do not pay tax or do not want to have the tax advantage, you can choose to invest in your PERI without this tax-deductible option (see below why it is good).

Note that you have to invest the money before the 31st of December to have the tax advantage for the same year (meaning to be noted on your income tax form in May the following year which is for this year).

HOW YOU GET YOUR MONEY :

Once you are retired, you can choose to have your money in a lump sum, as partial withdrawals, as regular Monthly, Yearly withdrawals or as annuities (for you or for your spouse) or some as partial lump sum and some in annuities (rent until you die). Well pretty much as you wish. Note that you can access the money before you retire in exceptional circumstances such as buying your main residence or becoming disabled.

TAX WHEN YOU TAKE IT :

If you had the tax advantage-tax deductible option when you put money in, then the money out is fully taxed (flat tax at 30% or added to the rest of your income and taxed accordingly which is best if you are below taxable income). If you did not choose the tax-deductible option, only the interest is taxed (just like an assurance vie investment).

INHERITANCE ADVANTAGE :

Just like an assurance vie, you name the beneficiaries when you set it up and they are entitled up to 152 500€ each if you die before 70 years or 30 500 if you die after (if the money is still in it).

HOW IT IS INVESTED :

As you wish but at least 30% on shares/funds or bonds. You can also choose a fund specifically dated for your retirement. If you think you will retire in 2030 for instance, then you can choose a fund which will automatically be riskier now and gradually as you approach the date of 2030 will swap from riskier to more secure.

PERP or Madelin contract:

If you have a PERP or Madelin contract which is a bit of the same (except the exit is only as an annuity and no assurance vie advantage in regards to death duties), note that those contracts will be transformed into PERI automatically and also note that you will be able to transfer those contracts from your current company to another one! That is also part of the new law.

FEES :

Entry fee of 4.80% negotiable of course + 12€ admin fee!! And yearly management fees of 0.73%.

No fees for taking the money out.

French people are very attached to their pensions!! But we must face reality one day and realise that it will be down to the individual to save for their pension themselves. This is exactly why this investment has been created. Allianz has a solvability ratio that is one of the best on the market at 174% for Allianz France and 200% for Allianz Group so don’t hesitate to contact me for any further information regarding our very large range of investments.

INSURANCE FRENCH VOCABULARY