In this issue :

- Isabelle Want’s Article of the Month

- Product of the mont

- This month’s recipe

- Agenda for December & Living in France

- What happened in France & Association of the month

- Insurance French Vocabulary

ARTICLE OF THE MONTH

HOW DOES YOUR TOP UP AND THE FRENCH HEALTH SYSTEM TOGETHER?

Basically, the two are linked. So, in theory, everything is automatic!

- If you do not have your carte vitale yet: The medical professionals give you a brown form to fill in and send to CPAM. See photo. So, you enter your social security number at the top of the page (usually a temporary one starting with 7 or 8) and sign at the bottom and send it to CPAM. As CPAM and Allianz are linked together by what we call “télétransmission”, the reimbursement goes directly into your bank account within 10 days. Therefore, we need your social security number when we do the top up contract. Sometimes, the medical professional does not have the machine for the carte vitale or your carte vitale is playing up, so you may have to use the brown form even if you have a carte vitale.

- When you have your carte vitale: When you visit your GP or other medical professionals, you first give them your carte vitale and then you pay. The reimbursement is then automatically done by CPAM and Allianz is linked with CPAM by the “télétransmission” so the top up payment from Allianz follows within 10 days of the CPAM reimbursement.

- Attestation de droits: This is a letter that shows you are entitled to a carte vitale. Sometimes, the “télétransmission” does not work and we need this letter to correct it. You can download it from your CPAM personal account (ameli.fr) or simply phone them and they will send it to you by post.

- Tiers payant card: That is your top up insurance card. This card does not show your level of cover. It simply proves that you have a top up and gives information to the medical profession in case of a “prise en charge”- this is when the top up pays instead of you.

You can download it from your Allianz customer account.

- Hospitalisation: When you are hospitalised, the hospital will contact Allianz, so Allianz set up “une prise en charge” meaning Allianz and CPAM will pay instead of you (just as well as the surgery could cost an arm and a leg!). The only thing you would have to pay for when you come out is the food, the individual room and telephone or TV bill. Simply pass it on to us for reimbursement or send it directly to Allianz santé (remboursementsante@allianz.fr).

- Pharmacy: Some of the medical professionals such as pharmacists will ask for your top up card and you therefore have nothing to pay as Allianz pays the pharmacy directly. It is called “tiers payant”. So, when you go to the pharmacy, you give them your prescription letter, your carte vitale and top up card.

- Surcharge: 100% top up cover is 100% of the price set by the French Health System, but the medical professionals are self-employed and are allowed to apply a surcharge. It is mostly done by consultants, surgeons, private hospitals, dentists, etc. Example: the French Health System set price for a hip replacement is 1000€ (not the actual figure, just an example), then you only get reimbursed 800€ (80%) and because the surgeon likes to go on golfing weekends!(Joke) and 1000€ is not enough for him, he can charge 3000€ , therefore, you would be 2200€ (instead of just 200€) out of pocket!! Therefore, a cover with your top up at 300% would cover that surcharge (and as long as the professional has signed an agreement with CPAM).

- Excess: There is an excess of 1€ per GP visit, 2€ for ambulance transport (not emergency) and 50p per box of medicine. This excess is taken back from your CPAM refunds so this is why sometimes you get less reimbursement than you should have.

- Glasses: Most of my British customers go back to the UK for them or buy them online. But you can choose to have them covered under your top up insurance. Only one pair every 2 years. It’s a calculation to make between what you would get back and how much it increases your premium. Note that some glasses are now fully reimbursed under the new 100% santé reform and the glasses shop is obliged to give you one quote for 100% santé.

- Dental cover: You simply give them your carte vitale and the reimbursement follows (for normal basic treatment). However, for crowns or major works, you first get a quote so you can first ask Allianz how much you can get back as Dentists always surcharge. Note that most types of crowns are now fully reimbursed under the 100% santé reform.

- www.ameli.fr: This is the CPAM website where you can create your personal account (you only need your carte vitale to do it). Yes, it is in French, but it is full of useful information. You can use the simulator to find out if you are entitled to CSS (people on low income can get free top up or help to pay for their top up). You can download your reimbursement and you can ask for your attestation de droits (proof of cover). This document is often asked for by insurers to give you access to top up health insurance. If you don’t speak any French at all, there is English speaking phone line created by the French health system to answer all your questions: 09 74 75 36 46 (from France) and 0033 974 75 36 46 (from abroad).

- Allianz.fr: From the Allianz web site, you can create your personal account. You simply need your surname, first name, date of birth, email address and contract number. Then you can view all your reimbursements, details of contracts, follow claims, send medical quotes, etc.

- Extras: With Allianz top up, depending on your cover, you can get extras like free cleaning if you are in hospital for more than 3 days or 2 hours of cleaning 48 hours after a chemotherapy session or even look after your pets, etc.

Also, you can get cover for an individual room up to 100 or 125€ (normal price is about 75€ so it’s plenty). In France, you either share the room with someone else or you can choose to be on your own like a hotel room (with your own bathroom). Note that the cover does not guarantee you will be able to get the room, it simply covers the cost if you can get one. Usually, you can always get one in a private hospital (Clinic).

CONCLUSION: Feel free to contact me if you would like information on any of the above or to get a free quote for top up health insurance. Note that the law has changed now and as long as you have had a top up contract for at least one year, you can swap at any time, no need to wait for the anniversary date and if you are happy with my quote, I will do the cancellation for you!

PRODUCT OF THE MONTH

HOUSE INSURANCE, BEING UNDER INSURED AND SOME FACTS

Like any other top up, premium is simply based on age, level of cover and postal address. Yes, for some reason, it is more expensive if you live in Paris or Bordeaux compared to Angoulême!!

There is no health questionnaire. You get a Tiers payant card (piece of paper in fact) that proves you are insured. You can check your reimbursment, send quotes and bills and reprint your card directly from your Allianz online customer account.

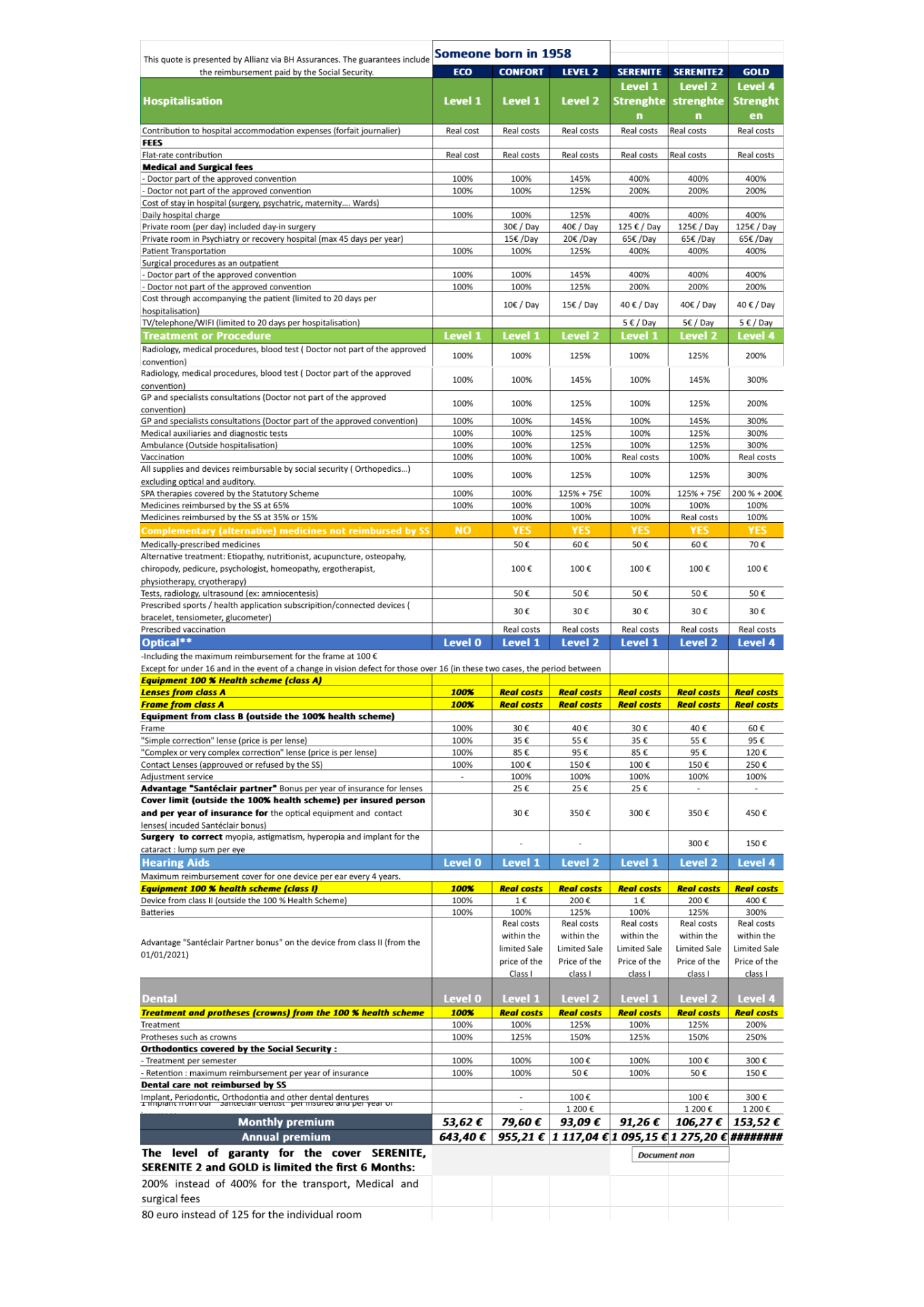

I have on the spreadsheet below detailed 6 types of cover and premium for someone born in 1958 so 65 years old and living in the Charente. This example includes a 10% discount as a customer (meaning this person already has another contract with us, either car or house, etc). Other levels of cover are available!

ECO COVER

What does it cover: This cover is the basic cover with pretty much everything at 100% of the CPAM set price. It is the cheapest basic cover as it does not include the 100% santé reform.

What it does not cover: Well, it does not cover surcharges, medicines that are only reimbursed 15 and 30% by CPAM and other perks such as individual room, alternative medicine, etc. Also, it might not be enough cover to fully reimburse your glasses and teeth treatment if these are complicated. It also does not include the new reform of 100% santé, so if you want hearing aids, glasses or crowns covered by the new reform, do not choose this cover.

CONFORT COVER

What does it cover: This cover is the basic cover with pretty much everything at 100% of the CPAM set price and also includes the 100% santé reform so covers hearing aids, crowns and glasses.

What it does not cover: Well, it does not cover surcharges. Also, it might not be enough cover to reimburse fully your glasses and teeth treatment if these are complicated and above the new level of cover set by the French government via the 100% santé reform. It does include the 100% santé reform.

LEVEL 2 COVER:

What does it cover: This cover is basically either 125% or 145% cover on mostly everything.

What it does not cover: Surcharges made by consultants and specialist (if above 125 or 145%). Also, it might not be enough cover to fully reimburse your glasses and teeth treatment if these are complicated and above the new level of cover set by the French government via the 100% santé reform.

SERENITE COVER

What does it cover: This cover is the best cover for hospital and also up to 125€ per day for an individual room and 100% for the rest plus some perks.

What it does not cover: Surcharges made by consultants and specialist (for consultations). Also, it might not be enough cover to reimburse fully your glasses and teeth treatment if these are complicated and above the new level of cover set by the French government via the 100% santé reform.

SERENITE 2 COVER:

What does it cover: This cover is the best cover for hospital and also up to 125€ per day for an individual room and either 125% or 145% cover on mostly everything.

What it does not cover: Surcharges made by consultants and specialist (if above 125 or 145%). Also, it might not be enough cover to reimburse fully your glasses and teeth treatment if these are complicated and above the new level of cover set by the French government via the 100% santé reform.

GOLD COVER

What does it cover: This cover is the best cover for hospital and everything else.

What it does not cover: Not much really! Although you still might have to pay surcharges on tooth implants.

FAQ:

When does the cover start: Straight away. Although the level of guarantee SERENITE is limited the first 6 Months (200% instead of 400% for transport, Medical and surgical, 80€ instead of 125€ for the individual room).

What about pre-existing conditions: There is no health questionnaire, so they are covered.

Can I upgrade or downgrade the level: Not the first year but any time after that, yes.

Does the top up cover me abroad: Only if CPAM does. It is a top up not private health insurance.

How do I cancel it: By written request on the anniversary date each year or if you leave France, we need proof of your address abroad. Or now with new law at any time once the first year has passed.

If you already have a top up but not with us, we will do the cancellation for you, so you have nothing to do.

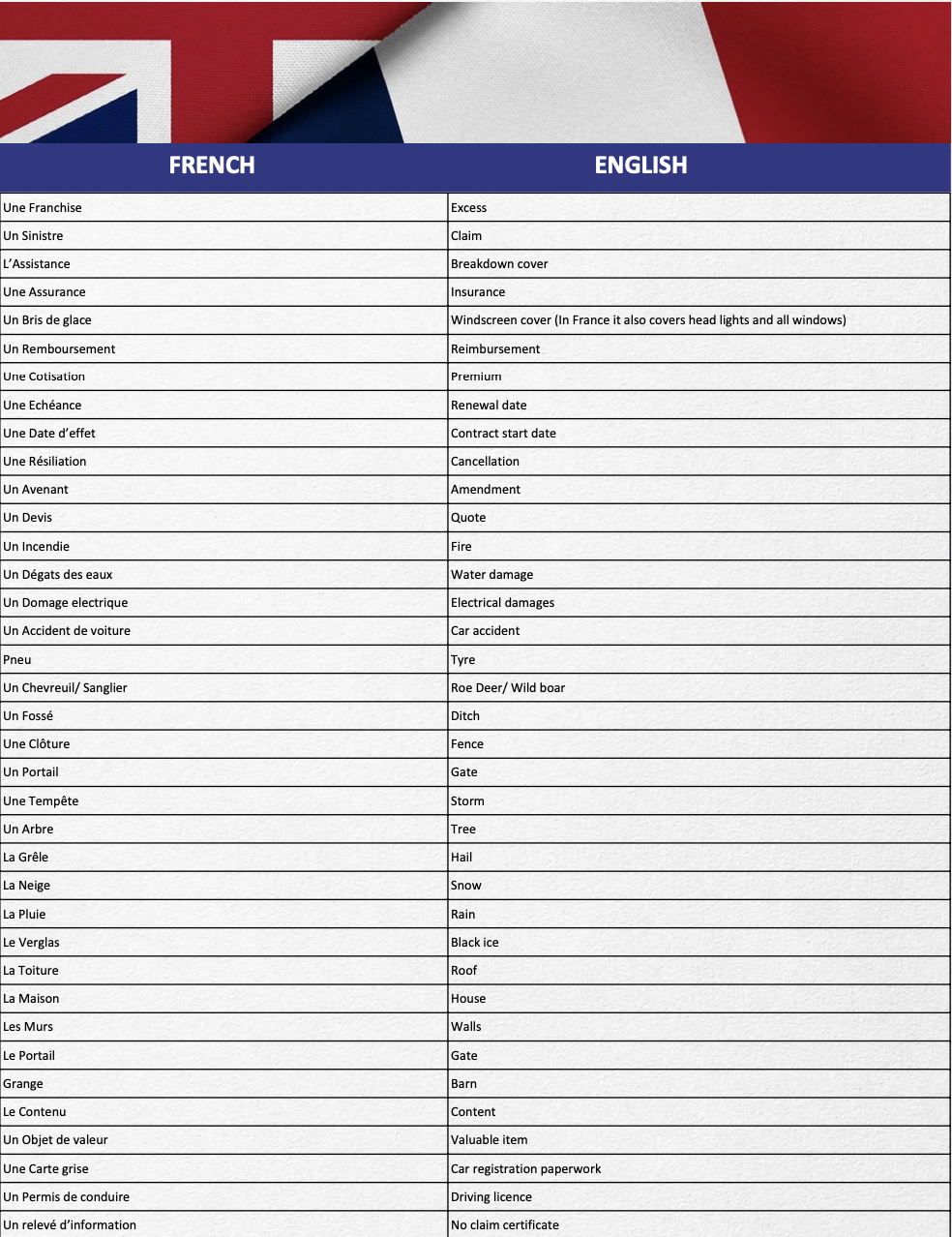

INSURANCE FRENCH VOCABULARY