A few notes to start with

- Bad news this year is that you have to re-enter all the details of your bank accounts held outside of France as they have changed it to include pay pal and assurance vie accounts. To save time, you can go to your personal page and print the 3916 from last year. Note that now they do ask for the year you open the account!!If you can’t remember, put a false one close to what you think it was.

- Some of you have the annexe 2041 ticked already. You need to untick it from the annexes. This is for non-residents. It is a bug!

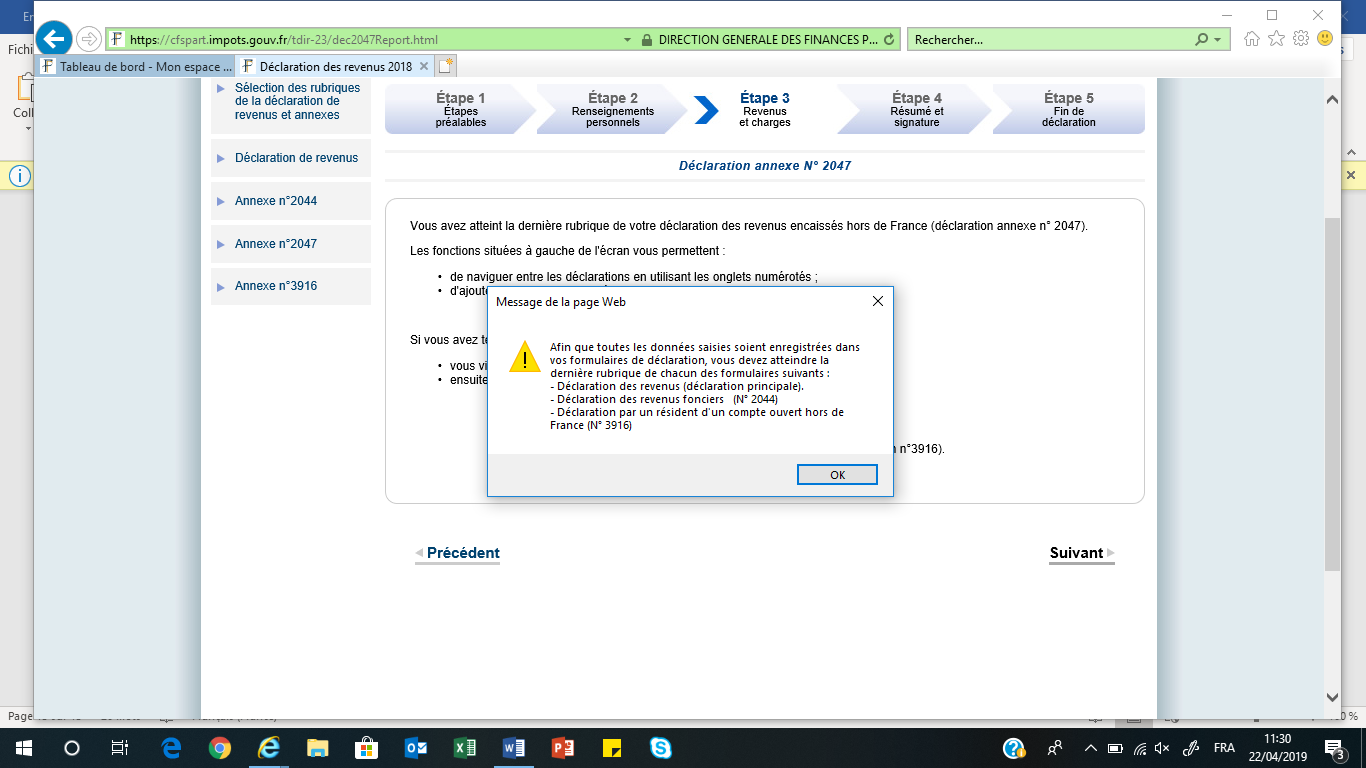

- There are loads of pop up windows coming on, simply click on OK to get ridde of them.

- Form 2042 does not exist online, it is « declaration de revenus » which amalgamate all the 2042 forms (RICI, 2042C, etc).

- If you get stuck with the pop up windows, click on either « declaration de revenus » on the left or the « annexe-2047-3916,etc. » that you have not yet filled in.

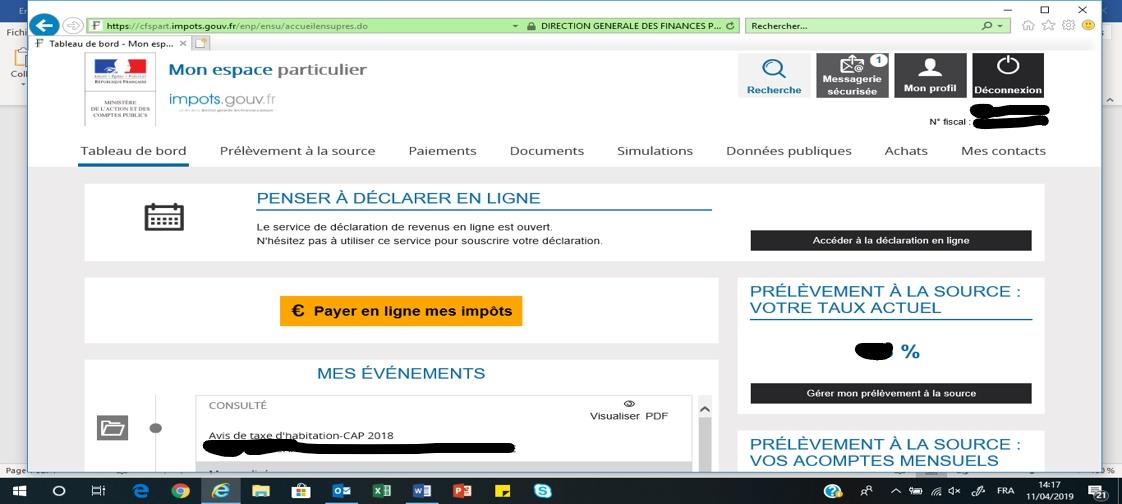

Once you are connected to your online account, click on « accéder à la déclaration en ligne » in the right hand side of the page in black:

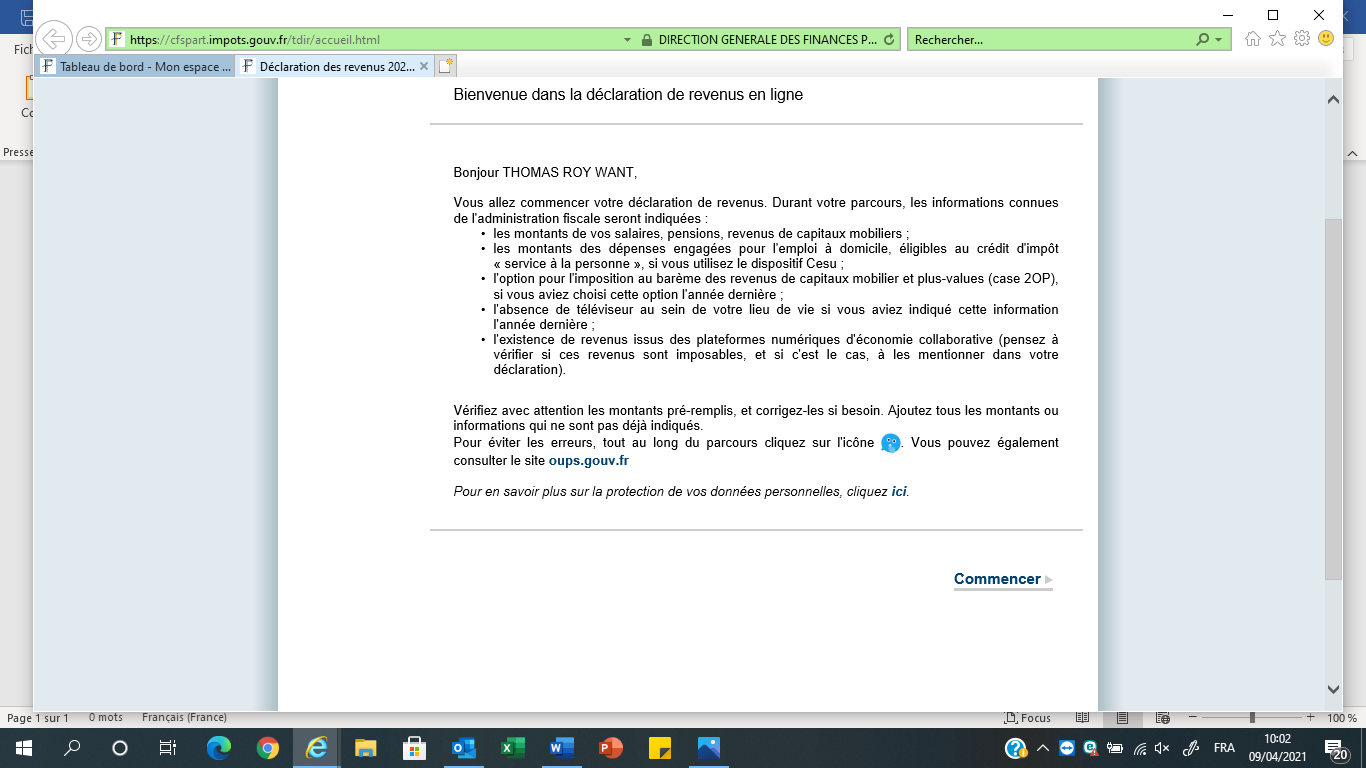

You then come to this page, click on « commencer » at the bottom right

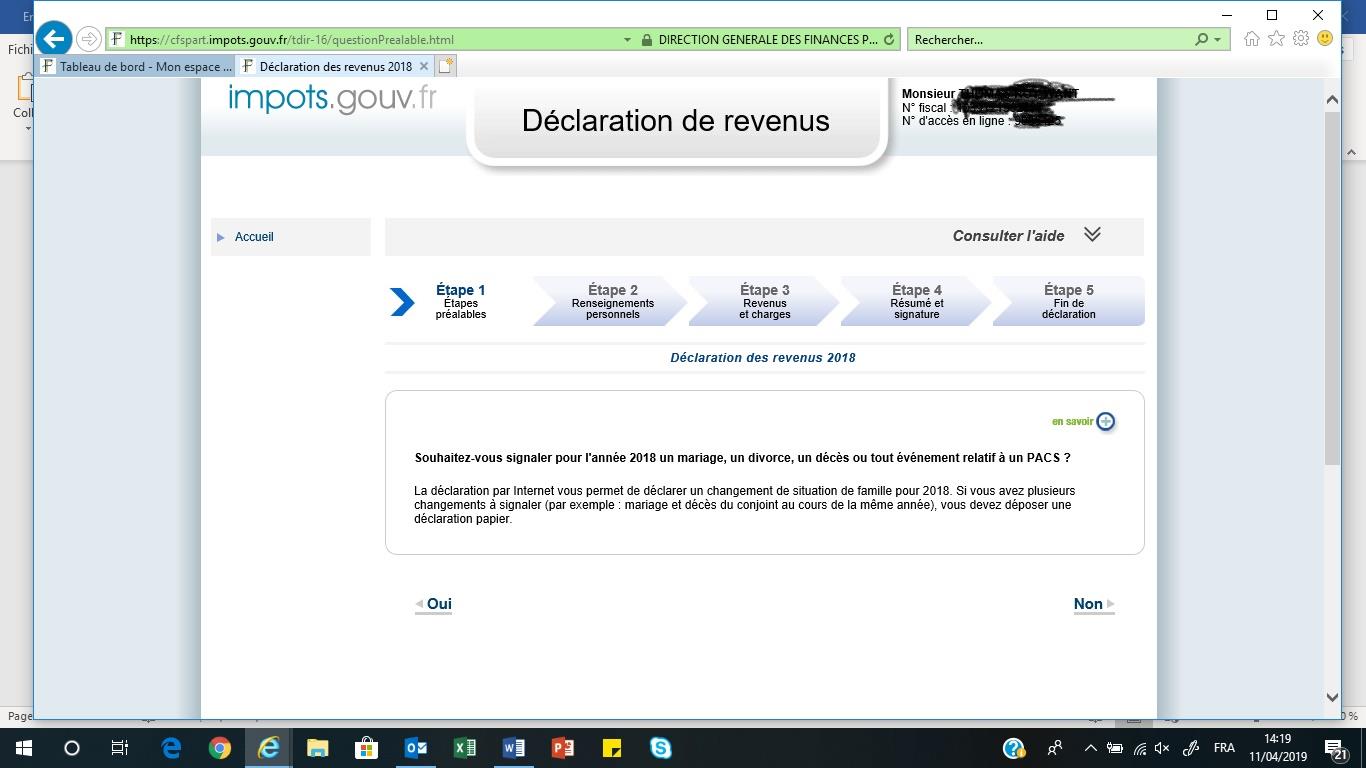

You then come to this page asking you if you had any changes in 2020 (i.e. marriage , divorce or death).

Click on Oui (Yes) or Non (No) at the bottom left or right.

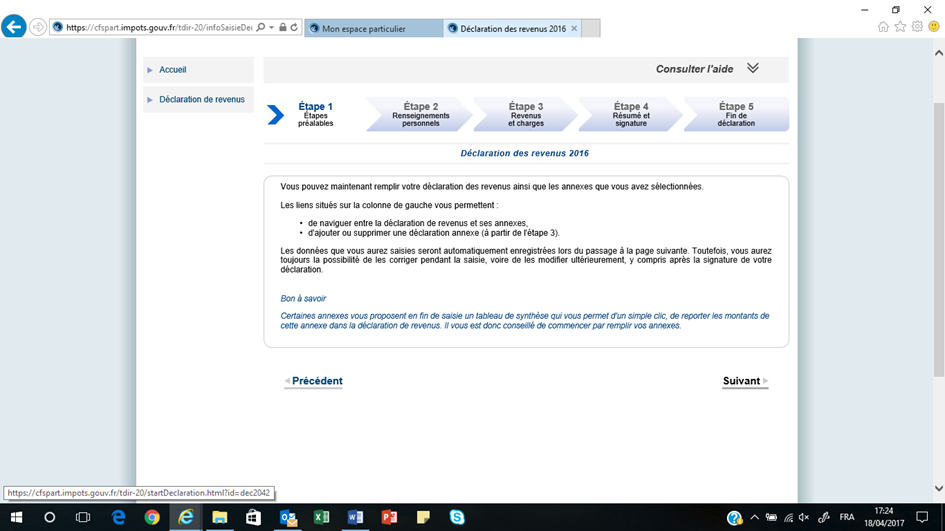

You then come to this page, just click on « suivant » on the bottom right

You then come to the page with your personal information on. if you have moved in 2020, you need to tick the box and enter your new address.

Otherwise just click on “SUIVANT”. You then come to this page below.

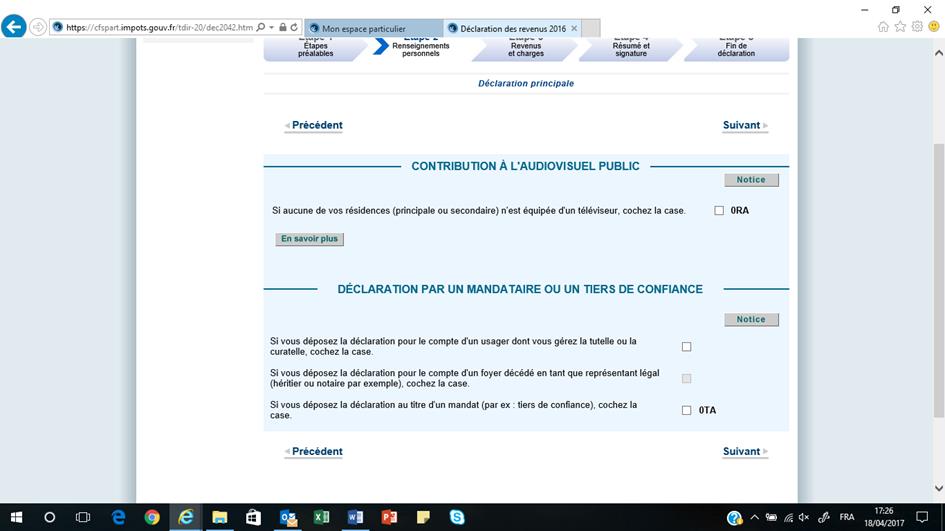

If you don’t have a TV, tick box 0RA.

Then click on “suivant”.

On this page, just check that all your details are correct and click on « suivant »

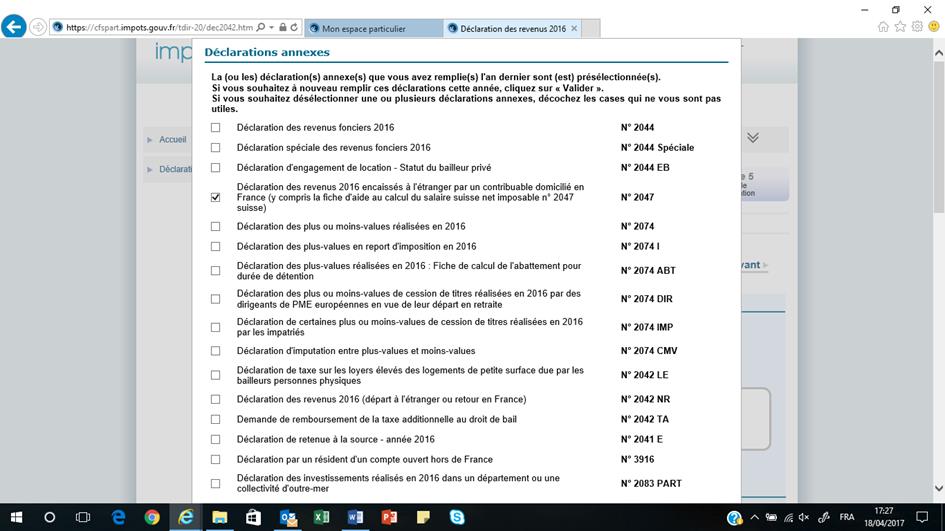

This window then pops up. Choose which annexes you need to fill in.

2047 (pink form) and 3916 (bank accounts opened abroad) these are the most common ones for British people. Then click on « valider »

If this window did not pop up, you need to click on « déclarations annexes » in the middle on the screen (see next page). Make sure 2041 is not ticked.

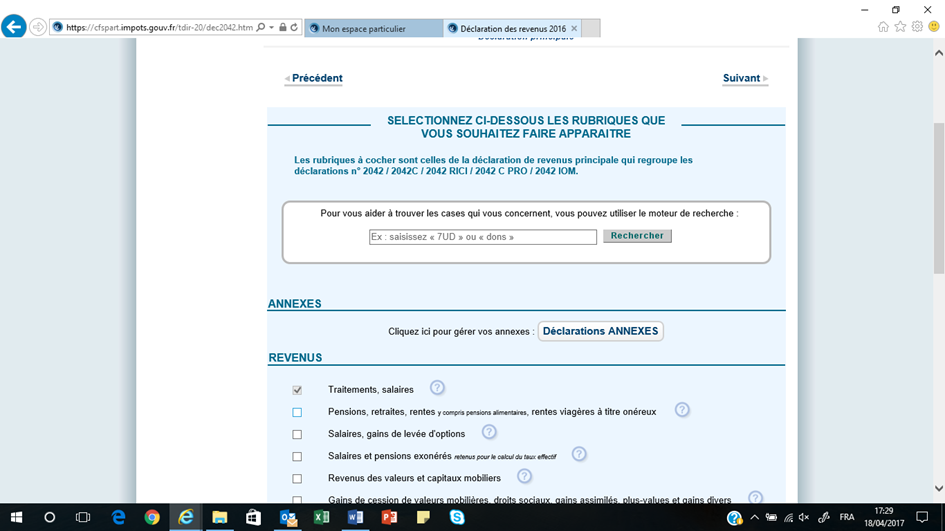

Then, it is pretty much the same as the paper version except you must tell the website which section you want to fill in.

For pensions for civil servant/army/teachers, tick on box « Divers » but also to tick box 8UU for bank accounts outside of France.

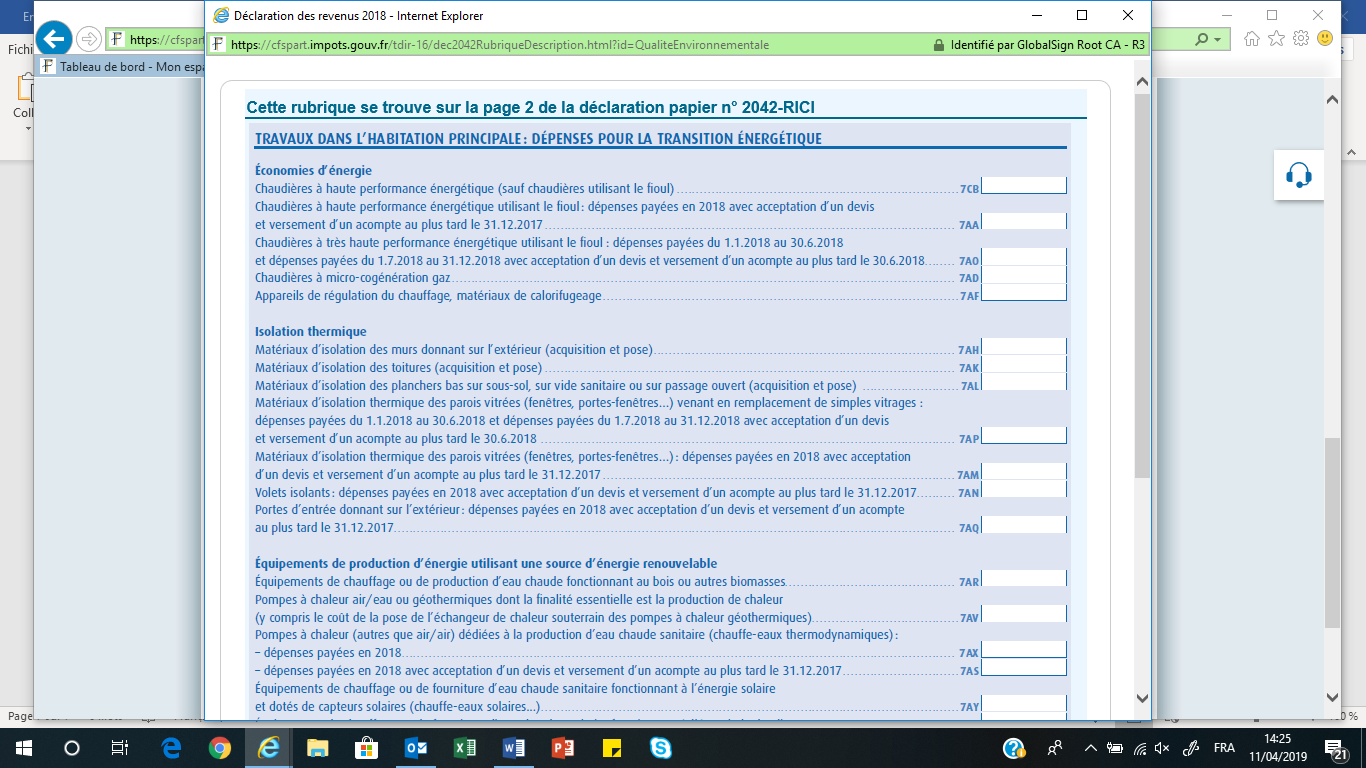

If you have given money to charity or employ someone at home for cleaning, etc, tick on box « reductions et crédit d’impots, etc, »

If you are not sure, click on the ? sign on the right of the sentence and a page showing you what it is opens:

Then this screen pops up and you now have the annexes on the left hand side.

Here below you can see « Annexe n° 2047 » in the middle left of the screen

so click on it. Always start by your annexes as what you put on them is sometimes reported on the « declaration de revenus »

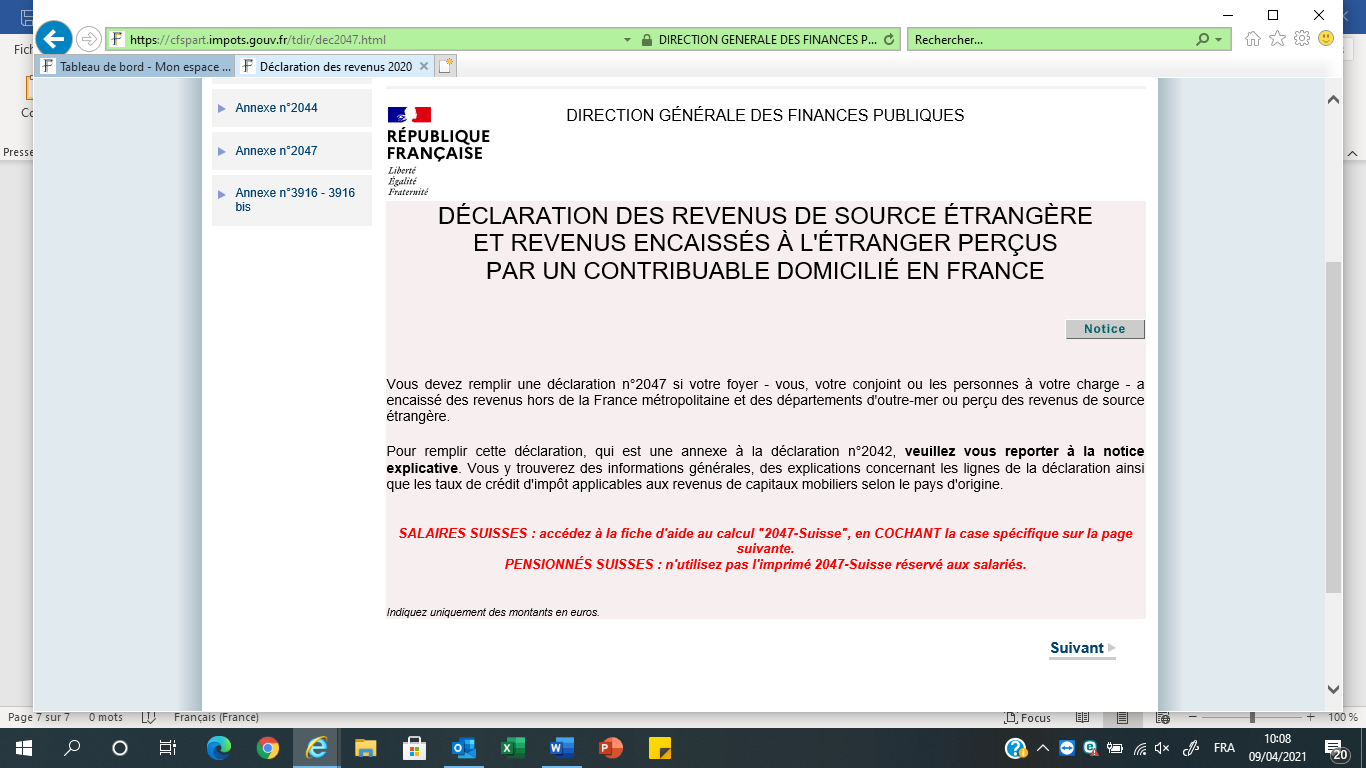

You then come up the 2047, click on suivant

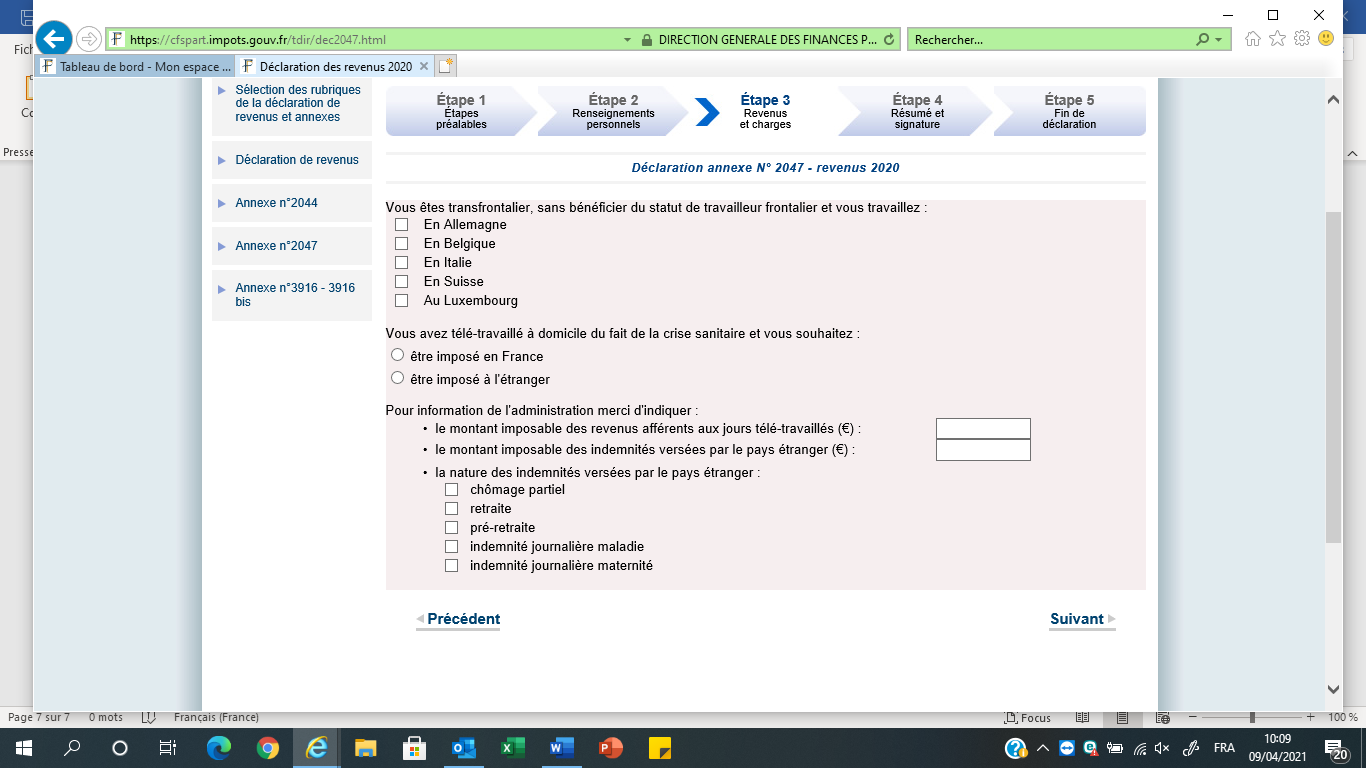

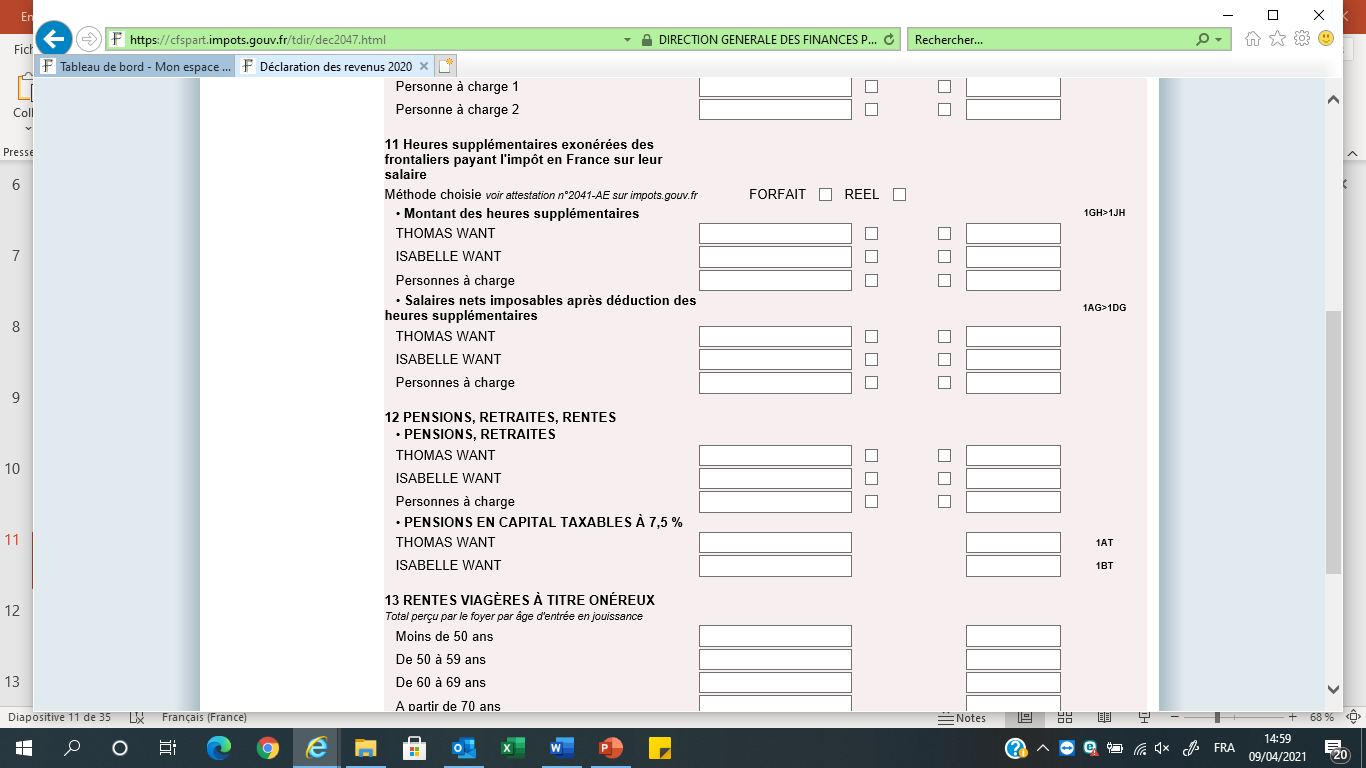

You come to a first page for people who work on the border so it is not for you.

So click on « suivant »

You then start to fill in the pink form. As per the blue form, it asks you which section you want to fill in so if you are not sure, tick them all.

Then click on « suivant »

Pensions: enter the country of origin of revenues and then the amount. Royaume Uni is United Kingdom in French.

Also tick if the pension is « public » (civil servant, teacher, army, etc) and/or « privé » (private and state pension). Click on « suivant »

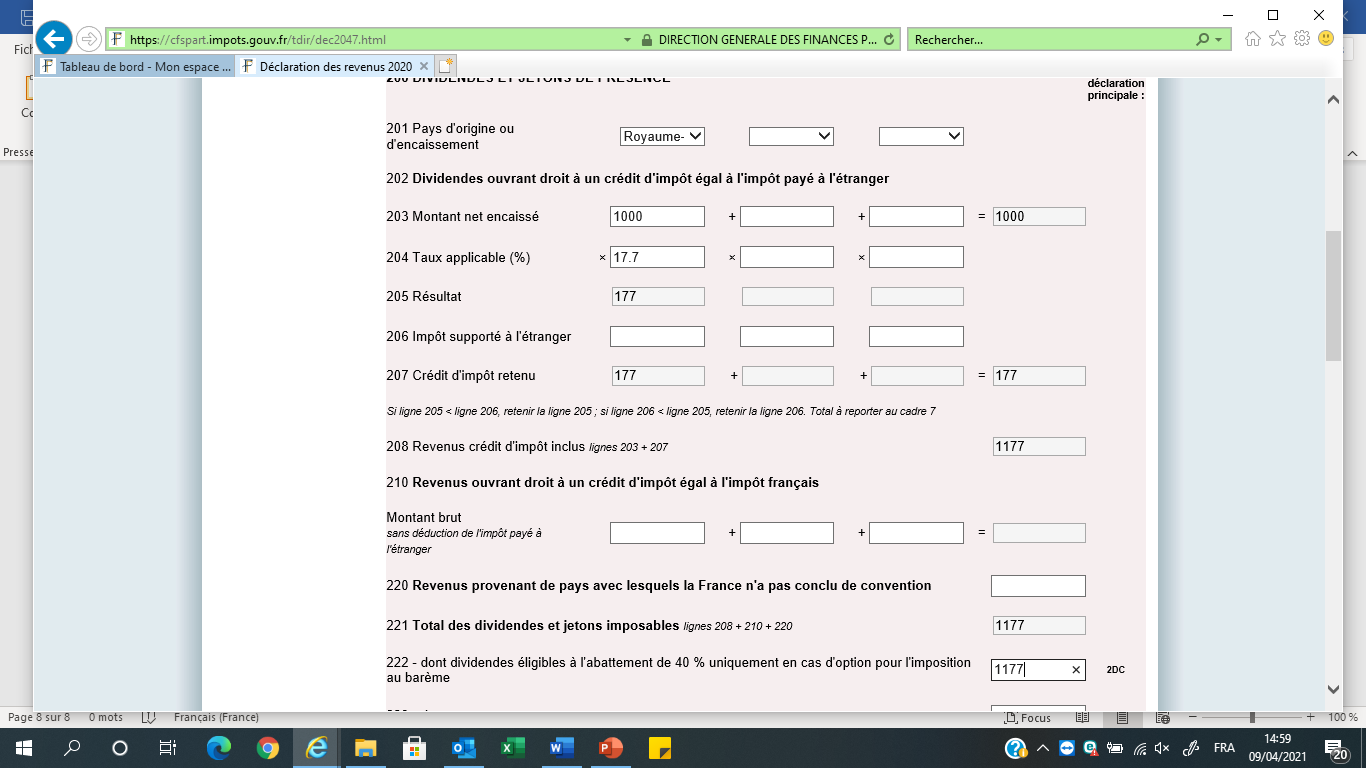

This is how you fill in Dividends: you need to select the country, then enter the amount and 17,7% below.

Then you need to manually enter the amount again on line 2DC. And remember to enter the tax credit of 17,7% on section 7. see later

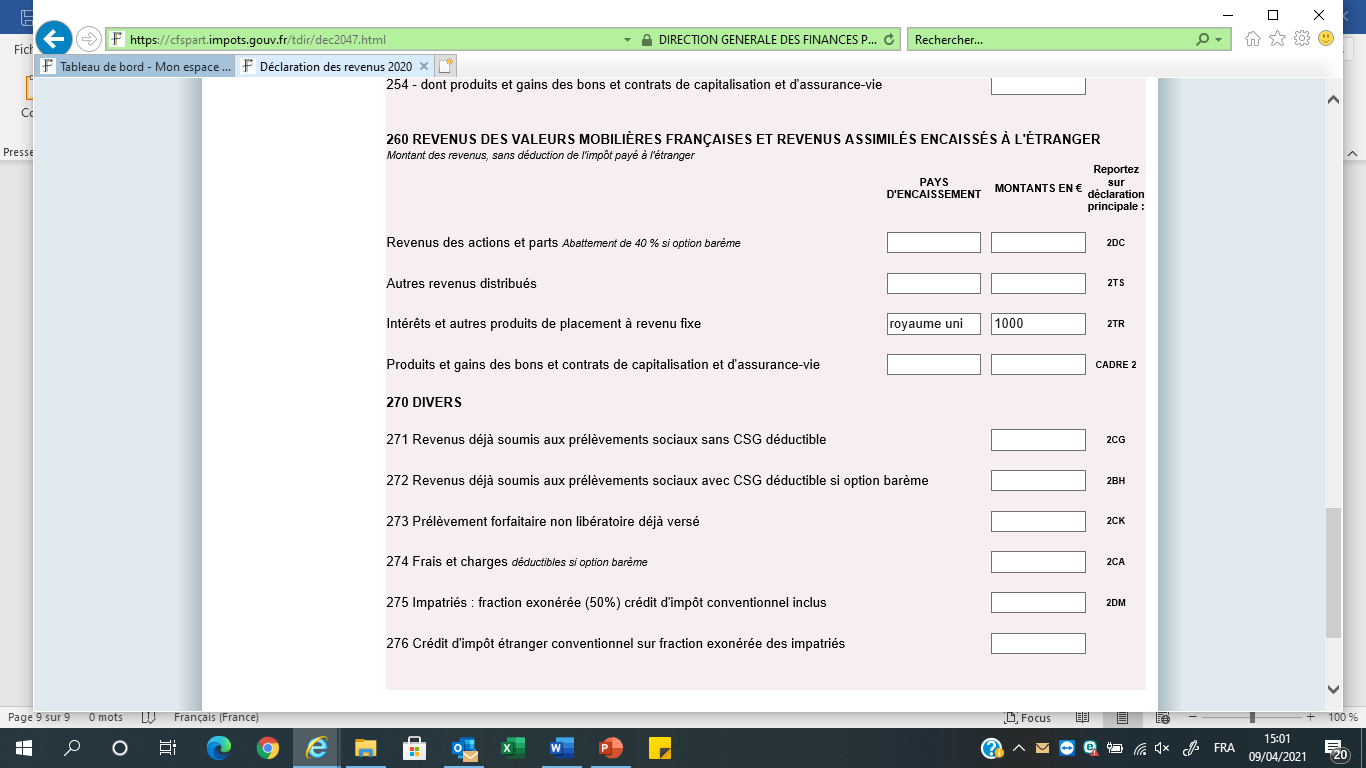

This is how you fill in the interest (premium bonds , ISA, interests,etc).

Select the country, then enter the amount in box 2TR.

This is the page for rental income in the UK.

Just put the address of the property, the country and the amount.

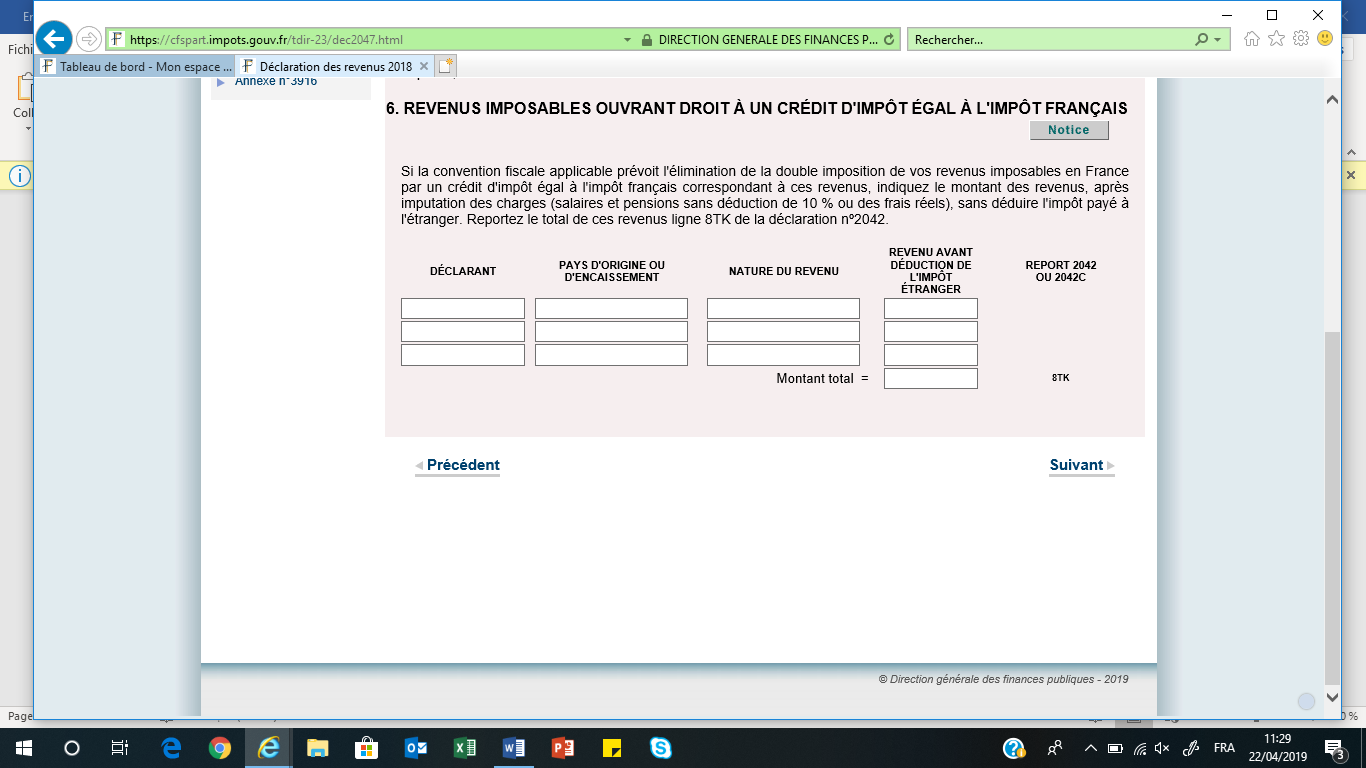

This is where you enter civil servant pension and rental income from UK.

Put 1 or 2 or 1 & 2 in « declarant », then the country.

Then enter the type of income eg: retraite militaire(army)/fonctionnaire( civil servant)/enseignant (teacher)for civil servant pension or revenu foncier for rental income.

This is where you enter the tax credit of the dividends.

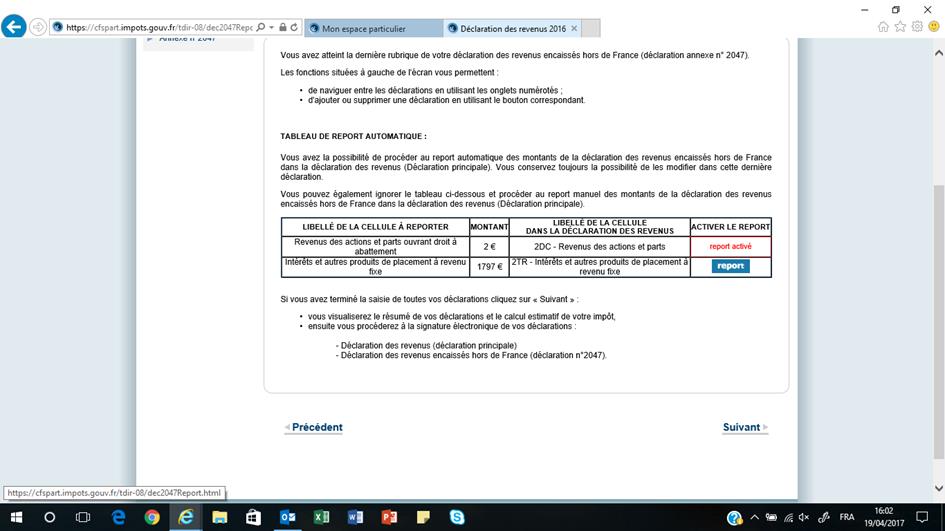

If you have entered an amount for bank interest, dividends or section 6, it will ask you on this screen to report it automatically on the 2042 form, so click on « report » in blue. It then says « report activé » so, click on « suivant ».

Note that the pensions and other type of revenus are not reported automatically on the 2042 so you need to enter them manually. So, make sure you take note of where you need to report them. Then click on « suivant » then another annexe on the side,

If you did not enter revenus from savings, this is the page that appears so just click on « suivant ».

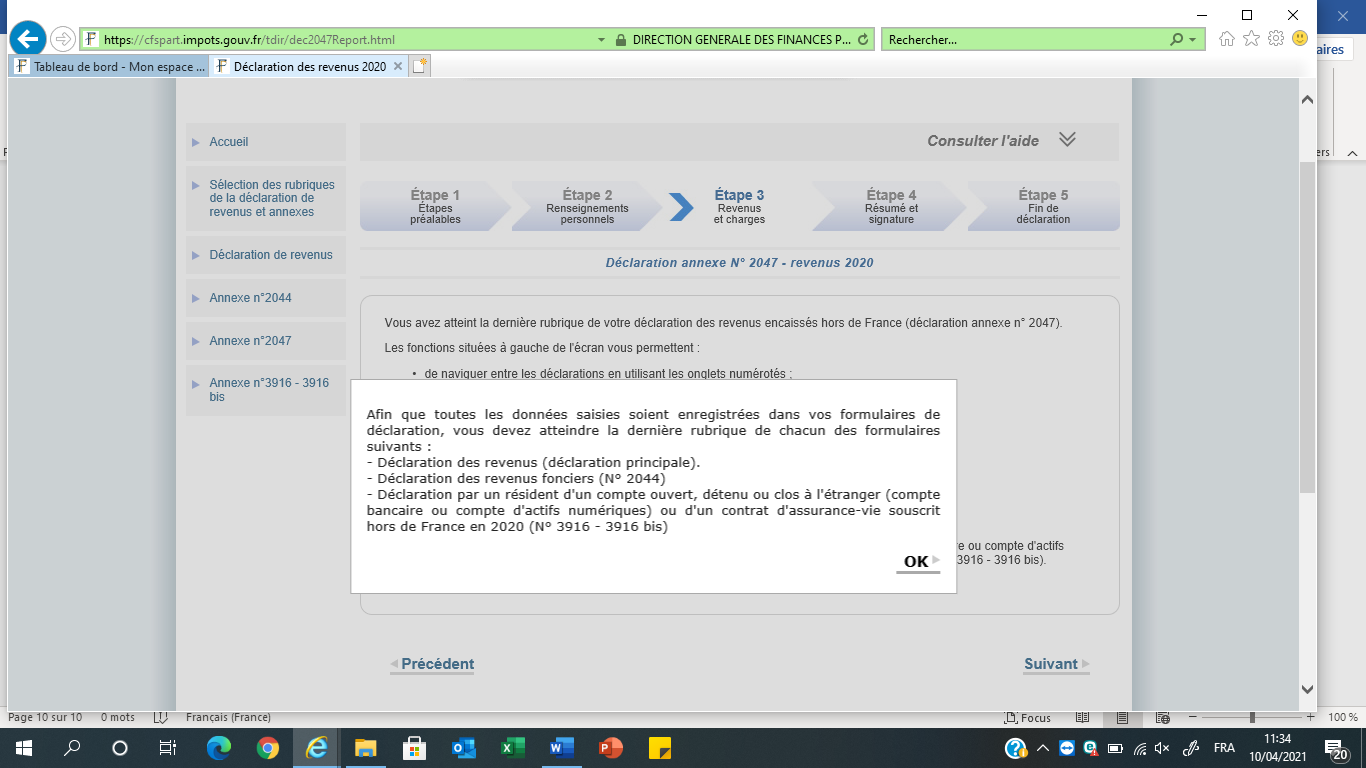

You also often get windows appearing, just click on OK, not just on that screen, all the time!! Then click on annexe 3916 on the left side.

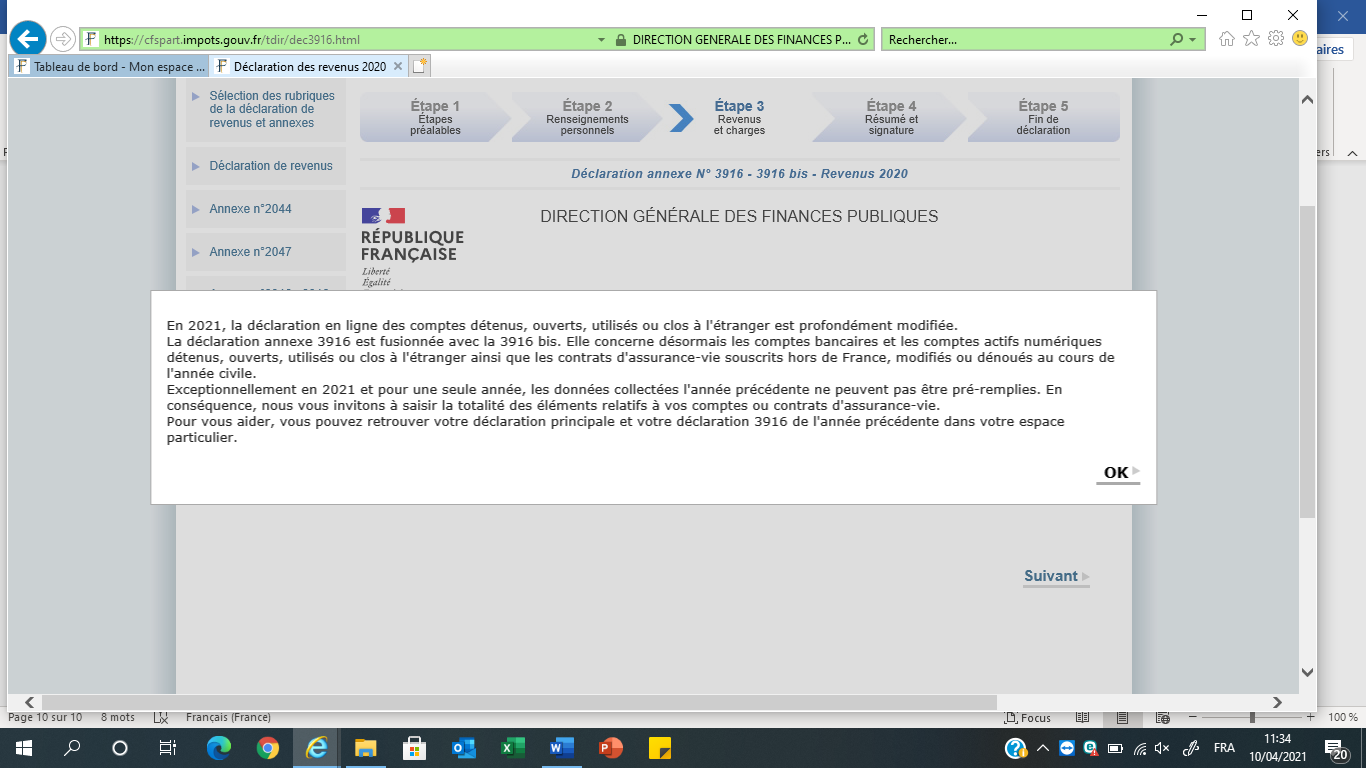

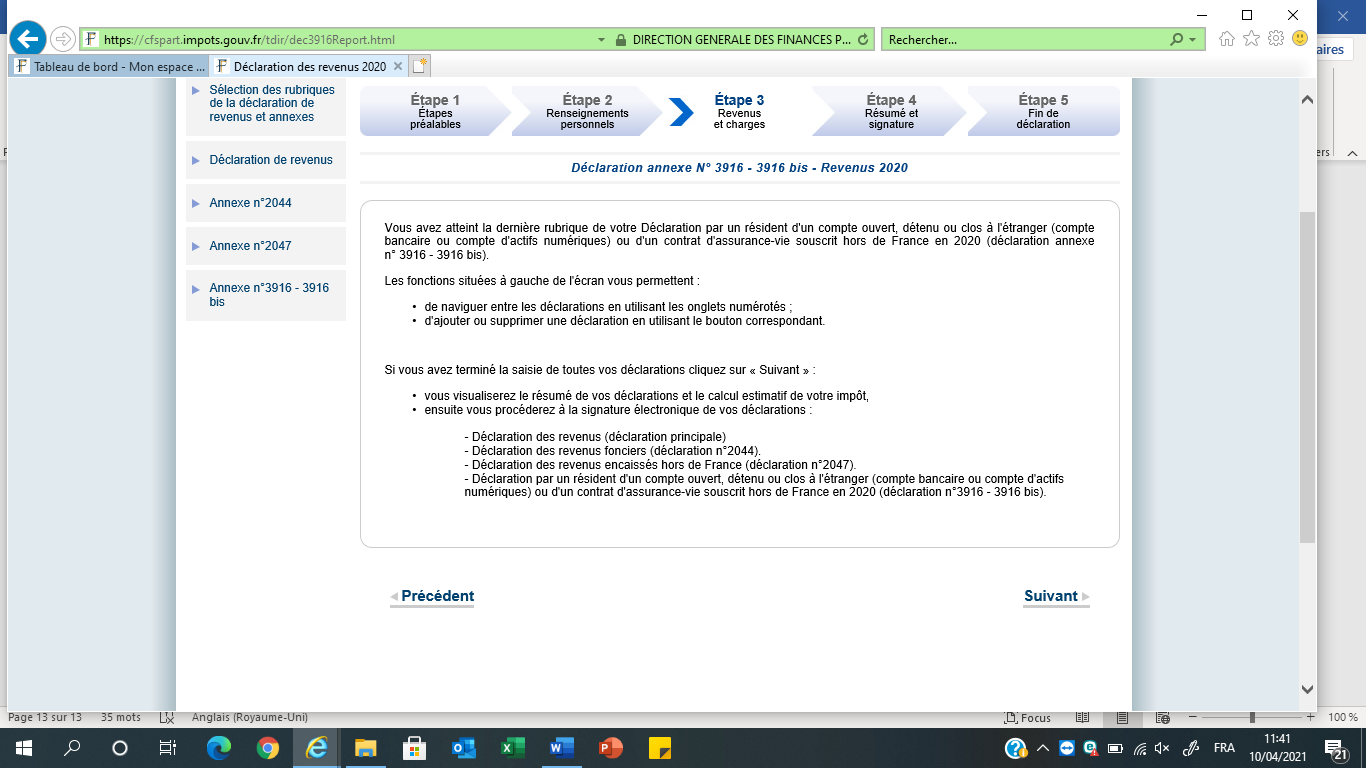

Then click on annexe 3916 on the left middle of the screen and you come up to this page below which tells you they have changed it this year to incorporate Assurance vie account and paypal, etc. so you have to enter all your bank accounts details again!! Before and next year, you simply have to check it is all OK!! So click on OK then enter how many accounts you want to declare in the little box.

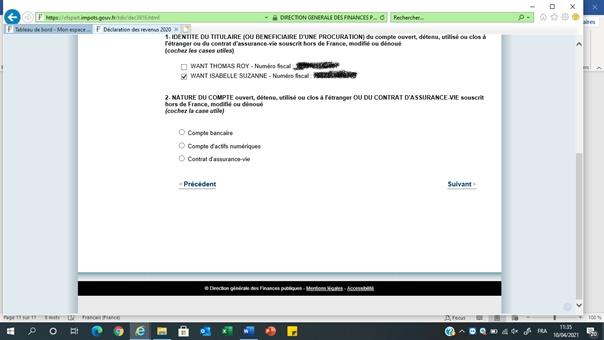

Then You need to tick whose account it is, tick both if both. Then click on « suivant »

Then it ask you what type of account it is: Bank account, Online account (paypal) or assurance vie account. Select the right one and click on « suivant »

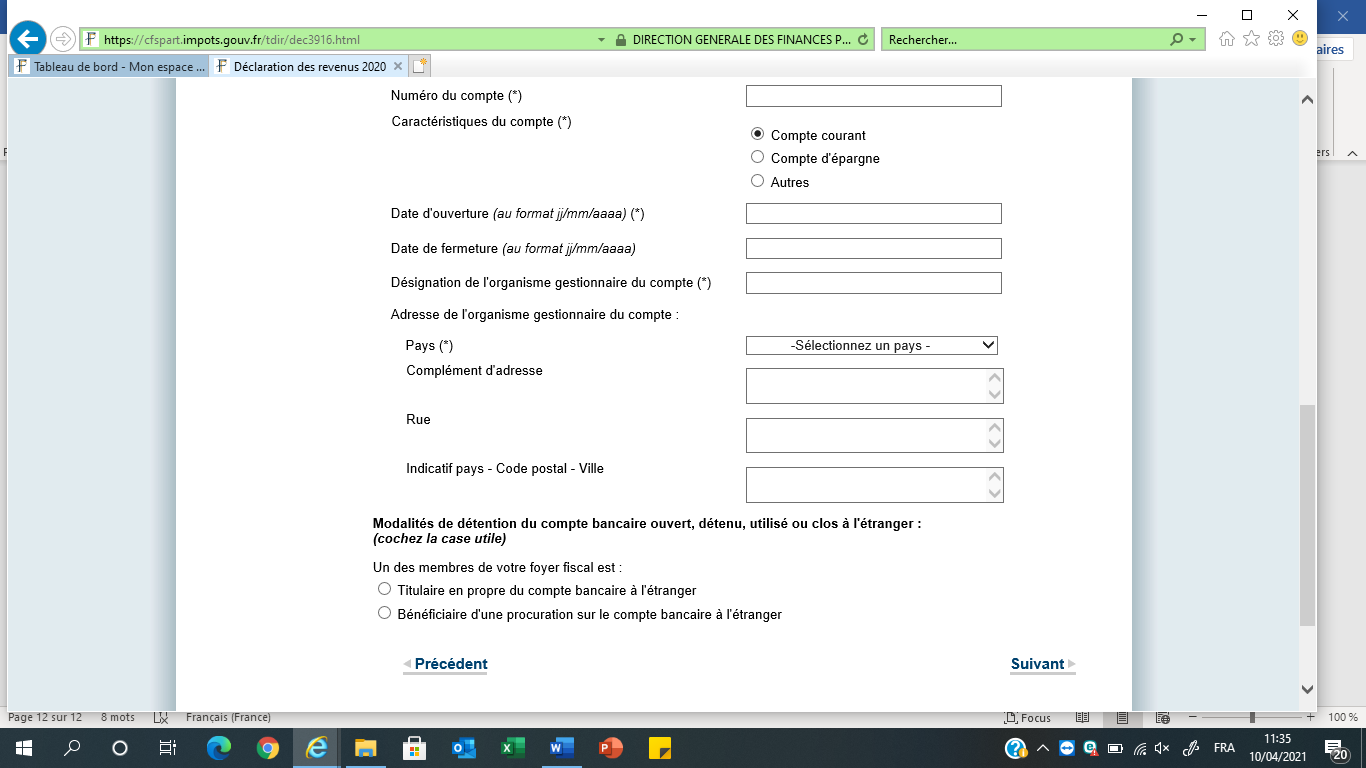

Then you fill in the account number, what type of bank account it is (current, saving or other), name and address of bank, date you have opened it (if you don’t know-like me, put a fake date!!). Then at the bottom, you tick if you own it or if you have a proxy for it. Then click on suivant

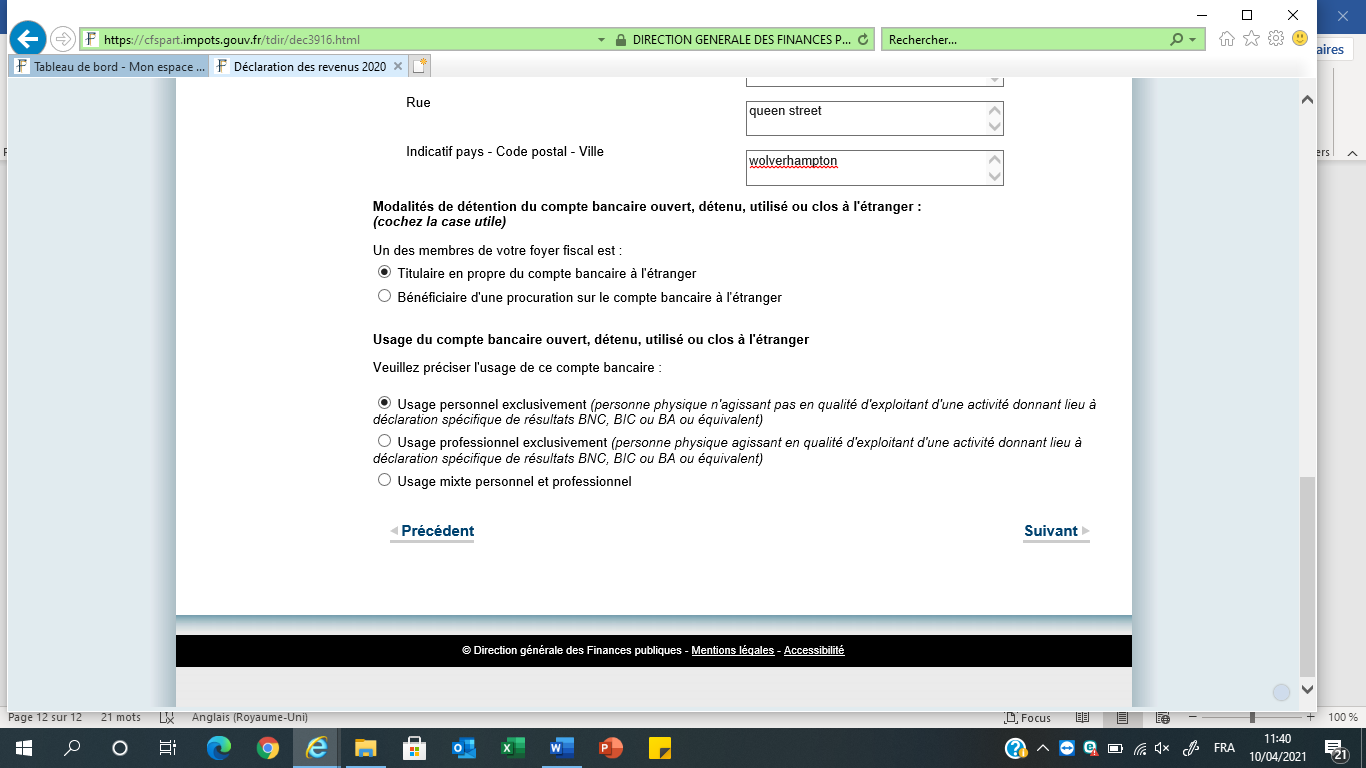

Then more appears asking you what use you have for it: private, professional or both, tick the one you want and click on suivant

Then this appears, click on suivant

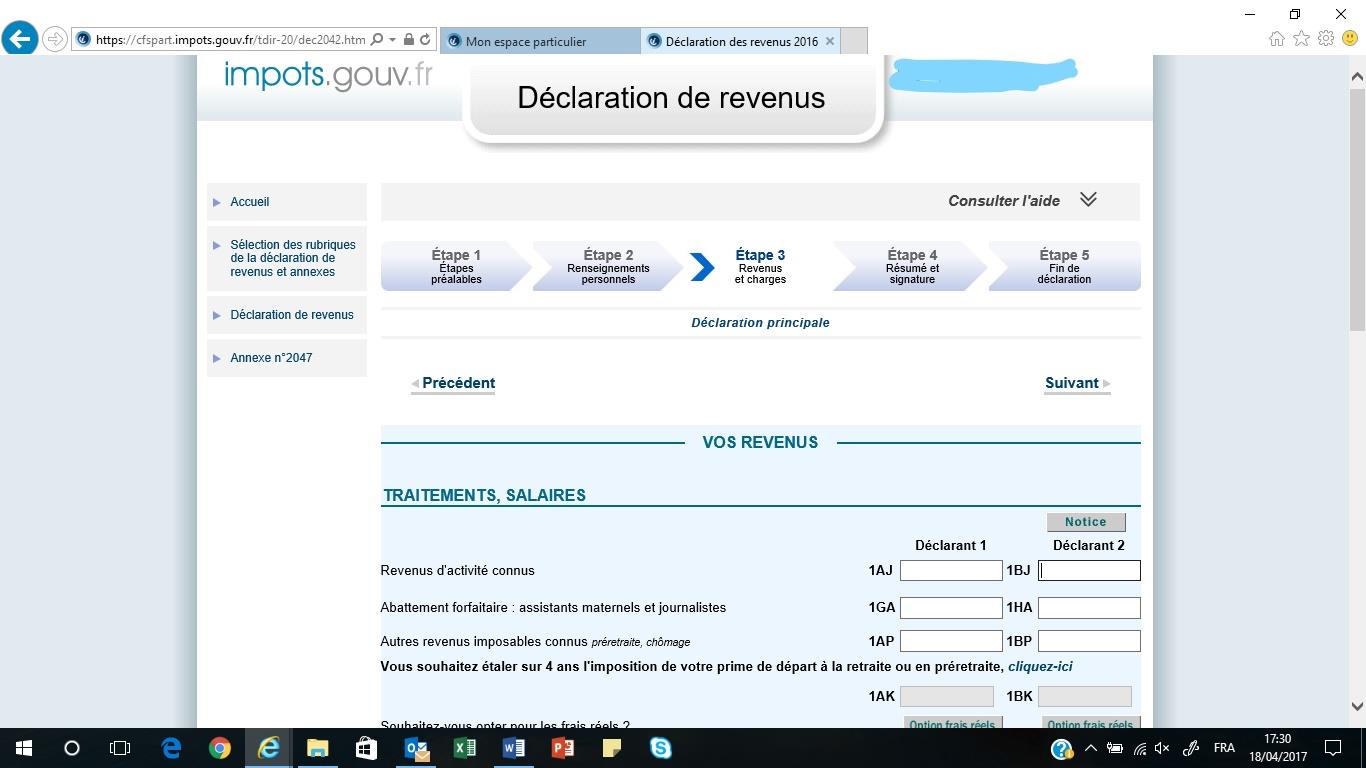

Click on « declaration de revenus » on the left of the screen and fill in the 2042 as per the paper version. Be carefull, some information you filled in on the other annexes (2047, etc) will have been automatically transfered on the 2042. So don’t add them to the 2042 again!!

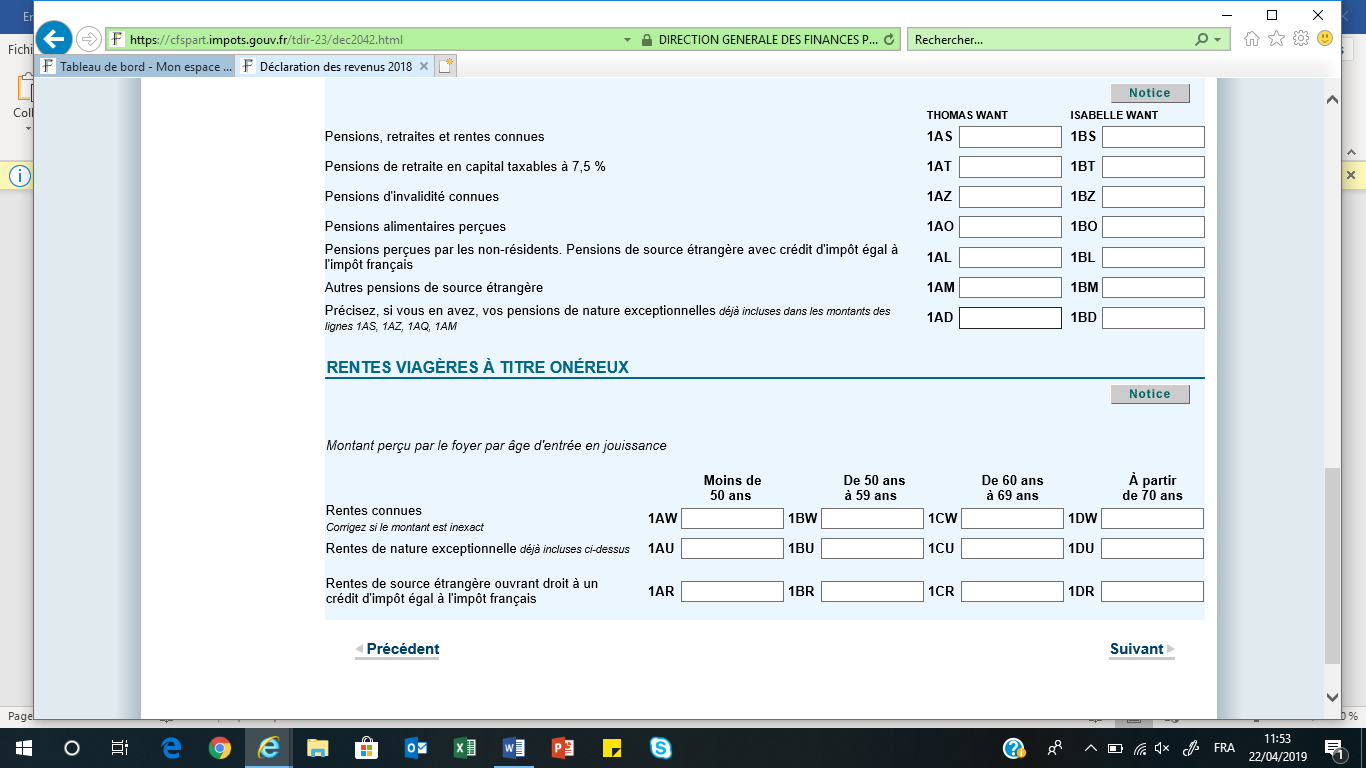

Here below you enter pensions on box 1AL, 1BL for public pensions and 1Am and 1BM for private and state pensions.

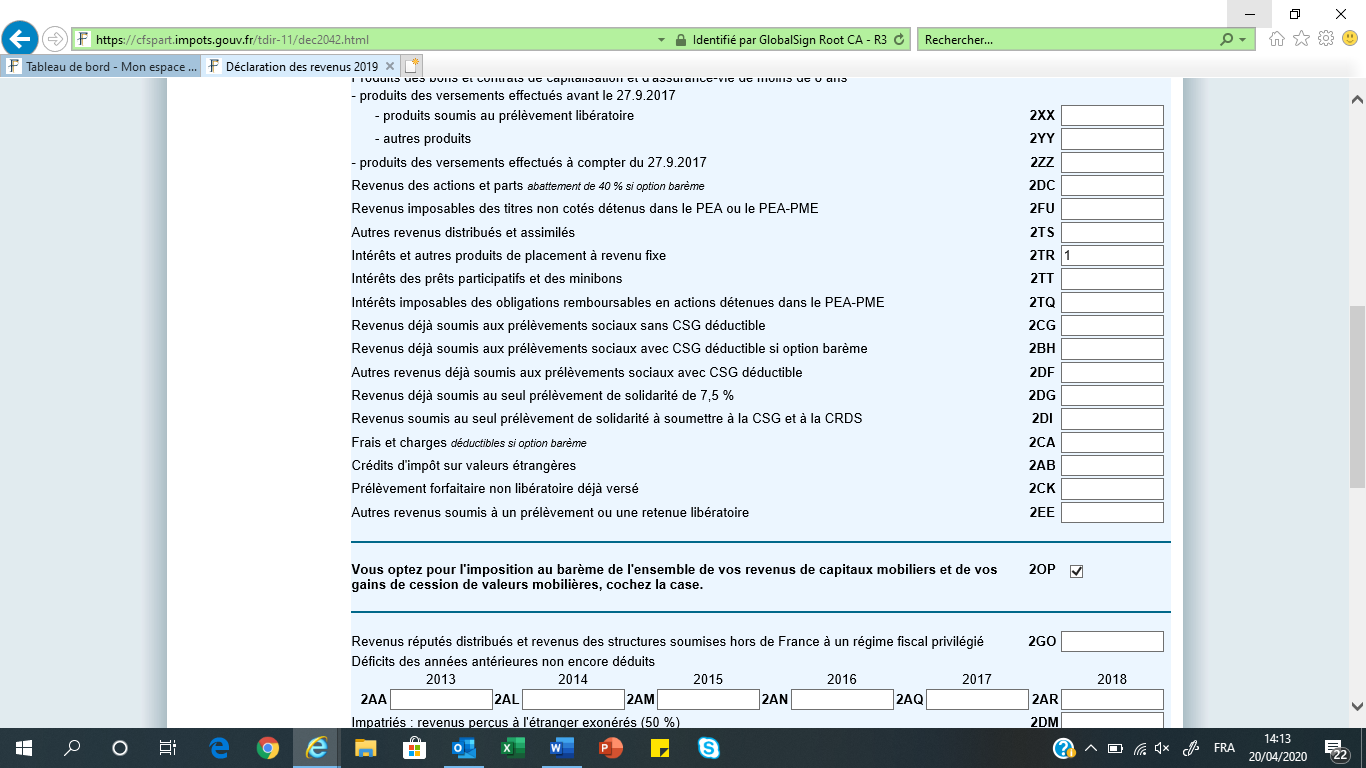

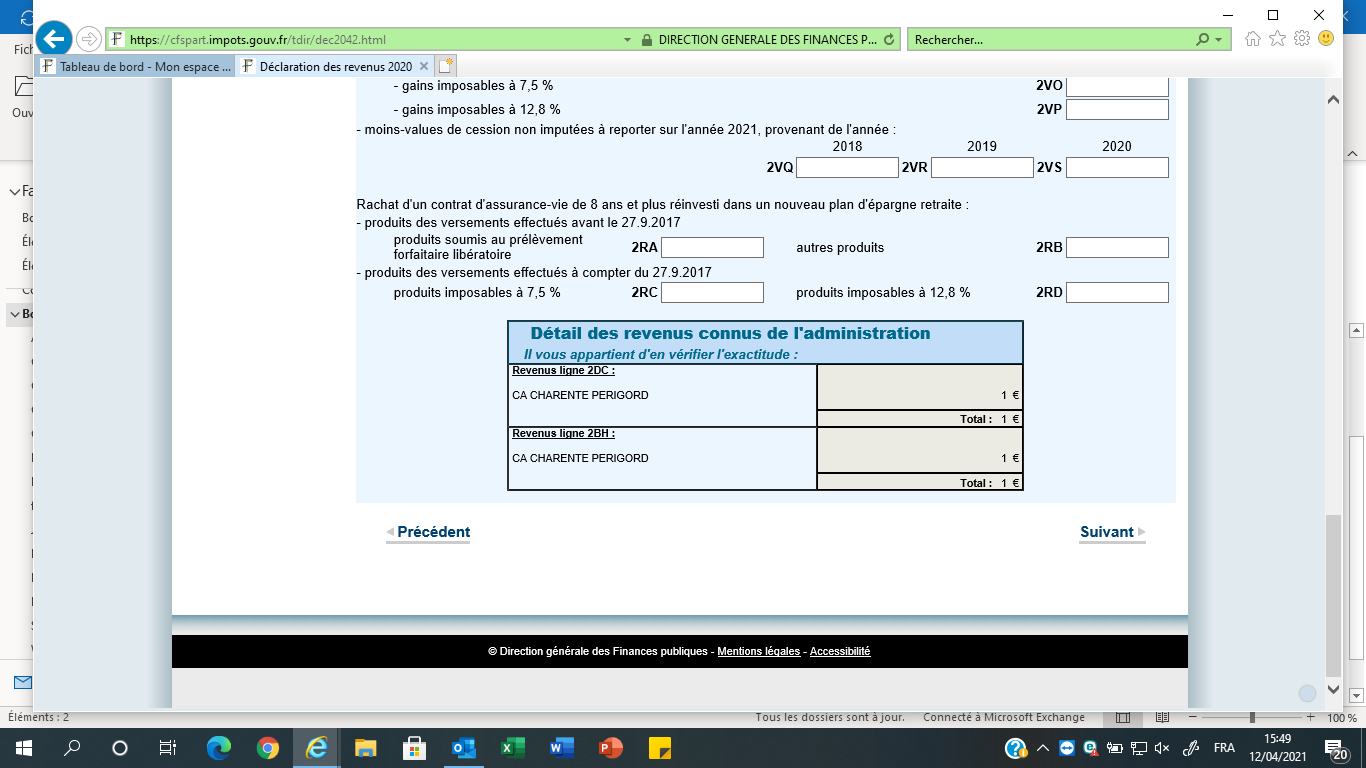

Make sure you have the correct amount of interest and dividends as per the 2047. If not, check that you did not have some interest or dividend already prefilled in there from French bank accounts. If so, you need to add the two together. And tick box 2OP if you don’t want your interest /capital gains/dividends taxed at the flate rate of 30% (12,8% income tax and 17,2% social charges).

If you already have an amount written on box 2TR for interest, it is written in a box like this below. So you need to add this number to whatever number you have reported from form 2047. Those are interests from French bank accounts

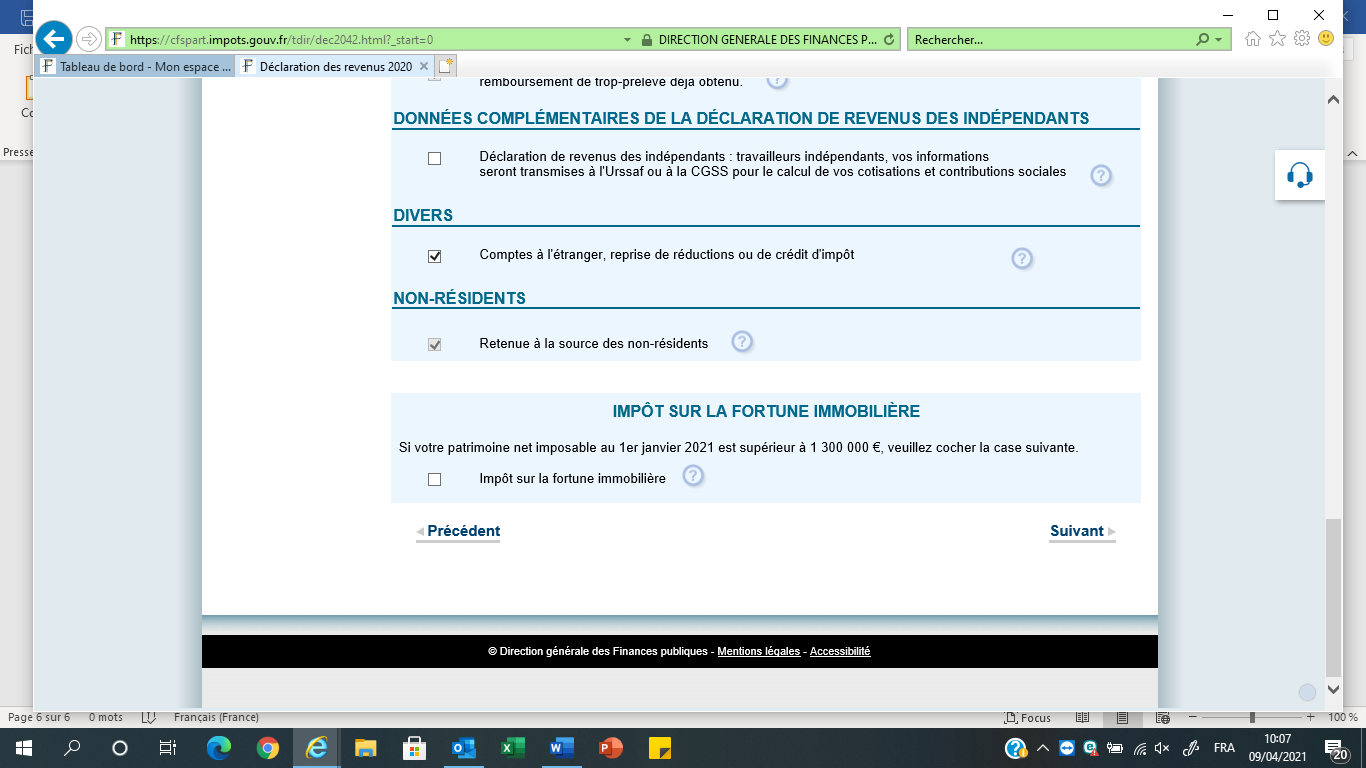

Dont forget to check that line 8TK is filled in if you have rental income or civil servant pensions.

Also tick box 8UU for bank accounts outside of France or/and 8TT for assurance vie accounts.

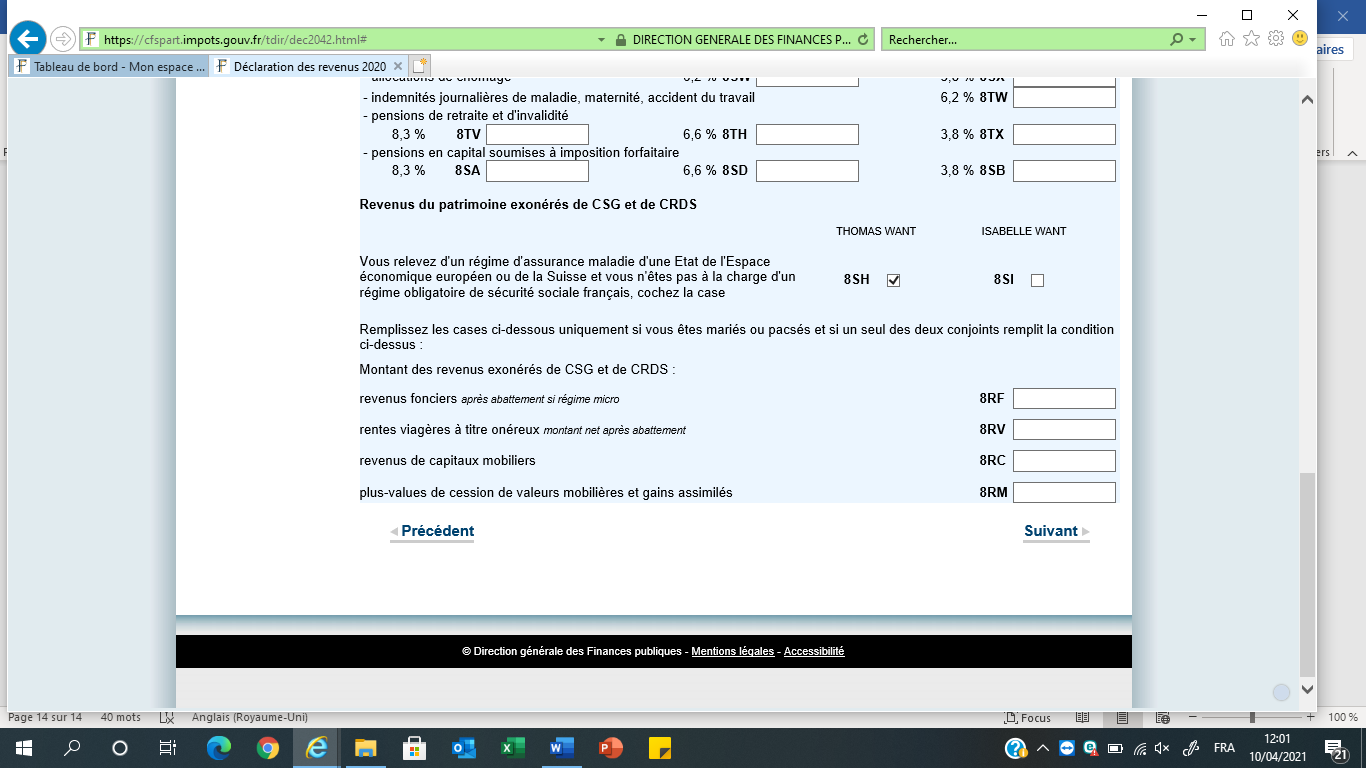

Don’t forget to tick the box 8SH and 8SI if you are on the French health system via an S1 form (in receipt of a state pension).

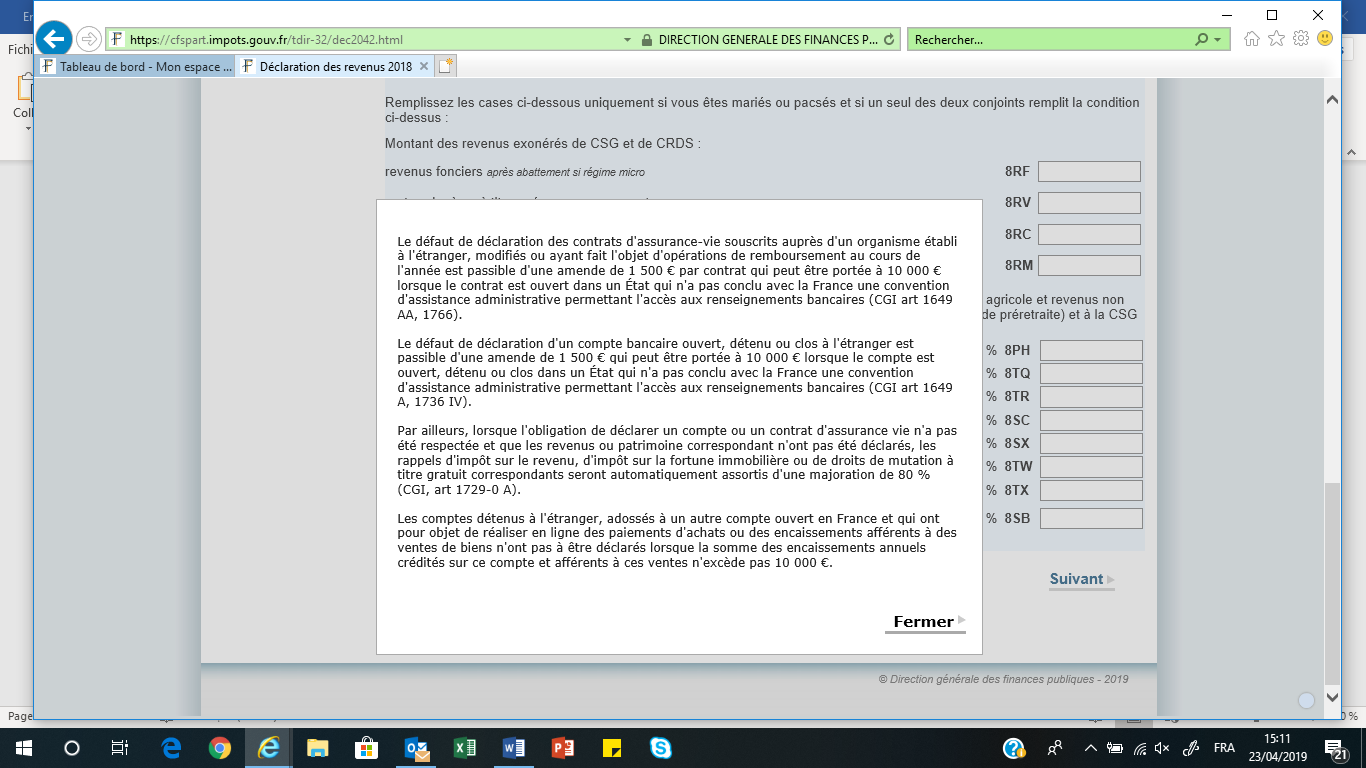

This window pops up if you have tick box 8UU or 8TT reminding you that failing to declare accounts outside of France carry a fine of 1 500 euro per accounts not declared or even 10K if in a country like Jersey or Panama!! Then click on « Fermer ». You then have to click on 3916 again and click on suivant to check all your accounts.

Then come back to the « declaration de revenus ».and carry on,

This is a page that lets you write a message to the tax office regarding a part of the tax you are unsure about.

You also get windows poping up telling you not to forget to fill in 3916 and other annexes you selected. Just click on OK.

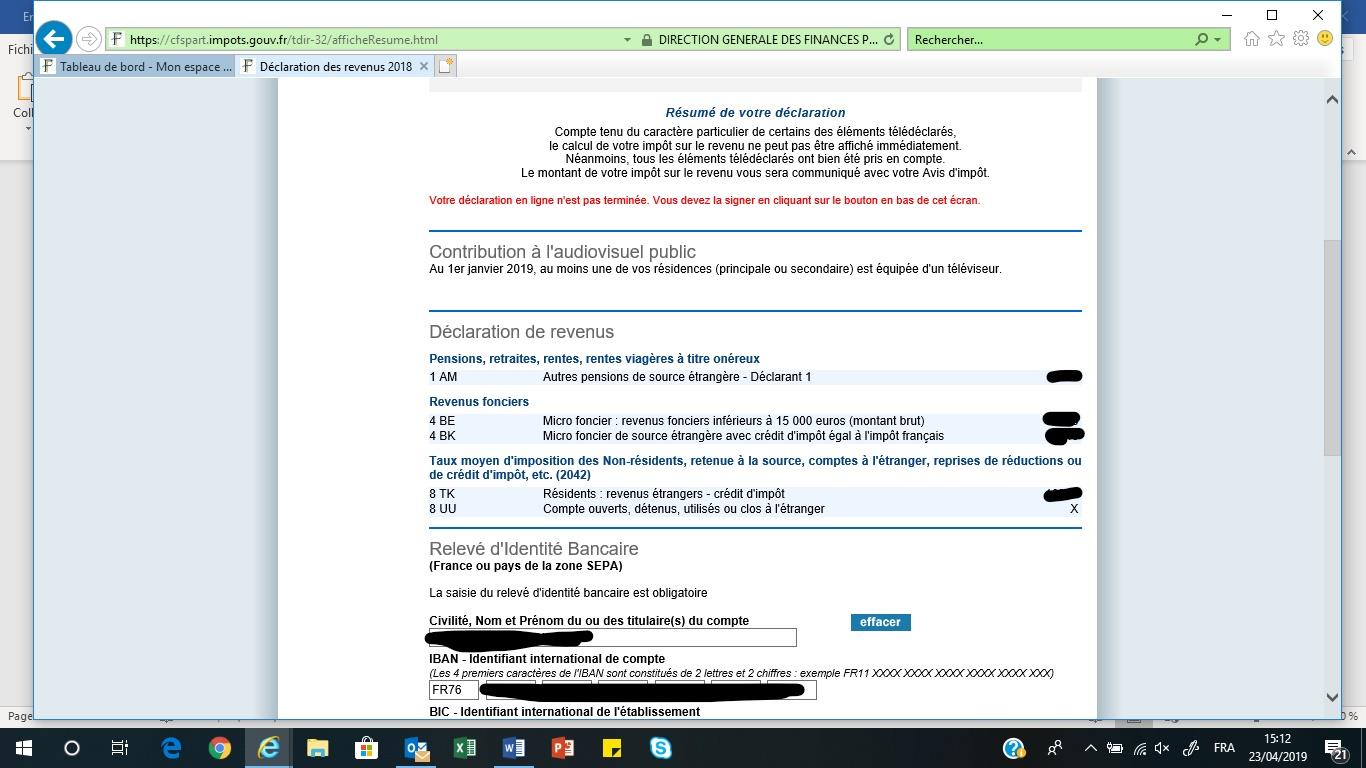

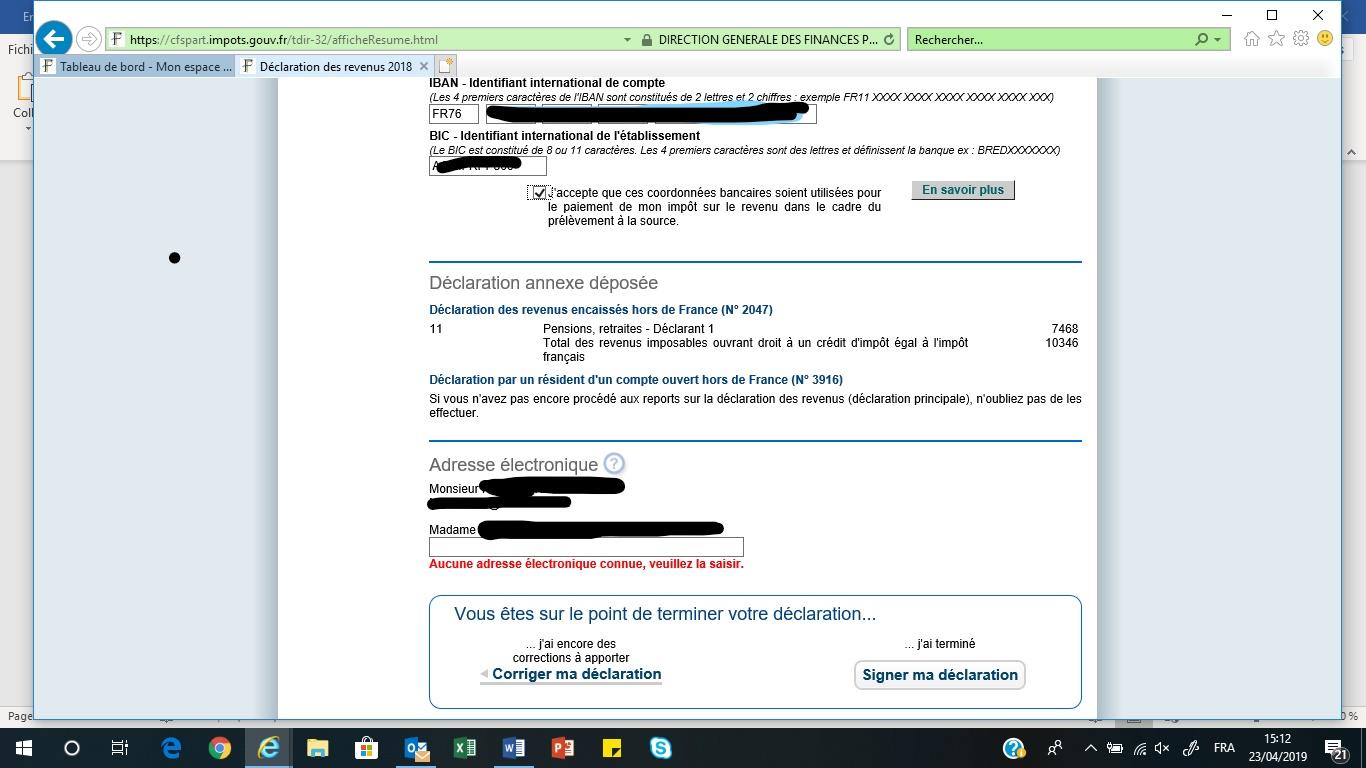

You then get to a page summarising all the figures.

Do check it is correct.

The bottom of the page asks you to confirm or enter your bank details. You must tick the box « j accepte que ces coord… » and then sign your declaration by clicking on « signer ma declaration » at the bottom.

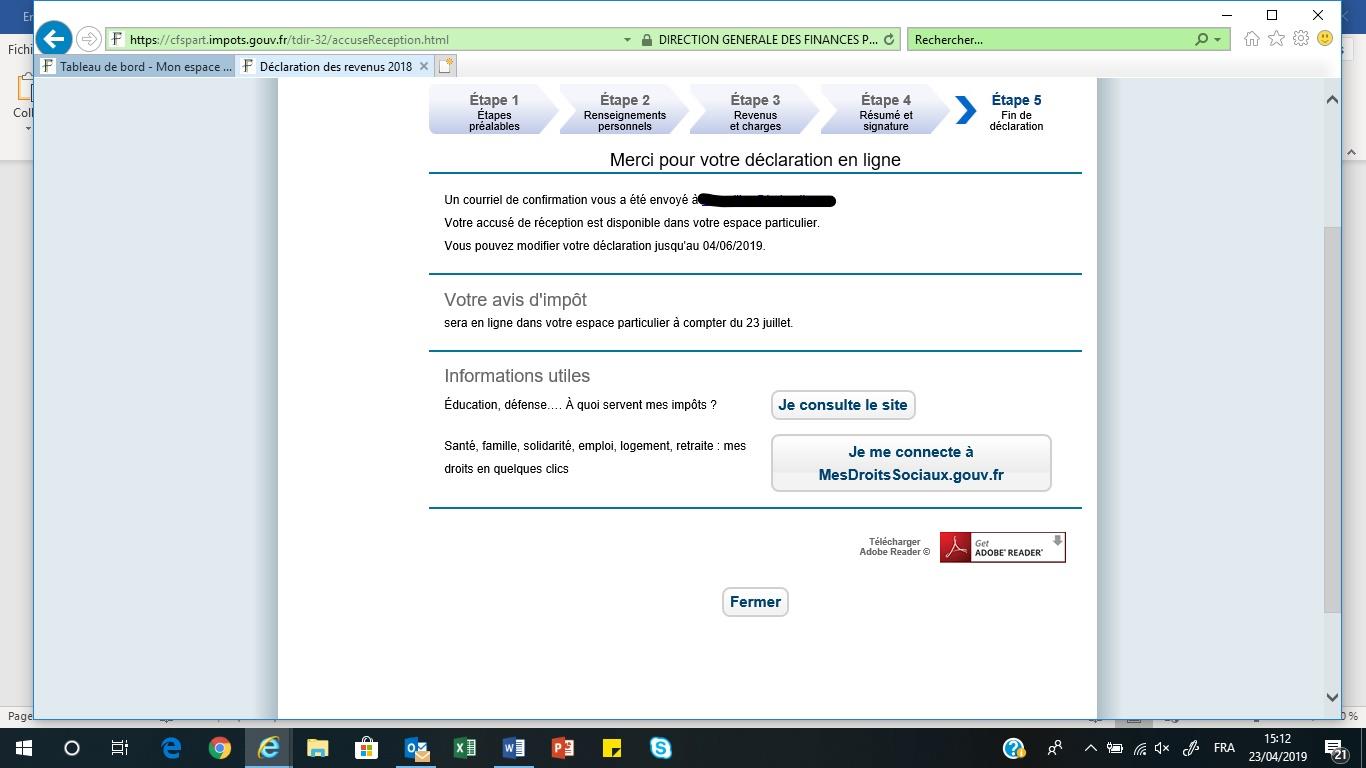

It then tells you that an email has been sent to your email address confirming it is completed .It also tells you that you can come back to make some changes and informs you of the deadline for it. This date depends on where you live. You then click on « fermer » and you’re done!! Congratulations!!!

Contact us !

In order to discuss and meet your need as best as possible, feel free to contact us with a mail, phone call... We can also schedule a meeting in one of our four agencies... Or directly to your home !