If like me, you are keen on nature and justice in this world and also like to make money without feeling bad about it, then, Allianz has created a new product for us! This investment ISR created last July is aimed to trade only in funds that include shares and bonds from companies that comply to ISR standards such as ecology, social equality, respect of staff, anti-corruption, etc.

1) What type of investment: It is invested inside an assurance saving account. So, it has all the same advantages of any normal assurance vie which are inheritance tax (extra allowance on top of normal allowance) and income tax advantages (some amounts tax free after 8 years).

The investment ISR has to follow some criteria based on 3 factors ESG:

Ecology: Management of waste, Reduction of greenhouse gas emission, Prevention Of environmental risk.

Social: Prevention of accident, Training of employees and equality of chances, Respect of employees’ rights and social dialogue, respect of subcontracting chain.

Governance: Independence of the board of directors, Quality of the governance of the company, remuneration of directors, effort in anti-corruption.

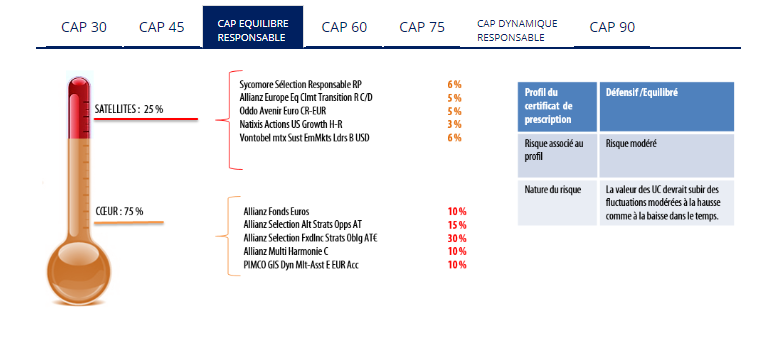

2) How is it invested: You can choose between 2 types of investment, one is called “Cap Equilibre Responsable” and is about 50% risky. 65% is low to medium risk and 25% is high risk. 10% is completely secured. see below:

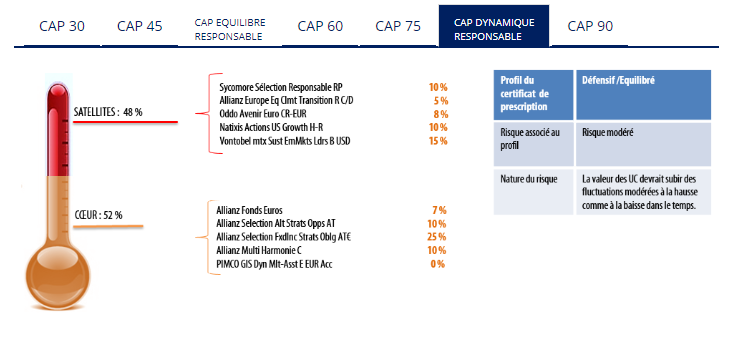

The other one is called “Cap Dynamique Responsable” and is around 80% risky. 48% is high risk and 45% is low to medium risk. 7% is completely secured.

3) Fees: Like any assurance vie, they are entry fees to set it up. These fees depend on the amount you invest. See below:

|

Amount deposited |

Entry fees |

|

<30K |

1% |

|

Between 30K and 50K |

0.50% |

|

Between 50K and 100K |

0.25% |

|

>100K |

0% no fees |

4) Hope of return: Well, you might think that because you choose companies which make more effort, you get a lower return but that might not be the case in the long term. You can earn more money by investing in companies whose search for fast return pays out in the short term but take the example of a famous low-cost airline who recently lost value on their shares due to staff going on strike!!Or even a famous oil company after the explosion of their oil rig off the coast of Louisiana! Companies that looks after their staff and environment usually do well. Who works better than happy employees? So, I cannot tell you what it will do in the future as I don’t have a Crystal ball! However, some of the funds ISR already existed with Allianz and the one called Allianz Europe Equity Growth has made 13.95% in 2017 and +64.20% in the last 5 years. Note that performances of the past are no guaranties for the future.

Conclusion: In this day and age of war on plastic and CAP 21, we are all starting to look at how to reduce our impact on our planet (except if you are Donald Trump) but why not look also at how we invest our money and who with! Allianz is a pioneer (being German) in waste management and ISR investment. We mostly use the Assurance Vie savings account to pass on some money to future generations so why not use it as well to make sure the planet is still here for them!

Contact us !

In order to discuss and meet your need as best as possible, feel free to contact us with a mail, phone call... We can also schedule a meeting in one of our four agencies... Or directly to your home !