In this issue:

Isabelle Want ‘s article of the Month

Product of the Month

Living in France & This Month recipe

Tax information, Covid 19 information & Agenda for January

Agency news & What happened in France in December

Brexit information

Professional of the Month

Some French vocabulary

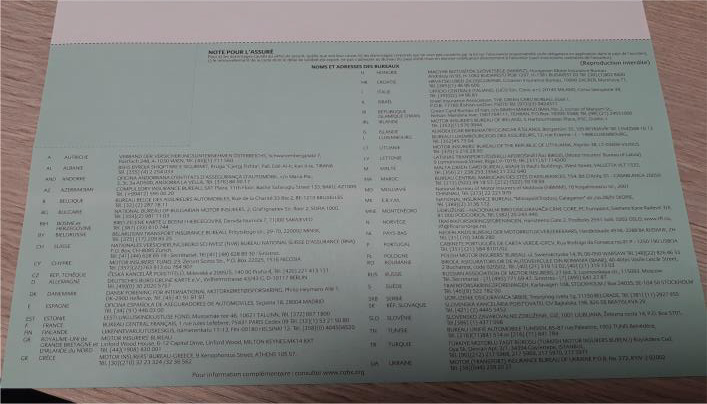

Useful information and contact details

ARTICLES OF THE MONTH

WHAT YOU NEED TO DO IF YOU HIT A DEER !!

OK, not what I wanted to happen just before Christmas but hey accidents do happen!! And lucky for me, I work in insurances, so I knew what to do. And, as my husband said (no, I have not sacked him), you will found out if your Allianz insurances that you sell will work!!

1) Hitting an animal while driving: On the Sunday morning 12th of December at exactly 8.20am, I was driving on the way to hunting some pheasants!! Yes ironic!! At the entrance of Mansle, a suicidal Chevreuils (French roe deer) decided to jump in front of my car. Lucky for me, it was not a big wild boar!! Even though it arrived from my left, it hit the right front of my car. That tells you how little chance I had to react. I stopped safely on the side and hoped it was dead, so I did not have to finish it off myself!! God only knows what people would have though driving pass seeing me shooting a roe deer on the side of the road (I had my gun in my car)!!

Once I established that my dog and I were alright and the deer was dead, I took photos of both the damages on my car and the dead animal. My car was still drivable and safe, so I went on my day.

2) Making the declaration of the claim: On Monday morning, after having responded to all my

emails (yes, I am very professional!), I told my colleague Florence who went on to open a file. She told me that I would be contacted directly by Allianz. It was 11am. At 12.10, Allianz phoned me on my mobile asking me for the circumstances, what damages I had and where it happened. Then the lovely lady gave me a list of garages which are partners of Allianz to take the car there so they could do a quote and a photo expertise (instead of an assessor visiting the garage, they take picture and send them to the assessor). I chose CIA in Ruffec. The lady gave me their phone number to make an appointment.

3. Visiting the garage: I phoned the garage and they told me no appointment, just turn up as it is done by photos. My husband took it Tuesday morning. It took less than 30 min.

4. Contact from Assessor: I also got a phone call from the assessor office asking me when I would take the car to the garage and received a few sms informing me all the time of what was happening or what I had to do: mostly, take your car to be assessed!! Even once it was done.

5. Appointment with the garage: Once the assessor did his report, I received it by SMS. It gave me a code to go online and download it but to be fair, I did not bother!! The accident was not my fault and I knew that I had 349 euro excess to pay as the deer would not pay for it!! The garage being on holiday between Xmas and New year, the car has to be taken to them on Monday the 4th of January. The repair would take 2 days and I get a courtesy car because it is a garage partner to Allianz.

6. What to do if the car is not drivable: If the car cannot be driven away from the crash, phone the breakdown line which is written on your green paperwork proof of insurance. They then take the car to the closest garage and arrange for a taxi to take you home and a taxi to take you to the garage once the car is repaired. Or if you have the option, you get a courtesy car for 7 days. Note that for the breakdown to be paid by Allianz, you must phone the Breakdown line. If you phone a garage yourself to be recovered, we will not pay for it. Same if you have the replacement car option, it only works if you have phoned and use the Allianz breakdown.

Conclusion: It went quite smoothy (apart for the deer!!). Luckily for me, the car was still drivable and safe. The thing you need to remember is that you need to be able to prove that it is an animal that caused the damage as opposed to you driving onto a post!! It makes no difference in regard to the excess as you still have to pay it yourself if you have one but it marked on your no claim as non-responsible so the premium does not go up as much as if it was your fault. As you can see on the photos, my car was covered in the deer hair!! So, the proof was there.

PRODUCT OF THE MONTH

ALLIANZ LOISIRS, BIJOUX ET AIDE A L’AUTONOMIE

LEISURE JEWELLERY AND SPECIAL EQUIPMENT INSURANCE

At last, Allianz has just come up with a new product to insure jewellery, bikes, golf clubs, hearing aids, etc that would have not usually been insured outside the house otherwise!!

1) Musical instruments: This is to cover musical instruments and their equipements such as cables, cases,etc) whether they are yours or rented for no more than a year from a school or a teacher.

It garanties damages caused by :

-a fire or explosion,

-action of electricity caused by lightning or power surges (as long as equipment is less than 5 years old)

-natural or technological disaster

-water

-theft, attempted theft or vandalism

-Any other accidental event

It does not cover:

-Scratches, blistering, paint deteriorations, stains, modification of sound if they are the only damages.

-The theft or damages limited to strings, bow hair, keys and string stretcher.

-Theft when the instrument is left in a performance room unless there is a special locker room.

-Theft if the instrument is left in a car or a place not locked.

How is it reimbursed:

-You must provide the proof of value of the instrument with an invoice or expert evaluation.

-If less than one year old, it is reimbursed new for old. Other wise it is value given by the assessor.

-If it is damaged, it is the cost of the repair without exceeding the value.

Note that there is a 10% excess.

2) Bikes: It is bikes and electric bikes as long as they can be identified with a serial number.

It garanties damages caused by :

-a fire or explosion,

-action of electricity caused by lightning or power surges (as long as equipment is less than 5 years old)

-natural or technological disaster

-water

-theft, attempted theft or vandalism under special requirement of security which are: bikes must be kept in a place locked by a key (no padlock) between 10pm and 7am. Any other time, it must be locked via a chain to a fixed post (security level U certified SRA). Non respect to this means the reimbursement is only 50% of what it would have been.

-Any other accidental event

It does not cover:

-Scratches, blistering, paint deteriorations, stains if they are the only damages.

-The theft or damages limited to tyres or equipment which don’t need a tool to take off the bike.

-Damages cause during an official competition.

-Damages when the bike was used for delivery or professional use.

How is it reimbursed:

-You must provide the proof of value of the bike with an invoice or expert evaluation.

-If less than one year old, it is reimbursed new for old. Otherwise it is valued less 1% per Month old with a cap of 60%.

-If it is damaged, it is the cost of the repair without exceeding the value.

Note that there is a 10% excess.

3) Sport and camping materials: It is any sport equipment or camping material such as golf clubs, horse riding equipment, fishing, diving, surf, etc…

It garanties damages caused by :

-a fire or explosion,

-action of electricity caused by lightning or power surges (as long as equipment is less than 5 years old)

-natural or technological disaster

-water

-theft, attempted theft or vandalism

-Any other accidental event

It does not cover:

-The theft or damages when the equipment is left unattended or in a place unlocked or in a car.

-Shoes and clothes

-Flying materials

-Equipement with an engine.

How is it reimbursed:

-You must provide the proof of value of the object with an invoice or expert evaluation.

-If less than one year old, it is reimbursed new for old. Otherwise it is valued less 6% per year old with a cap of 60%.

-If it is damaged, it is the cost of the repair without exceeding the value.

Note that there is a 10% excess.

4) Photo, sono, video and IT materials: It is It equipment such as computers, scanners, printers, keyboard, etc, tablets, cameras, videos, sound systems, accessories.

It garanties damages caused by :

-a fire or explosion,

-action of electricity caused by lightning or power surges (as long as equipment is less than 5 years old)

-natural or technological disaster

-water

-theft, attempted theft or vandalism

-Any other accidental event

It does not cover:

-Mobile phones

-Drones

-Loss of content (hardrive content for instance or photos)

-Theft when the equipement is left in a performance room unless there is a special locker room.

-The theft or damages when the equipment is left unattended or in a place unlocked or in a car.

How is it reimbursed:

-You must provide the proof of value of the object with an invoice or expert evaluation.

-If less than one year old, it is reimbursed new for old. Otherwise, it is valued less 1% per Month old with a cap of 60%.

-If it is damaged, it is the cost of the repair without exceeding the value.

Note that there is a 10% excess.

5) Jewellery: It is jewellery and watches. Maximum 6 items and value maximum 20 000 euro per contract.

It garanties damages caused by:

-a fire, explosion, lighting strike

-natural or technological disaster

-water

-theft, attempted theft or vandalism under special requirement of security which are kept in a safe sealed (not if above 100KG) when the house is unattended or if you have a house insurance with Allianz, security level 4 and above which is a full door with 5 lock bolt or armoured door with 3 lock bolt or full door with 3 lock bolts + video security agreed by Allianz. If the security is not met, the reimbursement is caped at 5000 euro. If you can’t meet the security requirement, best to have them insured under your house insurance contract for when they are left inside the house.

-Any other accidental event

It does not cover:

-The theft or damages when the equipment is left unattended or in a place unlocked or in a car unlocked. Unless it is a theft with aggression.

-Theft or damages when it happens during a stay in a hotel, rented property, camping, cruise or organised trip. However, it is covered if left in the hotel room in a safe or room locked.

How is it reimbursed:

-You must provide the proof of value of the object with an invoice or expert evaluation.

-If less than one year old, it is reimbursed new for old. Otherwise, it is value given by the assessor.

-If it is damaged, it is the cost of the repair without exceeding the value.

Note that there is a 10% excess.

6) Luggages: Luggages and their content

It garanties damages caused by :

-a fire or explosion, lightning strike

-natural or technological disaster

-water

-theft, attempted theft or vandalism

-Any other accidental event

It does not cover:

-Handbags

-damages caused by liquid or caustic material kept in the luggages

-Money, cheques, credit cards

-Jewellery

-Breakage of fragile objects

-The theft or damages when the equipment is left unattended or in a place unlocked or in a car unlocked. Unless it was under supervision of a transporter.

How is it reimbursed:

-You must provide the proof of value of the object with an invoice or expert evaluation.

-If less than one year old, it is reimbursed new for old. Otherwise, it is valued less 6% per year old with a cap of 60%.

-If it is damaged, it is the cost of the repair without exceeding the value.

Note that there is a 10% excess.

7) Wine cave: It is wine, spirits but also barricks and their content, material to put wine in bottles and electric wine racks.

It garanties damages caused by :

-a fire or explosion

-Electricity to wine racks

-natural or technological disaster

-water

-theft, attempted theft or vandalism as long as you have the same security as per the jewellery above. Otherwise the reimbursed is reduced by 50%.

-Any other accidental event

It does not cover:

-Wine or liquid going off unless it is due to one of the above garanties

-wear and tear of the wine rack

-The theft or damages when the bottle is left unattended or in a place unlocked or in a car unlocked.

How is it reimbursed:

-You must provide the proof of value of the object with an invoice or expert evaluation.

-If less than one year old, it is reimbursed new for old. Otherwise, it is value given by the assessor.

-If it is damaged, it is the cost of the repair without exceeding the value.

Note that there is a 10% excess.

8) Self sufficiency equipment: It is hearing aids except implants, wheel chairs, crutches, zymoframes, protheses and ortheses, optical material for blindness. This equipment either belongs to you or you are renting it from medical professionals

It garanties damages caused by :

-a fire or explosion

-action of electricity caused by lightning or power surges (as long as equipment is less than 5 years old)

-natural or technological disaster

-water

-theft, attempted theft or vandalism

-Any other accidental event

It does not cover:

-The theft or damages when the equipment is left unattended or in a place unlocked or in a car unlocked.

How is it reimbursed:

-You must provide the proof of value of the object with an invoice or expert evaluation.

-If less than one year old, it is reimbursed new for old. Otherwise it is valued less 6% per year old with a cap of 60%.

-If it is damaged, it is the cost of the repair without exceeding the value.

Note that there is a 10% excess.

9) Weapons: it is firearms, bow, crossbow and their cases

It garanties damages caused by :

-a fire, explosion or lightning strike

-natural or technological disaster

-water

-theft, attempted theft or vandalism

-Any other accidental event

It does not cover:

-The munitions, arrows, etc

-weapons not protected following French law regarding their safety

-scratches if it is the only damage

-The theft or damages when the equipment is left unattended or in a place unlocked or in a car unattended.

How is it reimbursed:

-You must provide the proof of value of the object with an invoice or expert evaluation.

-If less than one year old, it is reimbursed new for old. Otherwise, it is the value given by the assessor.

-If it is damaged, it is the cost of the repair without exceeding the value.

Note that there is a 10% excess.

General exclusions:

-Loss.

-Theft or attempted theft by a member of your family

-Damages caused by you intentionally

-Damages covered by the guarantee of the manufacturer

-Breakdown, or internal damages cause by manufacturer default

-Damages cause by wear and tear

-Damages cause by an IT virus

-Damages caused by someone else other than you (if object was borrowed by someone else).

-Damages caused by War

Exemples of cost:

1 Electric bike purchased new at 2 000 euro: 215.54 per year

1 hearing aid purchased new at 2 000 euro: 41.66 euro per year

1 Rolex watch purchased new at 10 000 euro: 317.18 euro per year

Golf clubs purchased new at 1000 euro: 38.42 euro per year.

1 Violin purchased new at 5 000 euro: 123.74 euro per year.

Conclusion: This is a great product as long as you understand the limit of the garanties (especially for jewellery with the special security measure you need to have in place in the house). And remember loss is never covered in France.

LIVING IN FRANCE

LA GALETTE DES ROIS

In January, you will see a lot of pastry cake called “galette des rois” in bakeries and supermarket. It is a pastry dessert eaten on the 6th of Jnauary to celebrate the visit of the 3 wise men (3 kings in French) to the divine enfant “Jesus” (Epithany). But as French people like their food, it is eaten all over January!! Not just on the 6th!

There are 2 types of galettes, the brioche type and the frangipane type (see recipe above). The Brioche type is a brioche with sugar bits on it and candied fruit inside. The frangipane type is with an almond paste inside.

Inside those galettes are hidden a “fève” which used to be a broad bean and is now a porcelain or plastic figure (depends on the price of the galette!). Whoever gets it when eating it (trying not to break his teeth on it) is the king or the queen for the day! Hence why those cakes are always accompanied by a fake crown to be given and worn by the king or queen of the day. The difficulty is not to reveal the bean while cutting the cake which takes away the fun of the anticipation to know who will be King or Queen (my mum always managed to do that)! This tradition dates back from Roman times as they used to name a slave King for a day during the “Saturnale” festival.

In any case, it’s now French so why not try it!

THIS MONTH RECIPE

GALETTE DES ROIS FRANGIPANE

Ingrédients :

2 puff pastry (pate feuilleté in French)

1 sachet of frangipane

10cl of water

1 egg yolk

In a recipient, put the content of the sachet of frangipane and add the water, stir well, rest 5 min and stir again.

ON a baking tray, lay the first puff pastry, then add the mixture in the middle, leaving 2-3 cm around free of mixture and cover with the second puff pastry making sure the outside is stuck together.

Brush over the top with egg yolk.

Bake for 30 min in a preheated oven at 180°C.

TAX INFORMATION

From 2021, the tax d’habitation will be reduced progressively until 2023 when it will be erased completely. It has happened already (since 2018)to some of you (80% of people) as your income was lower then others but now it is for everybody (only for main residence). It should be reduced by 30% in 2021 and so on the year after so it comes to 0 eventually!!. If you pay Monthly, they will reimburse you at the end of the year (October).

Be carefull as the TV tax is not included in the discount. TV tax is 138 €.

COVID 19 INFORMATION

From Saturday the 2nd of January, Curfew is at 6pm till 7am in 15 departments (mostly in the East of France) where the virus is not contained. Those Departments are : Hautes-Alpes, Alpes-Maritimes, Ardennes, Doubs, Jura, Marne, Haute-Marne, Meurthe-et-Moselle, Meuse, Moselle, Nièvre, Haute-Saône, Saône-et-Loire, Vosges and Territoire de Belfort. The campaign of vaccination has started and has already comes under huge criticism for its very slow pace!! Remember the application called “tousanticovid” to download. When you download it, it will tell you if you have been in contact with someone else who has it, but it is also full of good advice, information like where to get a test, how many affected daily, etc and you can download the attestation to go out. As of 3rd of January 2021, 100 départements are in high vulnerable situation:

Important numbers:

As of 03/01/2021 there has been 65 037 deaths in France (45 257 in hospital), +116 in the last 24H. There have been 2 655 728 confirmed cases (+12 489 in the last 24H), 7 460 people being hospitalised (in the last 7 days), 1 135 of them in intensive care. You can find all the information on this web site: https://www.santepubliquefrance.fr/dossiers/coronavirus-covid-19

AGENDA FOR JANUARY IN THE CHARENTE

27th: Rouillac Monthly big fair

Basically everything has been cancelled.

You can find the majority the Charente’s activities and visits in this free magazine. It is available at most bakeries, shops and tourist office and you can also download it online:

https://www.sortir-label-charente.net/

AGENCY NEWS

Our entire team wishes you all the best for this New Year.

Bonne Année 2021 et surtout bonne santé ! Stay safe !

Presentation of a new staff:

She is called Audrey ROUGIER and is 26 years old. She started Mid-December 2020 but was actually with us as part of her studies for BTS Commercial back in 2017. She is based in the office in La Rochefoucauld and deals with day to day management of customers contract such as claims, change of cars, payments, etc.

She is a fan of movies and animal welfare. She has 3 cats called Gaya, Minerva and Nagini, and also has a dog called Olivia. So she spends all her week ends walking in the Forest so that her dog is happy!!

Her English is not very good but she is looking forward to improving it!!

WHAT HAPPENED IN FRANCE IN DECEMBER 2020

In general, Our President Mr Macron had tested positif to Covid and isolated himself for 7 days.

The Ecologist maire of Marseille has resigned only 6 Months after having been elected.

5 Soldiers has been killed in Mali.

A Rave party with 2 500 people has taken place on New Year’s Eve despite Covid restriction. The French authorities have fined 1 600 people and ceased all the music materials.

In crime, A 16-year-old boy has been shot dead and 3 other people injured in a rough suburb of Bordeaux.

Obituaries, Our ex-President Valerie Giscard d’ Estaing has died of Covid at the age of 94 years old. He was President between 1974 and 1981. He was at the origin of the law that legalise abortion in France and the creation of the TGV (high speed train when it is not on strike!!).

Gerard Houlier who was coach of the French football national team as well as Liverpool and Aston Villa died at the age of 73.

Pierre Cardin (famous French clothes designer) has died aged 98.

BREXIT INFORMATION

We have had a lot of queries regarding car insurance and Brexit. Yes, your car will still be insured to drive in the UK after Brexit and no, it won’t be more expensive and NO, we don’t want to know when you are going. If you look at the back of your green paperwork proof of insurance which you should always have with you when you use the car, you will see a listing of countries where you are insured to drive. Note that countries like Iran or Russia are not in the EU but you can drive there. So it will be the same with the UK, deal or no deal!

Health cover: As you know, British people who want to apply to be residents in France must proove that they are on the French health system or that they have health insurance EQUIVALENT to the French health system+ top up. Good news for 2021, we now have it!! Via our broker insurance and April. The insurance is called Travel cover.

To do a quote I simply need your full name, occupation , birthdate and address in France. Note that the cover is for a determined period (3 or 6 Months) and the cover can be stopped with proof that you are on the French health system (attestation de droit).

To carry on the note on Health cover, I found that a lot of people panic about it but please remember that you have until the 31st of June to apply to residency hence loads of time to apply onto the French health system. Note also that if you are going to be an auto entrepreneur, you will automatically be onto the French health system. If you apply to PUMA, Cpam will backdate the cover to when you first apply.

PROFESSIONAL OF THE MONTH

LEARN FRENCH!

Jane Barlow

BA (Hons) French and Italian

janebarlow@orange.fr

| Learning French can be fun – honestly!! If you want to learn from scratch or improve your French and gain some confidence, I teach private classes in Verteuil (16510), where I’ve lived for the past five years. Very informal and we’ll go at a pace that suits. If you live a little too far away, then Skyping could be a possibility. Sadly there’s no quick fix to learning a new language, no matter what the websites tell you, but with a little effort and application it’s possible to make a lot of progress. Don’t let the terrifying word “grammar” put you off – that’s just a scary word for the building blocks that you need to make sense of it all. That and developing a good range of vocabulary make up the jigsaw puzzle. Don’t let any previous bad experiences put you off and remember that anything you learn is more than you knew before – and you might find you have a hidden talent you never knew about! You’ll find that being able to communicate more effectively will enrich your French experience immeasurably. I usually teach on a one-to-one basis, but if there are two or three of you at a similar level, then that’s fine. Send me an email (janebarlow@orange.fr) and I can let you have more information and discuss your needs and expectations in more detail. Don’t be shy to try – you might surprise yourself! |

“I have been learning French with Jane for less than a year and I am amazed at how much I have learned. I gained a French ‘O’ level many years ago but I retained very little knowledge. Learning a language is not easy and requires lots of hard work and Jane has made this a very enjoyable experience for me. She has excellent knowledge, is very encouraging and patient. I would never have persevered without Jane’s excellent assistance”. KIM. “I have been having French lessons with Jane for over a year and have progressed significantly over that time. Jane explains everything brilliantly and is very patient, allowing as much time as you need to understand. Jane is the perfect teacher for me and I know I will get there in the end. Learning French is not easy but because Jane is so easy to get on with this helps you maintain a sense of humour and to enjoy the lessons”. JACKIE. |

INSURANCE FRENCH VOCABULARY

| FRENCH | ENGLISH |

| Une Franchise Un Sinistre L’Assistance Une Assurance Un Bris de glace Un Remboursement Une Cotisation Une Echéance Une Date d’effet Une Résiliation Un Avenant Un Devis Un Incendie Un Dégats des eaux Un Domage electrique Un Accident de voiture Pneu Un Chevreuil/ Sanglier Un Fossé Une Clôture Un Portail Une Tempête Un Arbre La Grêle La Neige La Pluie Le Verglas La Toiture La Maison Les Murs Le Portail Grange Le Contenu Un Objet de valeur Une Carte grise Un Permis de conduire Un relevé d’information No claim certificate |

Excess Claim Breakdown cover Insurance Windscreen cover (In France it also covers head lights and all windows) Reimbursement Premium Renewal date Contract start date Cancellation Amendment Quote Fire Water damage Electrical damages Car accident Tyre Roe Deer/ Wild boar Ditch Fence Gate Storm Tree Hail Snow Rain Black ice Roof House Walls Gate Barn Content Valuable item Car registration paperwork Driving licence No claim certificate |

Contact us !

In order to discuss and meet your need as best as possible, feel free to contact us with a mail, phone call... We can also schedule a meeting in one of our four agencies... Or directly to your home !