In this issue :

- Isabelle Want’s Article of the Month

- Product of the mont

- This month’s recipe

- Agenda for December & Living in France

- What happened in France & Association of the month

- Insurance French Vocabulary

ARTICLE OF THE MONTH

REGULATED SAVING ACCOUNTS IN FRANCE

There are a number of French governments regulated saving accounts available in French banks so here is a sum up of all of them so you can choose which one is best for you and your financial situation. All those accounts are similar to ISAs in the UK in the way that they are not subject to income tax or social contributions. In short, they are earning interest and those interests are TAX FREE.

It is the French government who set the interest rate on all those types of saving accounts and the government reviews them twice a year (1st of February and 1st of August). So, the interest rate is the same in every bank (apart from Livret Jeune). Those interest are inflation linked.

Interest is calculated every 2 weeks (on the 1 and 16th of each month) so if you decide to make a withdraw, it is best to do it either on the 2nd or the 17th of the month so you don’t miss out on 2 weeks interest.

The interest is paid on the 31st of December each year.

LIVRET EPARGNE POPULAIRE (LEP): Only available to people over 18 who have a “revenue fiscal inferior to a certain amount (for a couple, 31 137 euro of revenue fiscal or 20 297 for a single). The “revenue fiscal is written on your income tax form you receive at the end of August. So, you need to be a French resident otherwise you won’t have a French income tax form. The bank asks for a copy of your income tax form to be able to open this account. As of 01/08/2022 interest is 6% tax free. Minimum of 30 euro on it and maximum of 10 000 euros (It has been increased this year as it was 7 700 before). Do note that the compound interest can make it go over the 10 000 limit but you can’t add to it and make it go over that limit. Only allowed ONE per person.

LIVRET A: Probably the most popular one in France as it is available to people under and over 18 as well as associative clubs. Minimum of 10 euros and maximum of 22 950 euros (76 500 for associative clubs). Same thing with the compound interest here as the LEP so you can have a Livret A with more than 22 950 on it. As of 01/08/2022 interest rate is 3% tax free. For under 18, they can only take the money from 16 years old, otherwise they need their parents or legal representative. Only allowed ONE per person.

LIVRET DEVELOPEMENT DURABLE (LDD): With some banks, you have this saving account automatically with your current account. Basically, you have no choice! Minimum of 15 euros and maximum of 12 000 euros. Same thing again with the compound interests so you can end up having more than 12000 on it. As of 01/08/2022 interest rate is at 3% tax free. Only ONE per person. You must be a French resident and over 18 years old.

LIVRET JEUNE: As its title indicate, it is only for young people (French resident) between the age of 12 and 25 years old. Maximum of 1600 euros. Same things with compound interests. The account must be shut on the 31st of December of the year of your 25th birthday otherwise the bank shuts it for you and transfer the amount on an account not earning anything while you decide what to do. You can only take some money out after you are 16 years old otherwise you need one of your parents or legal representative. The minimum interest set by the government is the same as the Livret A so as of 01/08/2022 interest rate is 3% but banks do a better rate than that and it is different from bank to bank so shop around. Usually between 3.5% and 4%. Only ONE per person.

Those saving accounts are very good for treasury as they are available straight away. You can even do wire transfer online from the saving account to your current account, so they are brilliant for the time when the boiler breaks down or the car repairs are due! However, they do come under the French inheritance law so make sure if you are in a relationship (or married) that you have one each and with roughly the same amount on each as if one of you dies, the account of the decease is frozen until the notaire sort out the inheritance (usually takes 6 months). I usually advise my customers to have about 2 to 3 times what they need in a month on one of these in case of emergency (boiler, car repair, etc.) so if you spend an average of 2000 per month, you should have 6000 euros on a tax-free saving account. I would then advise to invest in a more long term saving account like the Assurance Vie (please contact me for that) as the interest rate is higher and the amount on it is protected from French Inheritance law. The money is not blocked either, but you need at least 2 weeks’ notice to get it.

If you are confused by all this, feel free to contact me as my advice is FREE!

PRODUCT OF THE MONTH

HOUSE INSURANCE, BEING UNDER INSURED AND SOME FACTS

It often comes as a surprise to some people that when they want a quote for their house insurance, I ask to come and visit. If it is too far, I asked them for a complete description of the house. This is because in France, you are insured in accordance with the number of rooms you have and not on the value of the house. So, I will explain how the contract works and what are the consequences of being under insured.

- How do you count the rooms: In France, your insurance company will ask you how many “pieces” your house has. What counts as rooms (pieces) are bedrooms/ living room/ dining room/offices/mezzanine/verandas that are over 9m2 (with Allianz) but also a landing or reception room if it is very big. Bathrooms, toilets, kitchen, landing, corridors are not counted as rooms. Rooms over 40 m2 count as 2 rooms!

Kitchens that have a separation like a bar or if only half the room is a kitchen, and the other half is dining room could count as one room. To make sure what counts as rooms, it is better to check the “Dispositions Générales” of your contract. This is the booklet that comes with your contract (Dispositions particuliéres) and you would have a description of what the rooms are (written in the first few pages under definitions “pieces”). And do remember to inform your insurance company if you make some changes to your house (extra room, pool, conservatory, etc).

|

sum insured true value at risk |

x |

loss |

= |

claim sum paid |

What happens if you are not insured for the right number of rooms: In these circumstances, the insurer may choose to « apply average » to the claim under an « average clause ». This means that where the number of rooms insured is inadequate, the insurer can reduce its liability for a claim by applying a proportionate approach. The sum to be paid out is usually calculated as follows:

Basically, it means you get less money for your claim! That is why you should inform us when you make changes to your house.

- What are you insured for: Fire, damage caused by a vehicle (plane, space craft or meteorite!), theft, vandalism, terrorism, natural and technological catastrophy, water damage, electrical damage, Storm-snow-hail damage, glass breakage and public liability. These are the basic guaranties on your house insurance contract. Note that each company is different so check your booklet. For instance, with Allianz, if a car hits your fence and does not stop, we cover it. Most companies do not cover it if the guilty party is not identified!

- Chimney: If you have a wood burner, insert or fireplace, you must inform your insurance company. Yes, it increases the premium as it is an extra risk of fire. Inserts are the riskiest. You must also inform the company if the wood burner or insert was installed by a professional (send copy of invoice). It reduces the premium if so. Chimney sweep is obligatory and we need proof if you make a claim.

- Content: The house and content are on the same contract in France. Contents are movable things. So, imagine you are moving to a new house, it is the value of everything you put in the removal truck. Equipped kitchen is part of the house. Being insured for 100 000 euro does not mean you will get that if the house gets burned down so make sure you are covered properly. Yes, amount of content affects the premium.

- Valuables: Valuables are jewelry and precious metals and stones. With Allianz, for a furniture to be classed as valuable, it has to be worth more than 8000 euro. But depends on the company so check definitions on the booklet. Valuable objects are not covered in holiday houses during your absence.

- Theft: To claim for a theft or robbery, we need a police report. Padlocks are not recognized by insurance company as secure enough, so anything stolen that was protected by a padlock is not covered for theft. You can opt to have personal items covered for theft outside your house but it’s an option so ask for it to be added to your policy (up to 1500 euro with Allianz). Loss is not covered! Cash is not covered either. Make sure you have kept invoices or photos of your valuables as we need proof you had them in the first place!

- Outbuildings: If you have a garage or a barn, etc., it is insured under the same contract as the house. It is measured by the surface on the floor (walls included). There is a limit of cover for contents inside outbuildings so check your booklet. With Allianz, it is up to 1500 euro but can be increased to 4500 or 10 000 euro as an option.

- Business: If you use part of your house for business (gîte, chambre d’hôte, hairdressing, beauty, etc.) you must inform your insurance company as there is a professional insurance for that and the professional material is not covered under house content.

- Garden: It is a house insurance contract so if you want garden things like pergolas, Spas, barbecue, garden furniture etc. to be covered, it’s optional! Pergolas must be fixed to the ground to be covered. Same if you want trees to be removed in case of storms or your outside water pipes covered for leaks.

- Storm: For a storm to be officially recognized, the wind speed must be higher than 100km/h and garden furniture not fixed to the ground is not covered (unless you took out the garden cover option) so bring it in if a storm is coming!

- Water damage: If you have a water leak, the damage caused by the water leak is covered but not the cause of the leak. If your internal water pipe blows or water tank has a fault, it is wear and tear. Or it must be caused by a storm, earthquake, or any event covered by your insurance.

- Holiday house: You must turn off the water in winter and don’t forget to drain it as toilets can freeze and break and would then not be fully covered. You must also shut the shutters and get someone to check the house regularly. Some insurance companies don’t cover theft on holiday houses if you don’t have shutters (not Allianz).

- Lack of maintenance: Insurances do not cover if the damages come from a lack of maintenance so if you have a decrepit barn or roof and it collapses, insurances won’t pay!

- New for old: New for old does not mean you get new for old! You only get new for old if the wear and tear of the house covered is less than 25%. If it is more, you will have to cover the loss above 25% yourself. Eg: The roof is 35% wear and tear and it cost 10 000€ to repair, then 10% is left for you to pay (1 000€). Check your contract as it depends on each insurance company. New for old is new for old for content, no depreciation.

- New for old for electrical damage: You can add an option so that in case of electrical damage, the electrical equipment is replaced with new items. It only works if the equipment is less than 10 years old (with Allianz). It is different with other companies (check the booklet).

- Renewable energy: If you have solar panels or geothermic heating or anything to do with renewable energy/ecology, it’s an option so you must inform your insurance company otherwise it won’t be covered.

- Options: There are loads of them: Swimming pools, garden cover, horses, electrical damage, new for old, extra cover for outbuildings, outside water pipes and septic tank, gite or chambre d’hôte liability, horse liability, Beehive liability, lake liability, renewal energy equipment, theft cover outside the house, etc.

- Excess: Your contract will have a general excess decided by you (with Allianz between 0 and 800 euro) same as a car. But note that some events carry an automatic excess written on the “dispositions générales” or set by the government such as for example Natural catastrophy which is set at 380 euro (same for all insurances), for vandalism outside the house, with Allianz it is 10% of cost with a minimum of 460 and maximum 2000 euro, For theft of furniture inside holiday home it is 230 euro, etc.

- Security: If you have an approved alarm system, it reduces your premium. You must have at least one lock on each door. If you have a great number of valuables, the insurance company can ask for extra security (2 locks on doors, shutters, a safe, etc). With Allianz, if you do not meet the requirements, you get 50% less on your claim. Some companies give nothing!

You must think this is a bit heavy reading (and I agree) but note that all of us have the famous booklet “dispositions générales” in our office so we can check whether a claim made by a customer is covered or not or what are the limit of guarantees and excesses. The Allianz booklet is 94 pages long! So, we can’t remember it all. Mine is in my bag and when someone asks me if this is covered or not, or what excess is it, I double check it!

Some of you only look at the premium of your insurance, but you can’t just stop at this. Banks are the first one to give you quotes stating it is the same cover but it’s probably not! As my husband always says, buy cheap buy twice!

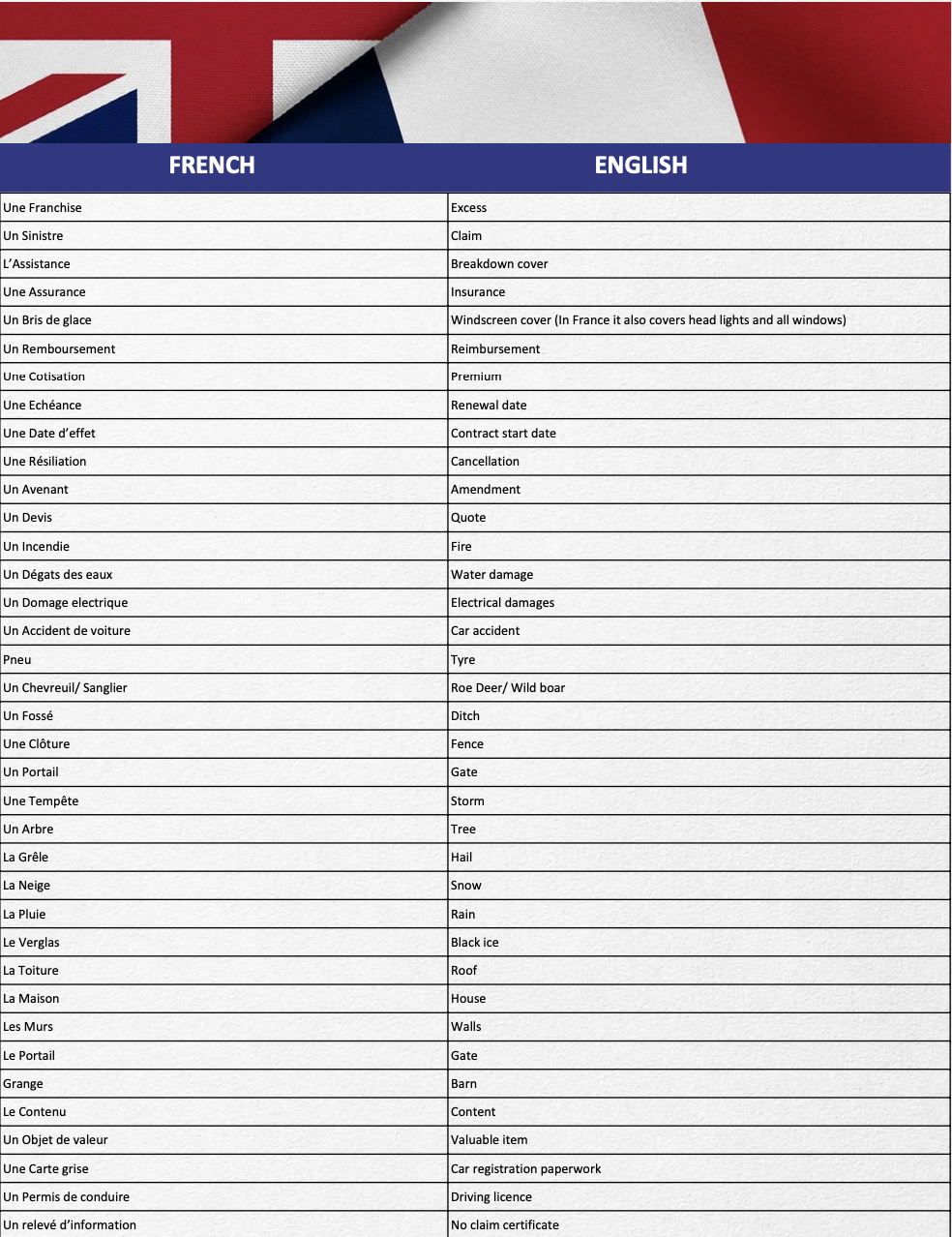

INSURANCE FRENCH VOCABULARY