In this issue:

♦ Isabelle Want ‘s article of the Month

♦ Product of the Month

♦ Living in France

♦ This Month recipe & Covid 19 information

♦ Tax information & Agenda for March

♦ Agency news & What happened in France in February.

♦ Professional of the Month

♦ Some French vocabulary

♦ Useful information and contact details

ARTICLES OF THE MONTH

INHERITANCE LAW IN FRANCE

It used to be the most talked about subject amongst Expats! Unfortunately, Brexit and Covid took over!! But this is not a subject to avoid as we are all going to die and once we are dead it is too late!!

As we say in France: “A happy family is a family that hasn’t inherited yet” so make sure you deal with it while you are still alive!!

Although there has been a change of law, which enables you to choose British rule on inheritance, it is not all plain sailing as French taxes still apply so let’s have a look at its implication and solutions.

First, I will explain the French inheritance law, its particularities and taxes, then, I will give you all the solutions! So, don’t panic as you read this, they are lots of solutions and do remember that French people have lived with this law since Napoleon!! And yes, we survived!

Please note that these explanations are plain and do not take into account what you have already done with your notaire. So, this is what happens if you have done nothing.

- Assets involved:

If you are a French resident (more than 6 months per year in France), then you are subject to the French inheritance law for all your assets in France and all your movable assets worldwide! That means that your savings in the UK are subject to French inheritance law as they are movable, but if you have a property in the UK, it will be subject to UK inheritance law (if people who inherit are not French residents).

If you have a holiday house in France (meaning you are not French resident), then only your house in France will come under French inheritance law and your bank account in France will be subject to UK law.

In France, your estate is comprised of assets minus your debt. It is the job of the notaire to ascertain your estate and who are your heirs. It is possible to inherit debts!!

- Marital status:

A Marriage regime (regime matrimonial) is a bit like a marriage contract and there are 5 different ones in France. Under European law British nationals are under the regime called “Separation de biens” meaning Asset splitting. That basically means that whatever is in your name is yours and will stay yours after the death of your spouse. That is why it is important to have money accounts in both names (mr OU mme) or one each with about the same amount on each (as the one of the deceased will be blocked).

- No Children:

You can leave your estate to whoever you want. Must be individuals or charities (no pets!). The only problems you will have is in regard to the taxes (see last chapter).

| Children | Minimum % |

| 1 | 50% |

| 2 | 33% |

| 3+ | 25% |

- Children:

You have children. Under French law, they are entitled to a minimum percentage of your estate. We call this percentage the “part reservataire”: the reserved part. This % depends on how many children you have. They have priority over your spouse! For example, you have assets worth 100 000€, and 2 children, then they have to inherit at least 66 666€ (33 333 each). If you do nothing, children automatically have ¾ of your assets.

- Spouse:

If you haven’t done anything and have children, your spouse is only entitled to a 1/4 of your estate. If you only get married once and the children are from this marriage, then the spouse has the choice between ¼ of your estate or the totality of your estate in Usufruit (see chapter 7). If you have children from previous marriage, this usufruit option is not available automatically (see solutions below)

- Orders of Heirs:

If you do nothing (make a will for example), then French law will determine who inherits your assets. There is an order of priority:

- Children

- Parents (if your parents are still alive, they can inherit ¼ each)

- Spouse (see above)

- Brothers/ sisters

- Nephew/nieces

- Uncle/aunts

- Cousins

- State

As an example, if you are single with no children, your parents are dead, then your siblings inherit. If your siblings are dead, then your nephew and nieces inherit. If they are dead, the cousins, if no cousins, then great cousins, etc….. It is the job of the notaire to find an heir. It is only when they can’t find anybody that the state inherits.

Note that partners are not recognized by law and therefore do not inherit anything from each other. In France, you need to be married or PACS (civil agreement).

| Age | Value of usufruit | Value of nue propriete |

| 51-61 | 50% | 50% |

| 61-71 | 40% | 60% |

| 71-81 | 30% | 70% |

| 81-91 | 20% | 80% |

| 91+ | 10% | 90% |

- Usufruit:

Understanding the term of usufruit(use of fruit) and nue-proprieté(naked property) is not easy! Imagine an apple tree and if you inherit the usufruit, it means that you inherited the apples. If you have the nue-proprieté, it means you have inherited the tree without any apples! In the case of a house: you purchase this house 50/50, you die, then your spouse (first marriage and children from this marriage) can chose between ¼ of your 50% of the house or the totality of your 50% in usufruit. It means your children inherit your 50% but cannot do anything with it therefore your spouse has the total use of it. Where it gets complicated is when you wish to sell as you need the agreement of a majority of the children (not all of them anymore). Usually they say yes as it means they will get a percentage on the sale of that property.

This % is calculated with the age of the usufruit person. As the apples get older, the value of the apple diminishes!!

| Allowance | Tax/death duties | |

| Children/parents | 100000 | 5 to 20% (mostly 20) |

| Brothers/sisters | 15932 | 35 to 45% |

| Nephew/nieces | 7967 | 55% |

| Others | 1594 | 60% |

So, if you are selling the house after you inherited the usufruit of the half of the deceased, you only get the % according to your age. Imagine the house is worth 200 000€, you are 75, then you keep 130 000€ on the sale and your children 70 000 between themselves. 100 000 for your half and 30 000 for the usufruit as you are between 71 and 81. If the usufruit person does not sell the house before she or he dies, then, automatically the apples rejoin the tree meaning your children already inherited half the house and will then be fully owners of this half (they don’t pay tax on inheriting the usufruit).

- Taxes:

you thought all the above was bad; well here comes the worst bit!! And please note that the changes that have applied in 2015 did NOT change this. In the UK, the allowance is for your total assets, here in France, the allowance is for the person that inherits and the amount is depending on their relationship to you. Good news is: No death duties between spouse, Pacs partners or French registered charities.

Sad news is: 60% tax between partners (not married or Pacs). So, if you have bought a house on Tontine and are not married or Pacs, the survivor of the two will have to pay 60% tax on the half of the house he or her will inherit!

Please also note that those allowances are per person so if you buy a house 50/50 (without Tontine), then the children have 100 000 each on the first death and then another 100 000 each on the second death.

Example 1: a couple in their mid 70’s have 500 000€ of assets and 2 children. On the first death, the survivor chose the usufruit so the children inherit 87500 each (70% of 250000) so no tax, on the second death the children inherit 125 000 each so less than 5 000€ tax each (between 0 and 15 000, only between 5 and 15% tax).

Example 2: The same couple but with one child each from a previous marriage. On the first death, the survivor gets ¼ on 250 000 (62 500) and the child of the deceased ¾ so 187 500 so about 17 500 tax. On the second death, the other child inherit 312 500 (250 000+62 500) so 42 500 tax.

SOLUTIONS

Well done, if you are still reading this and did not suffer a nervous breakdown while waiting for all the lovely solutions!

- Testament/Will:

Making a will in France is easy, it needs 3 conditions: be handwritten, dated and signed! So, you can do it yourself (in French is best). If you have no children there are no restrictions to who you want to name on your will but be careful with the taxes (chapter 8 above. If you have children, you need to respect the share available and reserve part (see chapter 4) or do a will stating you want UK law to prevail (see chapter 7 below). A will cost around 90 euro to be registered with a notaire.

- Tontine:

This is usually the most popular solutions used by expatriates but must be installed when you purchase the property but it only protects the property. It is a very weird clause that is included in your deeds of the house (called clause d’accroisement in the deeds). This clause says that the first one that dies was never in the deeds before; therefore, the survivor is the sole owner of the property. It is a good solution for protecting your spouse from the children.

Be careful if you have children from a previous marriage as this option will disinherit the children of the one who dies first. If the survivor wishes to give something to those children on the second death, those will be taxed 60% as they are not the children of the survivor but the children of the first deceased.

And do be careful with the tax as this solution makes it that the children only inherit on the second death and therefore only have one allowance of 100 000€ (one parent).

- Change marital status:

You can change your marital status (chapter 2 above) to a “regime Universel avec clause d’attribution integrale”. It is like a tontine but for all your assets not just the house. It would mean that whatever belongs to you belongs to your spouse so on the first death, the spouse is the sole owner. It is not recommended when you have children from previous marriage (as you would disinherit the children of the first deceased) or if you have assets worth more than 100 000 per child (as they would have to pay 20% on what is above this allowance).

- Donation dernier vivant/Donation entre époux:

This is a MUST if you have children from previous marriage. As I explained above (chapter 5), only couples with children from the same marriage have the option of usufruit. So, you can sign this contract (a bit like a will) which gives the option of usufruit on half of the assets belonging to the deceased to the survivor. It actually gives 3 different options to the survivor:

-¼ in full property and ¾ in usufruit

– The share available in full ownership

-The totality in usufruit

It has to be done by a notaire and costs around 175€. It has to be done for the one that has children from a previous marriage. If you both have children from previous marriage, then it will be 350€.

- Donation:

A good way to avoid the tax/death duties is to donate your assets to your children as you are still alive. You can give as much as the allowance (100 000 per child) every 15 years and once you have made the donation you can’t die for 15 years!!! You can give the Nue propriete to your children and keep the usufruit which enables you to give more as the value of the nue propriete is a % of the value of the assets you donate.

- Assurance Vie:

This is the most popular solution amongst French people to avoid tax and protect your spouse in regard to the savings. This is a normal investment composed of secure earnings (around 2.5%), shares or bonds but it has the particularity of being able to name beneficiaries of your choice. For the money you invest before you are 70 years old, the allowance is 152 500€per beneficiaries (on top of the allowances given by French inheritance law) and the beneficiaries will only pay 20% tax on what is above 152 500. Otherwise the allowance is only 30 500€ for all the money you put in after you are 70 years old and what is above is added to the assets inherited.

This is a huge tax saving when leaving legacies to unrelated beneficiaries such as friends or step children who would normally pay 60% tax (only 20% if you have invested the money in an assurance vie before 70 years old and after the allowance of 152 500).

They are also other advantages to this saving in regard to income tax (but that is another subject).

Obviously if you are interested in an assurance vie, contact me as it is my specialty!!

- 17th of August 2015

Most of you must have heard that since the 17th of August 2015, you are able to choose the law of your native European country regarding inheritance law. It basically means that you will not be subject anymore to the minimum percentage you are obliged to give to your children which is the French inheritance rule.

If you don’t have any children, it does not change anything! As under French law, you can then give to whoever you want (for that, you simply need to make a will).

To be entitled to this change, you need to make a will in France stating you want to adopt your native law and must name an executor.

A French will needs to be hand written, dated and signed so you could do it yourself but it only cost around 90 euro to have it registered through a notaire so why not! (and the notaire will help you write it).

Conclusion: I think I have covered most of it! Pretty complicated I know but help is at hand, advice is free with me or any notaire. I can do a study of your situation by simulating your death and calculating the tax if any and then we can see what solution is best for you.

And of course, if you are interested in opening an Assurance Vie, contact me!

PRODUCT OF THE MONTH

SWISSLIFE STRATEGIC PREMIUM

This is Swisslife most flexible and popular Assurance Vie saving account/investment product. It is an Assurance vie so it has all the advantages regarding French inheritance law, death duties and income tax.

- Who can invest in it: Anybody who is a French resident (and Monaco) and above 18 years old.

- How much can you invest in it: The minimum is 3 000€, no maximum.

- How is it invested: As you wish, all secured or all risky or a bit of both, it is up to you. The secure part is called Fond Euro and the interest of the secured part is given on the 31st of December each year. The rate on the secure part is around 0.8% and pretty much the same for every company. Shares/Funds can go up or down!! You can decide how much you want on shares so it could be all of it if you wish so. This assurance vie has more than 400 funds/shares available so loads of choices on investments.

- Investment socially responsible: Swisslife has a variety of funds which are classed as ISR which mean they have to follow some criteria based on 3 factors ESG:

Ecology: Management of waste, Reduction of greenhouse gas emission, Prevention Of environmental risk.

Social: Prevention of accident, Training of employees and equality of chances, Respect of employees’ rights and social dialogue, respect of subcontracting chain.

Governance: Independence of the board of directors, Quality of the governance of the company, remuneration of directors, effort in anti-corruption.

So, you can either choose some funds yourself that are ISR or choose the Gestion piloté which is Swisslife that choose and managed the ISR funds for you.

- Garantied death extra: This contract includes an insurance so that if you die before you are 80 years old, Swisslife gives to your beneficiaries at least the amount of the value of your contract when you invested (minus the amount you withdrawal yourself and maximum 1.5 million euro). This is automatically included in the contract. Egg: You invested 200 000€ on your account in 2018 and only have 174 800€ when you died (because your shares lost money), then Swisslife will give 200 000€ to your beneficiaries (minus fees and social charges) so reimburse the 25 200€ So, if the market crashes, you are sure that your heir will get at least what you wanted them to have.

- Options available:

- Securisation des performances: This is a very good option that means that when your shares/funds go up by 1 000, this gain is automatically transferred to the secure part of your Assurance vie. You can choose between 10% and 100% of gain but the gain has to be at least 1 000€. This is very good and some of my customers have appreciated this option when the market has crashed back in March 2020 (Covid). Indeed, the gain they made the previous year had been transferred to the secure part of the Assurance vie so the loss was less.

- Dynamisation progressive du capital: Some of you might be not too keen to invest all your eggs at once in case you are investing it all just before a crash (so at its highest) so Swisslife has come up with an option in which your capital is invested over a period of your choice :6, 9,12,18 or 24 Months. So that you are investing at different stages of the stock market value. This option is also available when you make another deposit, not just when you open the investment. This is free.

- Arbitrage: This is the French word for switching from one fund to another. With Swisslife you are entitled to one free per year but can do as many as you want. So, if you are not happy with a fund, you can switch at any time you want.

- Gestion piloté: If you are not willing to trust me or yourself to choose your funds, you can let Swisslife manage it for you. You can choose between 6 types of investment between very low risk to high risk. Swisslife re-adjust the investments following their own expert advisers, so you have nothing to do. You can also choose to have both, meaning some part of your investment on “gestion piloté” and some on Gestion libre (as you wish).

- Securisation du capital: You can choose to make sure that your beneficiaries will get at least the amount you have invested to start with so 100% or 120% of what you have invested. So, if the market crashes, you are sure that your heir will get at least what you wanted them to have or more! You invested 100K but lost 10K, you die, then your beneficiaries still get 100K and not 90K.

- Stop loss option: This is an option that means that when your shares/funds go down by at least 1 000€, the fund is automatically transferred to the secure part of your Assurance vie. You can choose between 10% and 100% of loss but the loss has to be at least 1 000€.

- Fees:

- Entry fees: The entry fee is normally 4.75% of the amount invested but I am very nice, so I negotiate. If you invest at least 30% in shares, there is 0.5% entry fee! whatever the amount. If no shares at all, 2.5% entry fee.

- Management fees:65% of the investment per year on the secured part (Fond euro). And 0.96% on the investment made of shares/Funds.

- Option fees:

-0.70% per year for the Gestion profile option (0.70% on the shares amount).

-0.1% of the amount transferred + 15€ administration fee for the securing of the performances.

-0.1% of the amount transferred + 15€ administration fee for the stop loss option.

-0.20% of the value of the shares/fund for switching shares/funds + a 30€ administration fee. Note that you are entitled to one free per year, so the fee is only taken if you have done one already.

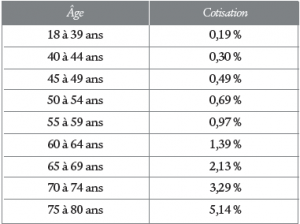

- Garantied death extra: The fee is calculated Monthly (end of each Month) and it is a percentage (depending on your age) of the capitaI loss. If we take the same example as per paragraph 4 and you have a capital loss of 25 200€. You are 50 years old, then the fee is 25 200×0.69% divided by 12=14.50€. This fee is then taken at the end of the year. This fee is only taken if the capital is at loss. Here are the percentages per ages:

- Adding money to it: You can add money to it at any time but a minimum of 1 500€.

- Regular withdrawal: You can set up Monthly, quarterly, twice a year or once a year automatic withdrawal which go directly to your bank account. This is free.

- Regular deposit: You can choose to do regular deposits (Monthly, quarterly, twice a year or once a year) so the amount you choose to add to your assurance vie is taken automatically from your bank account. The amount is 100€ min per Month.

- Availability: The present amount on your assurance vie is always available. So, the money is never blocked. There are no penalties for taking your money out, but tax may apply if you have made a capital gain. Note that there is a 30 days cooling period when you open an Assurance vie (same for every companies) so no money is invested for the first 30 days.

- French law: When you open a new assurance vie, there is always a 30 days cooling period before your money is invested.

Conclusion: The advantages of the Assurance vie savings account are well known and it is no secret that it is the preferred investment for French people not only because of its advantages but also for its flexibility. But even if Assurance vie investments offer the same envelop with every company (same advantages in regard to French inheritance law and tax and income tax), it is important to notice the little differences and therefore shop around before making a decision. They can be different from one company to another and not just the entry or management fees!

LIVING IN FRANCE

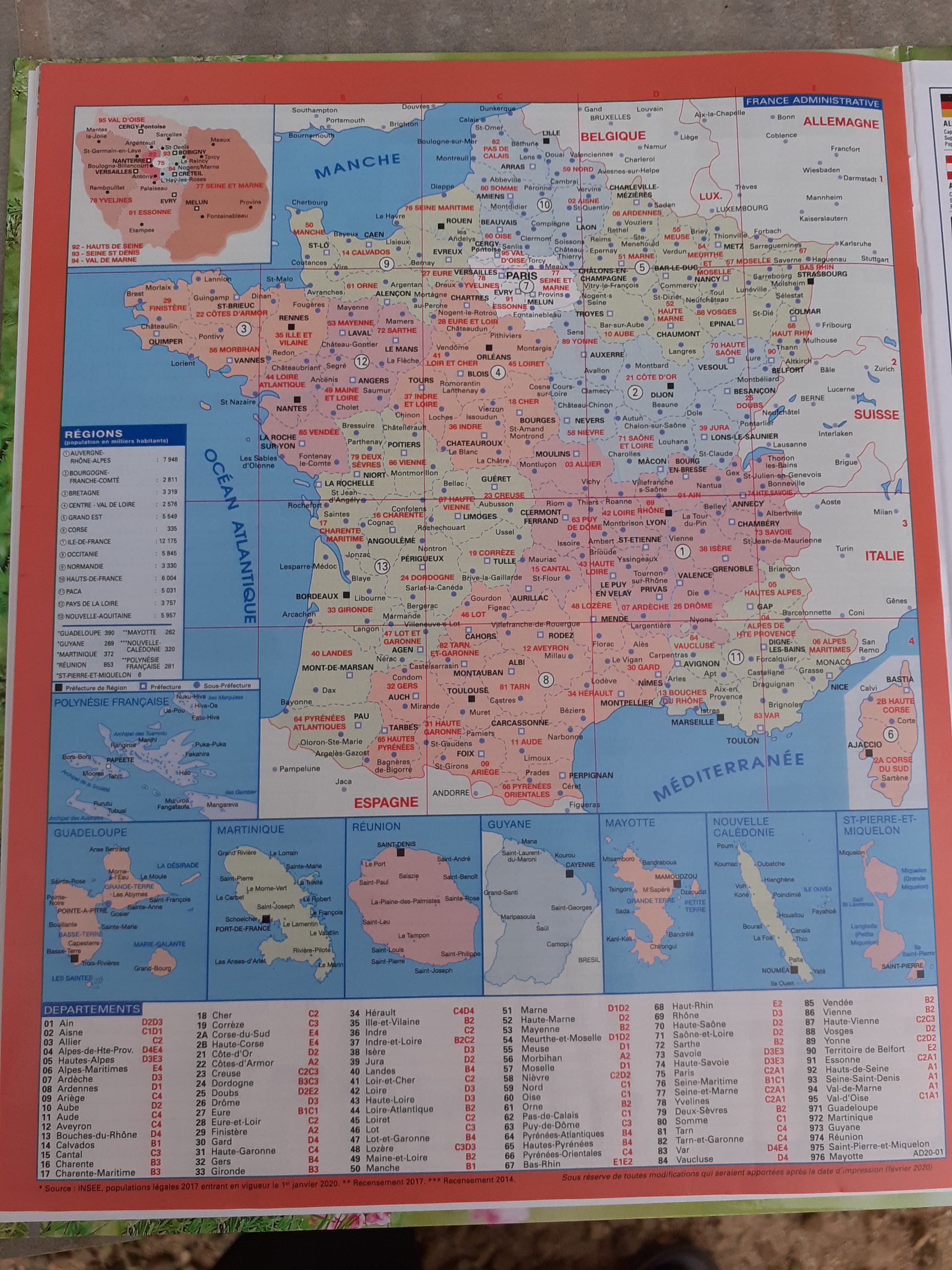

FRENCH REGIONS

It might not come to you as a surprise but this was first set up in 1789 after the Revolution by the parliament created by revolutionists.

There are 101 departements in France grouped inside 18 regions in France and abroad. Funny enough, they pretty much have kept the same name since the revolution apart from a few like Charente Maritime which was called “charente inferieure” (as it was a bit lower geographically) but people living there did not like being called inferior to the Charente people!! Not that we , yes I am a Charente person, like to remind them of that at all!!!

There are 18 regions since 2016, 27 before. The French governement trying to save money have made them bigger. 13 of them are in France (and Corsica). The others are Mayote, La Reunion (indian ocean), Guyane (South America) and Martinique, Guadeloupe (Caribean).

The role of the departement is wide but mainly, it is in charge of : roads (D roads), internet access, security against fire, education (in charge of colleges -school for year 11 to 15), libraries, sport centers, retirment home, handicap, social care and environment.

The role of the region is about the same but instead of college, it is Lycee (school for 15 to 18 years old), bigger roads (N roads), It is also in charge of economical development, European programs, Patrimoine, Environement and transport.

People/politicians representing us in the “conseil regionale” (mini parliament made of 183 people for Nouvelle Aquitaine region) are elected for 6 years. If your department has more than 100 000 inhabitants, you have 4 representatives, if lower, only 2 (one woman and one man).

Note that New Caledonia, French Polynesia, St Pierre et Miquelon, St Martin, St Barthelemy, Wallis et Futuna are Territoire d’Outre Mer so not entirely part of France and they have each their own law agreed with France. For instance, only St Martin is part of the European Union. French laws do apply on those territories and if you have the chance to go on holiday in Tahiti, you could get stopped by Gendarmes! And they do vote for the French President. But they also have their own President!! Some have their own money.

THIS MONTH RECIPE

Le riz au lait au caramel à l’ancienne (from Mr BOULESTEIX Jacques- The big boss)

Ingredients :

-150 g of desert rice

– 1 l of full fat milk

– 100 to 120 g of sugar

– 20 sugar cubes

– 5 ml of water

Soak the rice in warm water 5 to 10 minutes. Bring the milk to the boil. Once the milk is boiling, lower the heat and add the rice and stir regularly. Then add the sugar and cook another 30 min and stir regularly.

Make the caramel 10 minutes before the rice has finished cooking. For that put the 20 sugar cubes with the water in a dish that can take the heat and cook on medium heat stirring all the time.

Once the caramel is formed, put the rice in the dish, over the caramel.

Let it cool down a bit before you eat it!!

Jacques uses the dishes that were owned by his mother when she used to cook it for him!!

TAX INFORMATION

SOCIAL CHARGES: DO NOT FORGET TO CLAIM IT FROM FRENCH SAVINGS

CSG CRDS (French social charges) is for sure the most unpopular tax in France, not just for British people but also for French! Yes, even worse than VAT. We call it the weed, because like weeds, it grows everywhere, and you cannot get rid of it!

As you know, to prevent the French government taxing you on your UK gains/interests, you simply tick the relevant boxes 8SI and 8SH on the income tax form. But note that if you have some French savings in your bank or an Assurance vie account in France, social charges are taken at source (It cannot be stopped). So, it is for you to claim it back every year. So here is how to do it

- What is CSG CRDS PS: La “Contribution Sociale Généralisée, la Contribution pour le Remboursement de la Dette Sociale et Le Prelevement de Solidarité” was created in 1991 to help finance the French health system (which was in debt and still is). In 1991, the social charges were 1.1%. Successive governments (and there have been a few!!) have increased this tax so now it is up to 17.2%!!This tax is taken from revenues from rental income, pension, salaries, capital gain, interests, etc and the % of the tax can differ depending on what revenue is taxed. Finally, there is also a discount and exemption depending on your total income. It is made of 9.2% of CSG, 0.5% of CRDS and 7.5% of PS. Note that PS is not a tax for the French health system but for helping the elderly. So, you can only claim back CSG CRDS, not PS. And obviously, since having lost the court case, the PS has increased from what it was before and CSG reduced!!

- Who can claim social charges back: French residents who are in receipt of an S1 and have been charged social charges. Many of you are in receipt of your state pension (old age pension) and you are in the French health system via an S1 form which was sent to you by your government health department (Newcastle for the British). That means that any expenses with the French health system is covered by your S1; meaning reimbursed to the French health system by the country who issued the S1.

But also, people who have a private medical insurance and are not on the French health system. A bit tricky here as normally you have private for less than one year.

So, if you have been taxed social charges on any revenues, you can claim it back! Your claim can go back 3 years.

- How do you claim it back: Quite easy really, just write a letter to your tax office alongside a copy of your S1 and copies of your statement or email from your Assurance vie company or bank showing the social charges taken. Send the letter by registered mail and make sure you keep a copy of everything.

As I am very nice and I know that most of you are not bilingual, here is an example of the letter you should write to get social charges taken from interest on Assurance vie and bank back or even if you forgot to tick the boxes on your income tax form:

« Madame, Monsieur,

Nous venons par la présente demander le remboursement des contributions sociales que nous avons payées sur nos revenus de placement pour les années X, X et X (voir photocopies).

En effet, en accord avec la décision du Conseil d’État N° 365511 Extraite de l’alinéa 3 :

« Ne peuvent être assujetties à des contributions relevant du champ d’application du règlement n° 1408/71 les personnes qui résident en France mais qui ne relèvent pas du régime français de sécurité sociale «

Par un arrêt du 31 mai 2018, la Cour d’Appel administrative de Nancy a décidé que la nouvelle affectation de la CSG-CRDS au Fonds de solidarité vieillesse revêtait bien un caractère contributif et s’apparentait à un prélèvement social. Cette décision ouvre la voie au droit à remboursement sur les prélèvements indus depuis 2016.

Nous n’aurions pas dû être assujettis à ces contributions car nous sommes couverts par le régime social Britannique via une S1.

Au vu de tout ce qui précède, il vous est demandé le dégrèvement des prélèvements sociaux litigieux, et la restitution de la somme de XXX €.

Dans l’attente de votre réponse positive, veuillez recevoir mes salutations les plus sincères. »

If you did not keep a copy of your S1, phone CPAM or Newcastle and they will send you a copy.

Conclusion: It is not quick!! So be patient. I am pleased to say that everybody I know who claimed it back got it back. Also note that if you have an Assurance vie with us, please ask Allianz directly for the statement or email. Contact telephone number for your Assurance vie is written on your statement. The reason I say that is because it is quicker if you ask yourself directly.

And feel free to contact me when you have some needs on insurances or investment!! Especially if you get loads of money reimbursed thanks to me! I also like wine!!

COVID 19 INFORMATION

Remember the application called “tousanticovid” to download. When you download it, it will tell you if you have been in contact with someone else who has it, but it is also full of good advice, information like where to get a test, how many affected daily, etc and you can download the attestation to go out.

As of 28th of February 2021, 20 départements are under high surveyance, Dunkerk and Nice are under confinement during week ends. And there is a 6pm Curfew for all of France. Decision will be made on the 6th of March regarding those Departments which could mean localised confinements: They are: Var, La Moselle, Meurthe et Moselle, Rhone, Paris, Val de Marne, Seine et Marne, Eure et Loir, Seine St Denis, Hauts de Seine, Essonne, Pas de Calais, Nord, Val d’Oise, Oise, Yvelines, Eure et Loir, Drome, Alpes Maritimes and Bouches du Rhone

Important numbers:

As of 28/02/2021 there has been 86 454 deaths in France (61 598 in hospital), +122 in the last 24H. There have been 3 755 968 confirmed cases (+19 952 in the last 24H), 9 613 people being hospitalised (in the last 7 days), 1 871 of them in intensive care. And 2 967 937 people have been vaccinated. 82.9% of people in retirement home have received at least their first dose of the vaccine. You can find all the information on this web site: https://www.santepubliquefrance.fr/dossiers/coronavirus-covid-19

AGENDA FOR FEBRUARY IN THE CHARENTE

27th: Rouillac Monthly big fair

Basically everything has been cancelled.

You can find the majority the Charente’s activities and visits in this free magazine. It is available at most bakeries, shops and tourist office and you can also download it online:

AGENCY NEWS

Isabelle Want will be on holiday from the 11th to the 16th of March included as my husband is having another shoulder put in!!

Presentation of one of our bosses : Jacques BOULETEIX (aka “the legend”) started on the 13/12/1982 as an employee of AGF which was the old name of Allianz in France. His job was to advice people on asset management.

In October 1992, he decided to buy the Ruffec agencies with the 2 employees already present in it.

The developement has allowed him to go on and open the agencies of La Rochefoucauld in 1994, Chasseneuil in 1995 and lately Roumazières in October 2019. Today BH ASSURANCES is composed of 4 associates and 12 employees.

After 38 years of hard work, he aspires to more time practising his hobbies such as golf which he has been playing for the last 25 years (on the tee in La Preze on Sunday morning at 7.30am !!), gardening, travelling, good wine and very rarely cooking. The recipe above was inherited from his late mother. A real Epucurian!!

WHAT HAPPENED IN FRANCE IN FEBRUARY 2021

In general, February 2021 will be remembered for the bad weather, especially flood following unusually high rain fall. So far in the Charente, 46 communes have been declared “catastrophe Naturelle” -zone of natural catastrophy. More could follow.

In crime, A 20 years old Marrocan who lived in Royan was shot dead in Angoulême in a suburb known for drug dealings. Another 20-year-old has admitted the crime and gave himself up to the police.

2 teenagers aged 14 were shot dead in a brawl between rival gangs in the department of Essonne (Rough Paris suburb known for Crimes). 2 Teenagers below 18 years have been arrested.

Sport, France has been successful during the World Skiing championship with 4 gold medals: 2 for Mathieu Faivre in Parallel skiing and Giant slalom, one for Emilien Jacquelin in Biathlon (sprint event) and one for Antoine Guigonnat and Julia Simon in the mixt relay in Biathlon as well.

16 staff and players of the French rugby team have been tested positive for Covid and the match against Scotland has to be postponed.

PROFESSIONAL OF THE MONTH

LEARN FRENCH!

Jane Barlow

BA (Hons) French and Italian

janebarlow@orange.fr

|

Learning French can be fun – honestly!!

If you want to learn from scratch or improve your French and gain some confidence, I teach private classes in Verteuil (16510), where I’ve lived for the past five years. Very informal and we’ll go at a pace that suits. If you live a little too far away, then Skyping could be a possibility.

Sadly there’s no quick fix to learning a new language, no matter what the websites tell you, but with a little effort and application it’s possible to make a lot of progress. Don’t let the terrifying word “grammar” put you off – that’s just a scary word for the building blocks that you need to make sense of it all. That and developing a good range of vocabulary make up the jigsaw puzzle.

Don’t let any previous bad experiences put you off and remember that anything you learn is more than you knew before – and you might find you have a hidden talent you never knew about! You’ll find that being able to communicate more effectively will enrich your French experience immeasurably.

I usually teach on a one-to-one basis, but if there are two or three of you at a similar level, then that’s fine.

Send me an email (janebarlow@orange.fr) and I can let you have more information and discuss your needs and expectations in more detail.

Don’t be shy to try – you might surprise yourself!

|

“I have been learning French with Jane for less than a year and I am amazed at how much I have learned. I gained a French ‘O’ level many years ago but I retained very little knowledge. Learning a language is not easy and requires lots of hard work and Jane has made this a very enjoyable experience for me. She has excellent knowledge, is very encouraging and patient. I would never have persevered without Jane’s excellent assistance”. KIM.

“I have been having French lessons with Jane for over a year and have progressed significantly over that time. Jane explains everything brilliantly and is very patient, allowing as much time as you need to understand. Jane is the perfect teacher for me and I know I will get there in the end. Learning French is not easy but because Jane is so easy to get on with this helps you maintain a sense of humour and to enjoy the lessons”. JACKIE.

|

INSURANCE FRENCH VOCABULARY

| French | English |

| Une Franchise | Excess |

| Un Sinistre | Claim |

| L’Assistance | Breakdown cover |

| Une Assurance | Insurance |

| Un Bris de glace | Windscreen cover (In France it also covers head lights and all windows) |

| Un Remboursement | Reimbursement |

| Une Cotisation | Premium |

| Une Echéance | Renewal date |

| Une Date d’effet | Contract start date |

| Une Résiliation | Cancellation |

| Un Avenant | Amendment |

| Un Devis | Quote |

| Un Incendie | Fire |

| Un Dégats des eaux | Water damage |

| Un Domage electrique | Electrical damages |

| Un Accident de voiture | Car accident |

| Pneu | Tyre |

| Un Chevreuil/ Sanglier | Roe Deer/ Wild boar |

| Un Fossé | Ditch |

| Une Clôture | Fence |

| Un Portail | Gate |

| Une Tempête | Storm |

| Un Arbre | Tree |

| La Grêle | Hail |

| La Neige | Snow |

| La Pluie | Rain |

| Le Verglas | Black ice |

| La Toiture | Roof |

| La Maison | House |

| Les Murs | Walls |

| Le Portail | Gate |

| Grange | Barn |

| Le Contenu | Content |

| Un Objet de valeur | Valuable item |

| Une Carte grise | Car registration paperwork |

| Un Permis de conduire | Driving licence |

| Un relevé d’information | No claim certificate |

Contact us !

In order to discuss and meet your need as best as possible, feel free to contact us with a mail, phone call... We can also schedule a meeting in one of our four agencies... Or directly to your home !