In this issue :

- Isabelle Want’s Article of the Month

- Product of the mont

- This month’s recipe

- Agenda for December & Living in France

- What happened in France & Association of the month

- Insurance French Vocabulary

ARTICLE OF THE MONTH

ETAT DE CATASTROPHE NATURELLE ET TECHNOLOGIQUE

What it is :

This is an insurance that covers the risk of natural disasters such as earthquakes, landslides, flooding, drought, sea surges, massive storms, etc, basically natural disasters.

This insurance is included in your house and car insurance (it depends on the guaranties for car insurance, but it is for sure included in fully comprehensive cover).

The government must state and publish a document which says that your affected area is an area of natural disaster.

Being insured against natural disaster will not work unless the government states it is!

This document published by the government states: The areas affected and when it happened.

And the nature of the damages caused by this natural disaster.

How to claim:

You have 10 days from when the document is published to declare your claim to your insurance company. Send an email or letter to your insurance company which includes (if possible):

Your details (name, adress), Insurance contract number,

A description of the claim (nature, date, time, place),

A list of all the objects lost or damaged alongside proof of ownership which can attest the value and existence of those objects (invoices or photos for example),

The damages caused to others (if a tree from your garden has fallen on your neighbour’s fence for instance),

Contact details of victims if there are any

Note that if you are doing the repair yourself (fully or partially), make sure you keep invoices of materials so that it is taken into account by the insurance company.

Keep the objects in their damaged state until they are seen and examined by the insurance company and the designated assessor.

Make sure you give a copy of your claim to your Mairie. The more proof your Mairie has of claims, the more chance it’s got to be declared a Natural disaster. It is your Mairie that asks the Préfecture (Head of the County) to be classed as a Natural disaster zone.

Limit of cover:

Well, check your contract. You are only insured for things that are covered. If you don’t have a garden pack for instance, your garden furniture will not be covered.

You can only claim for damages, not cost for loss of use. Eg: the gîte you rent out is destroyed and you lose the income.

Note also that some insurance companies do not cover some natural disasters (flood, earthquakes and drought are very good examples) unless your area is declared as catastrophe naturelle. Allianz does cover flood damages even if your area is not classed as Catastrophe Naturelle but not earthquakes or drought. So, check your contract.

Excess

Even if you have a contract without any excess, you will have an excess to pay if your area is classed as Natural disaster. So, it is not always good news!! This excess is set by the government.

380 € for houses and other building that are non-professional,

1 520 € if damages are due to a landslide following a drought or rehydration of the ground.

Delay:

You must get a percentage of the amount you are due within 2 months following: The date of the estimation of how much it will cost to repair,

Or the date of the publication of the document stating natural disaster.

You get compensated fully within 3 Months following: The date of the work is finished,

Or the date of the publication of the document stating your area is natural disaster.

Note that if the storm has made your house unhabitable, the insurance company take the cost of rental somewhere else themselves but check your contract to make sure it does (with Allianz up to 400 euro per person).

Note also that reimbursement is usually always quicker, those above are legal limits of time, but we reimburse within 10 days.

Catastrophe technologique :

What is it :

It is a technological disaster which involves accidents:

In a factory or installation classed as dangerous (such as a nuclear plant or a chemical factory), Inside an underground stocking of dangerous materials,

With vehicles transporting dangerous materials.

This law was created in 2005 because of the AZF Toulouse factory which exploded in 2001 killing 31 people and injuring 2500 others. The material damages in the southwest of the town cost more than 2 billion euros. Before this law, each victim had to claim against the insurer of the factory responsible for the disaster. Needless to say that it took ages for people to get compensation!!

Condition of application

The guarantee only works if at least 500 houses are classed as non-habitable and the préfecture publish the document classing the area as Technological disaster.

This guarantee is inside your house insurance contract but not automatic with your car (unless you are fully comprehensive)

How to claim:

You have 5 days from when the disaster happened to make your claim to your insurance company. Send an email or letter to your insurance company which includes (if possible):

Your details (name, adress), Insurance contract number,

A description of the claim (nature, date, time, place),

A list of all the objects lost or damaged alongside proof of ownership which can attest the value and existence of those objects (invoices or photos for example),

The damages caused to others (if a tree from your garden has fallen on your neighbour’s fence for instance),

Contact details of victims if there are any.

Note that if you are doing the repair yourself (fully or partially), make sure you keep invoices of materials so that it is taken into account by the insurance company.

Keep the objects in their damaged state until they are seen and examined by the insurance company and the designated assessor.

Make sure you give a copy of your claim to your Mairie. The more proof your Mairie has of claims, the more chance it got to be declare technological disaster. It is your Mairie that ask the Préfecture (Head of the County) to be classed as technological disaster zone.

What do you get :

If you own the house, you get compensated by your insurance company without any excess and no limit of guarantee. If the repair is impossible, the company compensate you so you can get

an equal type of house in the same area (or somewhere else if it is a technological disaster such as Chernobyl!!).

Same for the contents without excess and new for old.

If you have no insurance covering it, there is a fund called Fonds de garantie des assurances obligatoires (FGAO) which will compensate you anyway under certain conditions.

Note: The guarantee « catastrophes technologiques » does not cover outbuildings (garage,

garden shed, barn…), nor their contents. With Allianz it does, not with Thelem (the main two companies we use for house insurance).

Delay: You are compensated within 3 months

Of the date of the repairs,

Or the date of the publication of the document stating technological disaster.

Conclusion: As always, some companies do more than others so check your contract. It is

particularly important if you are close to a river as floods could be covered by your contract only if your area is classed as natural disaster zone (Not with us of course!) It is doubtful that your Mairie is going to apply if you are the only house affected!

In conclusion, it is not always good news if your area is classed as disaster as the excess is usually higher but in general, it makes things simpler in regard to paperwork and compensation.

PRODUCT OF THE MONTH

CAR INSURANCE

Who is insured and where: This is the main difference from the UK. In France, it is the car that is insured so everybody can drive it as long as they have a valid driving license and have authorization to drive it. But note that if someone else drives your car and crashes it, it is YOUR no claims discount that is affected and not theirs, and on some policies, there is an additional excess on top of the one you already have if it was not a named driver that crashed the car (around 750 euro on top of your normal excess). But like I said, if they crash it, they should pay the excess! If it is a young driver (driving license held for less than 3 years) that drives your car and crashes it, the excess is much higher. You must inform the insurance company if a young driver drives it regularly.

It is a legal obligation to have a motor vehicle insured even if you don’t use it. If someone steals it and kills someone with it, you are responsible, so you must insure it for at least public liability.

You and your car are covered if you are hit by an uninsured driver (if it is fully comprehensive cover). Insurance companies have a special money pot for that.

Car insurance also automatically covers trailers up to a certain weight (750kg with Allianz). Caravans and trailers above 750kg must have their own number plates and insurances (and registration paperwork).

Finally, your car insurance in France does not cover you to drive someone else’s car in the UK! Your car however is insured everywhere in Europe and beyond.

In fact, you have a listing of all the countries where you are insured to drive written on the back of your green insurance paperwork (Tunisia, Russia, etc. are not in Europe and are included so no fear of Brexit!). And we don’t need to know when you are going abroad! So please stop telling us!

No Claims discount/Bonus malus: In France, you need to have 13 years without a claim to be entitled to a 50% discount. 50% is the maximum discount. If you have had 50% bonus for more than 3 years, you keep your maximum discount after an accident that is your fault (a little thank you for being so good for so long!).

We accept no claims certificates from the UK. We also have protected bonus. You need to have held it at 50% for 3 years and it is transferred if you change your insurance company.

Excess /Franchise: Like most insurances, you can choose whether or not to have an excess (affects your premium). If the accident is not your fault and the culprit (third party) is

identified, you have no excess to pay. If your car is stolen, you have an excess. The excess can be different depending on the claim (always check your contract).

Fully comprehensive/Third party: Fully comprehensive is the same as in the UK, you and the car are insured whether it is your fault or not. Third party means that your car is not covered for an accident (only public liability) if it is your fault, and it has different levels of cover. Some include glass breakage, theft and fire, some don’t. Check your contract.

Glass breakage / Bris de glace: The excess is less for glass breakage, and it covers windscreens, windows and headlights but does NOT include wing mirrors and backlights.

Breakdown cover/ Assistance 0km ou 25km: You can have breakdown cover (recovery of your vehicle up to 180€) from 0km (from home) or from 25km, meaning if you break down at only 5km from your house, it is not covered (with Allianz). For the recovery, the car is taken to the closest garage (not the one you want). If the repair takes less than 2 days, the insurance pays the hotel, otherwise, the insurance pays to take you home or where you were going with your car. The insurance then pays for you to pick up your car (only one person) once it is repaired.

Replacement vehicle: You can have this option added to your contract. With Allianz, it’s about 6 euro more per month. There is a limit on the length of time for the replacement which depends on if it is for a breakdown, theft or accident.

Pack Valeur Plus: You can add an option which means that you get at least a minimum amount for your car if it is written off (3000 euro) or get back the purchase price of the car (if the car is less than 2 years old), then you can get the assessor’s value +20%, 30%, etc. depending on the age of the car, etc. Basically, it’s an option that guarantees you don’t feel let down with the value of your car if it is written off. The condition of this option is different depending on the company you are with, and the car must have less than 150 000km on the clock when you take out this option.

Special discount for car with special options: Allianz offers 25% off for cars that have one of those options: AEB (Autonomous emergency brake system), City Park Full (autonomous parking assist) or ACC ( a car that brakes if you are too close to the vehicle in front).

4

Claims /Sinistres: In case of an accident, make sure that you fill in an agreed statement of facts on motor vehicle accident form (Constat in French). Make sure you always have one in the car and don’t sign it if you disagree with it. I strongly advise that you prefill it with your personal details and insurance details so that it is easier when you have an accident (usually people are a bit stressed and panicky!). Also, always fill one in even if the other person involved tells you if they want to do this amicably or have no insurance. DO NOT TRUST PEOPLE!! And take pictures. We all have mobile phones that have camera.

There is an emergency helpline (they speak English) for breakdown, accident, etc. but also make sure you have the number on you even if you are not using your car as it includes repatriation and health cover abroad. The number is written on your green paperwork proof of insurance. Note that the breakdown fee will not be reimbursed if you do not phone them (unless it was organized by emergency services due to an accident). Neither will the replacement car be allowed (if you took out the option) if you don’t follow proper procedure (Just phone them before you do anything).

Compensation for death or injury is decided by the French code of law and the amount is calculated in accordance with the extent of injuries or loss. E.g.: the death of a father of 5 children will be better compensated than the one of a 100-year-old without any family.

Note that you will not get compensation for death or injury or for the car if you took the vehicle without permission of the owner or if you were under the influence of drugs or alcohol before the accident. And you will have to pay for the compensation and damages you have caused to others! So, don’t drink and drive! Basically, the insurance will not work!!

UK number plates: Under European law, you have 3 months to change your number plate to a French plate. With Allianz, we do insure UK plated cars and we are lenient if it takes you more than 3 months to change it (when there is a good reason). However, note that if you go back to the UK on a UK plate with French insurance, you will get fined as not having insurance as our system is not recognized in the UK by the Automatic recognition plate system.

Premiums: It is calculated taking lots of different facts into account (probably why it is done by computer): The model of the car, price of replacement bits, horse power, the date it was first on the road, nationwide statistics of theft, what option you chose (third party, fully comprehensive, replacement car, excess, etc.). You can reduce the premium if you do less than 9000, 7000 or 4000km per year.

If, like my lovely English husband, you think French drivers are dreadful (OK I drive too close to the car in front but it’s only because they are too slow!!), then make sure you are properly insured and check the options on your contract.

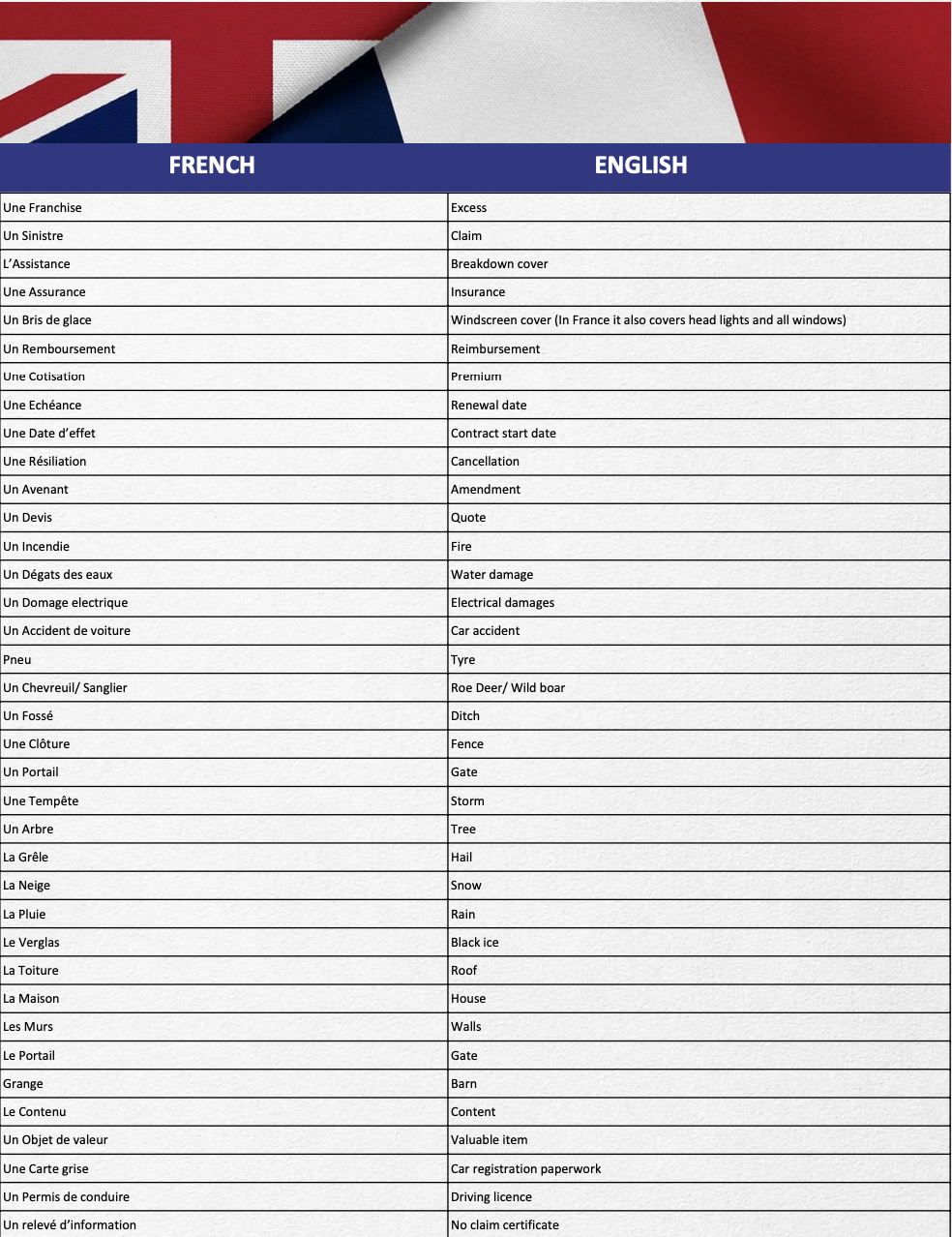

INSURANCE FRENCH VOCABULARY