In this issue:

♦ Isabelle Want ‘s article of the Month

♦ Product of the Month & Agenda for May

♦ This Month recipe

♦ Agenda & Living in France

♦ Agency news & Covid 19 information

♦ What happened in France in April

♦ Professional of the Month

♦ Useful information and contact details

♦ Some French vocabulary

♦ Useful information and contact details

ARTICLES OF THE MONTH

INCOME TAX FORMS 2021!!!

Oh no! It is that time of the year again when you have to fill in your income tax form. It’s all in French and there is lots of pages and boxes to fill in! And they may have changed it again!

Well, worry not, help is at hand. I will try to explain it to you and make it simple. I will only cover the most common revenues so for more technical information, contact me directly.

1) Changes

Just one I noticed, on the 2047, it is easier to enter interest, just box 2TR, section 260.

2) Important dates:

You have to declare your revenue for the year 2020 (January 1st to 31st of December). However, the tax office accepts that you use the revenue corresponding to the UK tax year.

You can start filling the forms online (only if it is NOT the first time) from the 08th of April and until the 26th of May 2021 for Departments 1 to 19 (Charente is 16), 1st of June 2021 for Departments 20 to 49 and 8th of June 2021 for Departments 50 and above (Deux Sevres is 79 and Vienne 86).

Deadline to send or deposit your paper tax form is the 20th of May 2021.

The result (the bill!!) is called Avis d’ imposition and is sent to you from mid-August.

Note that in September 2021, the French government will then readjust the amount that they take out of your current account Monthly according to what you have filled in (so more or less or even reimburse you if you had less income than 2019). Or change the % tax on your salary if you are an employee.

3) What forms and how do you fill them in:

The 2042 is the blue form that everybody has to fill in and it is on this form that you report what you have filled in on other forms. But there are different versions of the 2042:

2042: This is the normal blue 2042 form that everyone has to fill in- no exception.

Check or fill in the information on page 1 (name, address, etc). On page 2, check or fill in the information asked for (marital status, etc) and make sure it is correct as they can give you allowances or discount (invalidity, number of children living with you, etc).

2042RICI: This is the form on which you report things that give you tax credits such as having kids at college, lycee, etc or doing some work on your house related to saving energy and ecology. Note that this year, the box for employing a gardener or cleaner, giving to charity is on the normal 2042.

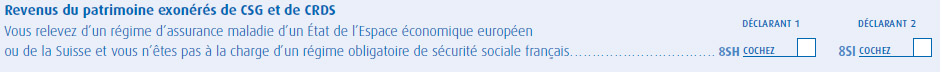

2042C: This is the form to have if you are under the French health system via an S1 (you are receiving a state pension). You need to tick box 8SH (declarant 1) and/or 8SI (declarant 2) to avoid paying Social charges on your interest. Box 8TK which was on the last page on the normal 2042 before is now on this form. This is the box that people with government pension or UK rental need to tick. You can also find box 8VL which is the 17.7% tax credit on your dividends. Those boxes are on the last page of form 2042-C.

2042C Pro: If you are self-employed in France, this is where you fill in your professional revenue.

This is also the form used to declare revenues from Gites or chambre d’hôtes nonprofessional.

2044: This is the form to fill in if your rental income is superior to 15 000 euro per year.

2047: This is the purple form (or pink) on which you enter your revenue from abroad. It is better if you start with this one and then report the result on the other forms. Here is how to do it:

2047: Enter all your pension revenues (even those from civil servant that are taxed in the UK) on page 1, section 1 in the box called « Pensions, retraites, rentes”. Be careful, you now must tick the box stating if the pension is public (ex-civil servant) or Privé (private and state pension/old age). So, if you have both, tick both boxes. You then have to report pensions to the pension section on the 2042, page 3, section 1, line 1AM (or 1BM for declarant 2) for pensions taxed in France (state pension and private pensions) and line 1AL (or 1BL for declarant 2) for pensions from UK government employees such as teachers, civil servant, military, NHS, etc).

In section 2, on page 2 is where you put the interest you earned on savings in the UK. And yes, ISAs and Premium bonds are taxable in France as you are French resident! So, you have to fill them in at the bottom of page 2 in the box 260 “intérêts”. Enter the country of origin, then you write the amount on line 2TR.

Then you report the amount in line 2TR, page 3, section 2 of the 2042.

You also need to tick box 2OP on form 2042, page 3 if you want the interest to be taxed according to the rest of your income and not at 12.8% flat tax.

In section 4, you enter the revenues from house rental abroad. Then report on section 6 to get the tax credit (because it is taxed in the UK) and report on line4BE and 4BK, section 4 of the 2042. If revenues from rental are > 15000 euro, you have to fill in the 2044 form.

In section 6, you put the revenue from government employees pension (military, police, NHS, civil servant, etc) and rental income from property in the UK (those will always be taxed in the UK whether you are French resident or not). Then you report the amount in line 8TK, last page of the 2042C. This is because those revenues/income get a tax credit in France equivalent to what the tax would be on it in France as they are taxed in the UK. You must enter the gross amount (before tax for pensions or expenses for rental).

3916: you have a bank account outside France, then you have to declare it on that form (section1 and 4). One form per account. Or if you have a lot, on a blank A4 paper.

Don’t forget to date and sign the forms!! If it is your first, join a RIB and copy of your passport.

The exchange rate for 2020 is 1.13 (that is the average of last year). You can get another rate from your local tax office, use theirs if it is lower than 1.13! Note that when you ask the official Paris tax office they tell you to use the rate from the “banque de France” on the day you got paid! Or use the average of the year.

If your pension has been directly transferred to your French bank account, just add up all the figures of last year as long as it is a gross amount (not taxed at source).

4) Help:

A complete guide on how to fill in your tax form online is on our web site:

https://bh-assurances.fr/taxes/ if you can’t find it, email me!!

If you are one of my customers, you are entitled to free help in 2 of our offices (no appointments, just turn up):

-Chasseneuil sur Bonnieure on Tuesday the 4th of May (all day apart from 12-2pm-my lunch)

-Ruffec on Thursday the 6h of May (all day apart from 12-2pm-my lunch)

Please make sure you have all the figures ready and the relevant forms (you can get them from your local tax office or online) when you come to see me. Otherwise I get very grumpy!

And remember to check out our web site www.bh-assurances.fr/en for all my previous articles and register to receive our monthly Newsletter. You can also follow us on Facebook: “Allianz Jacques Boulesteix et Romain Lesterpt”

And don’t hesitate to contact me for any other information or quote on subject such as Funeral cover, inheritance law, investments, car, house, professional and top up health insurance, etc…

PRODUCT OF THE MONTH

ALLIANZ PER-I

This is an assurance vie created by Allianz but also all the other insurance companies to comply with the new law PACTE created by the government. This new law relates to pensions in France and in order to encourage people to save themselves for their pension, they have come up with the “PERI: Plan Epargne Retraite Individuel”. Most British people will recognise it as pretty much the same as any pension plan in the UK.

1. Who can invest in it: Anybody who is a French resident between 18 and 62 years old. This product is mainly for people who want to put aside for their retirement.

2. How much you can invest: You can invest as little as 50€ per Month or/and as little as a lump sum of 600€.

3. Tax advantages: Well, this is the good thing! Putting money into it gives you a tax advantage. So, if you put 100€ per Month on it for instance which is 1 200€ per year and you declare 30 000€ income per year, then you will be only taxed on 30 000- 1 200= 27 800€.

If you do not pay tax or do not want to have the tax advantage you can choose to invest in your PERI without this tax-deductible option (see below why it is good).

Some of you have asked me why there is an amount written on section 6 of your 2042: charges deductible. This is the maximum amount that you can invest per year to get a tax credit.

4. How you get your money: Once you are retired, you can choose to have your money in a lump sum, as partial withdrawals, as regular Monthly, Yearly withdrawals or as annuities (for you or for your spouse) or some as partial lump sum and some in annuities (rent until you die). Well pretty much as you wish. Note that you can access the money before you retire in exceptional circumstances such as buying your main residence or becoming disabled.

5. Tax when you take it out: If you had the tax advantage-tax deductible option when you put money in, then the money out is fully taxed (flat tax at 30% or added to the rest of your income and taxed accordingly). If you did not choose the tax-deductible option, only the interest is taxed (just like an assurance vie).

6. Inheritance advantage: Just like an assurance vie, you name the beneficiaries when you set it up and they are entitled up to 152 500€ each if you die before 70 years or 30 500 if you die after (if the money is still in it).

7. How it is invested: As you wish but at least 30% on shares/funds or bonds. You can also choose a fund specifically dated for your retirement. If you think you will retire in 2030 for instance, then you can choose a fund which will automatically be riskier now and gradually as you approach the date of 2030 will swap from riskier to more secured.

8. PERP or Madelin contract: If you have a PERP or Madelin contract which a bit of the same (except the exit is only as an annuity and no assurance vie advantage in regards to death duties) , note that those contracts will be transformed into PERI automatically and also note that you will be able to transfer those contracts from your current company to another one! That is also part of the new law.

9. Fees: Entry fee of 4.80% negotiable of course + 12€ admin fee!! And yearly management fees of 0.73%.

No fees for taking the money out.

As you can see from the French news and the numerous past strikes in Paris, French people are very attached to their pensions!! But we must face reality one day and realise that it will be down to the individual to save for their pension themselves. This is exactly why this investment has been created.

THIS MONTH RECIPE

GRIWECH, ALGERIAN LITTLE CAKE

This recipe is from Emilie Marot who is married to an Algerian man. This is also called “Chebakia” in Morocco. The hardest thing is to get the knack of folding them.

Ingredients :

▪ 500 g of flour

▪ 150 g of butter

▪ 1 egg

▪ 1 teaspoon of vanilla powder

▪ 1/2 of yeast (Levure Chimique in French)

▪ 1 teaspoon of white vinegar

▪ 1 soup spoon of orange flower water diluted in one 10cl of water

▪ A pinch of salt

▪ Honey (proper one !! from Sophie our colleague is the best!!)

▪ Golden Sesame seeds

Melt the butter and let it cool down.Break the egg and beat it with a fork. Add the butter to it gradually. Mix well; Add this mixture to the yeast then add the vinegar, flower water until you get a pastry soft and non-elastic. Divide the pastry in many balls. Cover them in clean film and let them rest 15 minutes.Spread one of the balls with a pastry roller until you get a rectangular of about 3 mm thick roughly. Make some 10 cuts as per the photo. Fold it in two, then 4.Take both extremities and push to the middle and turn it inside out as per the photos above. Then fry them in oil at 150 degree C for 10min or until golden brown. Dry them on kitchen paper. Finally pass them in a mixture of honey and orange flower water and sprinkle some sesame seeds on it. Enjoy with a Green mint tea!!

LIVING IN FRANCE

BANK HOLIDAYS

The Month of May in France is famous for bank holidays!! So what a good oportunity for me to enumerate them all and how they work compare to Great Britain.

First of all, we have more than you BUT if it falls on a Sunday, tough luck!! WE don’t have “in lieu”. And in fact this Month of May is terrible as 2 of them are on a Saturday!! I don’t work Saturdays so I lost 2 bank holidays. One of them which is Ascension on the 13th is on a Thursday so French people do what we call the Bridge- “Faire le Pont” in French means you take the Friday off to bridge to the week end!! Note that some bridges can be bigger than others!! Especially if the bank holiday falls on the Wednesday!!

List of bank holidays in France for 2021:

1st of January: New year day.

5th of April: Easter Monday, sadly no Good Friday in France

1st of May: Fête du travail- Labour day. Yes we have a day off to celabrate work!!

8th of May: Victoire 1945-Armistice of the second world war

13th of May: Ascension (Always a Thursday)

24th of May: Pentecote (Always a Monday)

14th of July: Fête Nationale- French national day to celebrate start of French revolution when people stormed the Bastille Prison in Paris.

15th of August: Assumption, sadly this year on a Sunday!! No, we work Monday!

11th of November: Armistice 1918-celebrate end of First world war. This year on a Thursday so a bridge is coming for me!!

25th of December: Christmas. Sadly here again it’s on a Saturday!!

AGENDA FOR APRIL IN THE CHARENTE

1st: Bank holiday, Fête du travail

8th: Bank holiday, Victory of 1945 (first world war)

13th: Bank holiday, Ascension

24th: Bank holiday, Pentecôte

27th: Rouillac Monthly big fair

30th: Mother’s day

You can find the majority the Charente’s activities and visits in this free magazine. It is available at most bakeries, shops and tourist office and you can also download it online:

https://www.sortir-label-charente.net/

AGENCY NEWS

All our agencies will be shut on the 1st, 8th , 13th and 24th as they are all bank holidays.

Isabelle Want will be on holiday on the 14th. Yes I am doing the bridge !!! ![]() To recover from all those tax sessions and queries!! And drink all the wine you gave me!

To recover from all those tax sessions and queries!! And drink all the wine you gave me!

COVID 19 INFORMATION

Remember the application called “tousanticovid” to download. When you download it, it will tell you if you have been in contact with someone else who has it, but it is also full of good advice, information like where to get a test, how many affected daily, etc and you can download the attestation to go out. As of this Monday 3rd of May 2021, the rule of the 10Km is over and you can travel anywhere you want without an attestation. All schools reopen with limits. The 7pm curfew stays on. From the 19th of May, terrasses of restaurants and bars are allowed to open (6 per tables max). All non-essentiels shops , plus theatres, cinemas, museum, outdoor sport centers can also re-open (800 people max inside, 1000 outside). From the 9th of June, the curfew is put at 11pm, Bars and restaurants can re-open as well as indoor sport centers and exhibition centers and concerts up to 5000 people with a Pass! From the 30th of June, end of the curfew, back to pretty much norma apart from night clubs still shut. All those measures are subject to the situation of each department. If the number of cases per 100 000 inhabitants goes over 400, the Department goes back to its previous stage. You can find details new rules on: https://www.gouvernement.fr/info-coronavirus

Important numbers:

As of 29/04/2021 there has been 104 253 deaths in France (78 020 in hospital), +321 in the last 24H. There have been 5 592 390 confirmed cases (+26 538 in the last 24H), 11 439 people being hospitalised (in the last 7 days), 2 612 of them in intensive care. And 14 900 784 people have been vaccinated. You can find all the information on this web site: https://www.santepubliquefrance.fr/dossiers/coronavirus-covid-19

WHAT HAPPENED IN FRANCE IN APRIL 2021

In general, A michelin star chef and an art collector (Christophe Leroy et Pierre Jean Chalençon) have been arrested for organizing some very expensive private clandestine dinners despite Covid restrictions. They were discovered by an undercover Tv journalist.

Our President has decided to shut down ENA which is a school that creates civil servants and politicians!! ENA: Ecole nationale de Administration was created in 1945 by General De Gaulle to form High rank civil servant. Famous Ex-student include François Hollande, Jacques Chirac and of course our actual President Emmanuel Macron. This school has long been hated by French people and depicted as a factory for Politicians and high rank Civil servants. This was one of the measure promised by our President to calm down the Gilets Jaunes!!

A list of retired generals and active army personnel (18) have written an open letter stating France was on the brink of civil war!! Due to unrest in suburbs and rise of extremist islamist. This letter was applauded by Marine Le Pen (of course) but outraged the rest of the army which do not think they should get involved in politics.

In Crime, A 18 years-old girl has been arrested in Beziers for terrorism. She had planned to attack a church in Beziers during Easter ceremonies.

A mother has kidnaped her daughter and got caught 4 days later in a squat in Switzerland. She was not allowed to see her daughter on her own due to Psychological issues.

A police women has been stabbed to death in a police station in Rambouillet (near Paris) by a terrorist.

PROFESSIONAL OF THE MONTH

This Month you get two for the price of one!! Same person, two jobs!!

INSURANCE FRENCH VOCABULARY

| French | English |

| Une Franchise | Excess |

| Un Sinistre | Claim |

| L’Assistance | Breakdown cover |

| Une Assurance | Insurance |

| Un Bris de glace | Windscreen cover (In France it also covers head lights and all windows) |

| Un Remboursement | Reimbursement |

| Une Cotisation | Premium |

| Une Echéance | Renewal date |

| Une Date d’effet | Contract start date |

| Une Résiliation | Cancellation |

| Un Avenant | Amendment |

| Un Devis | Quote |

| Un Incendie | Fire |

| Un Dégats des eaux | Water damage |

| Un Domage electrique | Electrical damages |

| Un Accident de voiture | Car accident |

| Pneu | Tyre |

| Un Chevreuil/ Sanglier | Roe Deer/ Wild boar |

| Un Fossé | Ditch |

| Une Clôture | Fence |

| Un Portail | Gate |

| Une Tempête | Storm |

| Un Arbre | Tree |

| La Grêle | Hail |

| La Neige | Snow |

| La Pluie | Rain |

| Le Verglas | Black ice |

| La Toiture | Roof |

| La Maison | House |

| Les Murs | Walls |

| Le Portail | Gate |

| Grange | Barn |

| Le Contenu | Content |

| Un Objet de valeur | Valuable item |

| Une Carte grise | Car registration paperwork |

| Un Permis de conduire | Driving licence |

| Un relevé d’information | No claim certificate |

Contact us !

In order to discuss and meet your need as best as possible, feel free to contact us with a mail, phone call... We can also schedule a meeting in one of our four agencies... Or directly to your home !