In this issue:

♦ Isabelle Want ‘s article of the Month

♦ Tax information

♦ This month’s recipe

♦ Agency news, Living in France & Agenda for april

♦ What happened in France & Professional of the month

♦ Some French vocabulary

♦ Contact details & Useful informations

ARTICLE OF THE MONTH

INCOME TAX FORMS 2023 !!!

Oh no! It is that time of the year again when you have to fill in your income tax form. It’s all in French and there is lots of pages and boxes to fill in! And they may have changed it again!

Well, worry not, help is at hand. I will try to explain it to you and make it simple. I will only cover the most common revenues so for more technical information, contact me directly.

Changes

They have put box 8TK back on the 2042 so no need to also have the 2042-C

Important dates:

You have to declare your revenue for the year 2022 (January 1st to 31st of December). However, the tax office accepts that you use the revenue corresponding to the UK tax year.

You can start filling the forms online (only if it is NOT the first time) from the 13th of April and until the 23rd of May 2023 for Departments 1 to 19 (Charente is 16), 30th of May 2023 for Departments 20 to 49 and 7th of June 2023 for Departments 50 and above (Deux Sevres is 79 and Vienne 86).

Deadline to send or deposit your paper tax form is the 18th of May 2023.

The result (the bill!!) is called Avis d’ imposition and is sent to you from mid-August.

Note that in September 2023, the French government will then readjust the amount that they take out of your current account Monthly according to what you have filled in (so more or less or even reimburse you if you had less income than 2021). Or change the % tax on your salary if you are an employee.

What forms and how do you fill them in:

The 2042 is the blue form that everybody has to fill in and it is on this form that you report what you have filled in on other forms. But there are different versions of the 2042:

2042: This is the normal blue 2042 form that everyone has to fill in- no exception.

Check or fill in the information on page 1 (name, address, etc). On page 2, check or fill in the information asked for (marital status, etc) and make sure it is correct as they can give you allowances or discount (invalidity, number of children living with you, etc).

2042RICI: This is the form on which you report things that give you tax credits such as having kids at college, lycee, etc or doing some work on your house related to saving energy and ecology. Note that this year, the box for employing a gardener or cleaner, giving to charity is on the normal 2042.

2042C: This is the form to have if you are under the French health system via an S1 (you are receiving a state pension). You need to tick box 8SH (declarant 1) and/or 8SI (declarant 2) to avoid paying Social charges on your interest. You can also find box 8VL which is the 17.7% tax credit on your dividends. Those boxes are on the last page of form 2042-C.

2042C: This is the form to have if you are under the French health system via an S1 (you are receiving a state pension). You need to tick box 8SH (declarant 1) and/or 8SI (declarant 2) to avoid paying Social charges on your interest. You can also find box 8VL which is the 17.7% tax credit on your dividends. Those boxes are on the last page of form 2042-C.

2042C Pro: If you are self–employed in France, this is where you fill in your professional revenue. This is also the form used to declare revenues from Gites or chambre d’hôtes nonprofessional. 2044: This is the form to fill in if your gross rental income is superior to 15 000 euro per year.

2047: This is the purple form (or pink) on which you enter your revenue from abroad. It is better if you start with this one and then report the result on the other forms. Here is how to do it:

2047: Enter all your pension revenues (even those from civil servant that are taxed in the UK) on page 1, section 1 in the box called

« Pensions, retraites, rentes”. Be careful, you now must tick the box stating if the pension is public (ex–civil servant) or Privé (private and state pension/old age). So, if you have both, tick both boxes. You then have to report pensions to the pension section on the 2042, page 3, section 1, line 1AM (or 1BM for declarant 2) for pensions taxed in France (state pension and private pensions) and line 1AL (or 1BL for declarant 2) for pensions from UK government employees such as teachers, civil servant, military, NHS, etc).

In section 2, on page 2 is where you put the interest you earned on savings in the UK. And yes, ISAs and Premium bonds are taxable in France as you are French resident! So, you have to fill them in at the bottom of page 2 in the box 230 “intérêts”. Enter the country of origin, then you write the amount on line 2TR, line 252.

Then you report the amount in line 2TR, page 3, section 2 of the 2042.

You also need to tick box 2OP on form 2042, page 3 if you want the interest to be taxed according to the rest of your income and not at 12.8% flat tax.

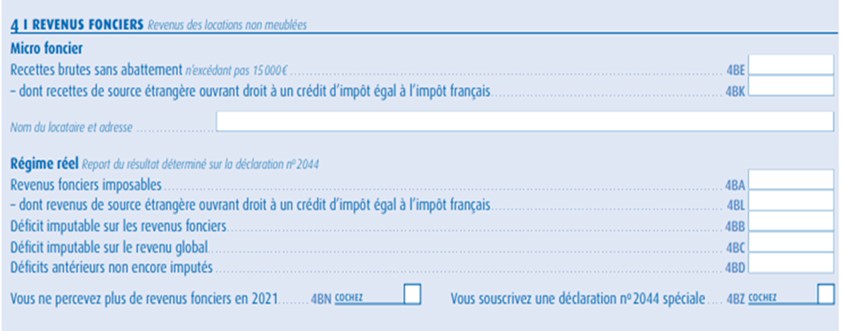

In section 4, you enter the revenues from house rental abroad. Then report on section 6 to get the tax credit (because it is taxed in the UK) and report on line4BE and 4BK, section 4 of the 2042. If revenues from gross rental are > 15000 euro, you have to fill in the 2044 form and report the figures on line 4BA and 4BL on form 2042.

In section 6, you put the revenue from government employees pension (military, police, NHS, civil servant, etc) and rental income from property in the UK (those will always be taxed in the UK whether you are French resident or not). Then you report the amount in line 8TK, last page of the 2042. This is because those revenues/income get a tax credit in France equivalent to what the tax would be on it in France as they are taxed in the UK. You must enter the gross amount (before tax for pensions or expenses for rental).

3916: you have a bank account outside France, then you have to declare it on that form (section1 and 4). One form per account. Fail- ing to declare them brings a fine of 1 500 euro per account not declared. 10K if the account is in Jersey, Panama or other countries not nice with French tax office!

You will also need to tick box 8UU on the last page of the 2042 stating you have bank account outside of France or 8TT if you have an Assurance Vie investment account.

Don’t forget to date and sign the forms!! If it is your first, join a RIB and copy of your passport.

The exchange rate for 2022 is 1.17 (that is the average of last year). You can get another rate from your local tax office, use theirs if it is lower than 1.17! Note that when you ask the official Paris tax office they tell you to use the rate from the “banque de France” on the day you got paid! Or use the average of the year.

If your pension has been directly transferred to your French bank account, just add up all the figures of last year as long as it is a gross amount (not taxed at source).

Help:

A complete guide on how to fill in your tax form online is on our web site: https://bh-assurances.fr/taxes/ if you can’t find it, email me!!

If you are one of my customers, you are entitled to free help in 2 of our offices (no appointments, just turn up):

-Chasseneuil sur Bonnieure on Tuesday the 9th of May (all day apart from 12-2pm-my lunch)

–Ruffec on Thursday the 11h of May (all day apart from 12-2pm-my lunch)

Please make sure you have all the figures ready in Euros and the relevant forms (you can get them from your local tax office or online) when you come to see me. Otherwise, I get very grumpy! But a bottle of wine does help to make me smile! Never mind my liver!

TAX INFORMATION

DECLARING YOUR RENTAL INCOME IN FRANCE

If you are a French resident in France, you must declare your rental income from the UK or/and France each year on your income tax form.

If you are UK resident and have some rental income from a property in France, you also must declare it.

There are 2 ways to declare it: “Micro Foncier or Regime Réel”:

Micro Foncier: You can declare on the Micro Foncier if your rental income is below 15 000 euro. The tax office will automatically give you a 30% discount to cover your running cost such as management, repairs, etc. So, on the 2042 above, section 4, you simply enter the name of the tenant and the address of the property and the Gross amount (box 4BE) meaning the total of the rents you have received. If your rental is from the UK, you also enter the amount in box 4BK and fill in form 2047 and 2042-C (for box 8TK). Quite easy!

Regime Réel: More complicated! This is if your income is above 15 000 euro or if you think you are better off declaring your rental income Net meaning rental minus all the cost such as repairs, management, insurance, interest on mortgages, etc. But of course, the tax office does not trust you just to let them know the net amount, they want you to detail it on form 2044.

Note that if you opt for the Regime Réel, you are obliged to use it for the following 3 years so not good if you have rental income below 15K and only have one year with extra expenses that are above 30%.

My advice is to do it online, much easier as the figures you enter on each section are automatically transferred on the Net amount on line 420: Resultat- Result. And on the 2042. Not the 2047 and 2042C if you have rental income from the UK.

below 15K and only have one year with extra expenses that are above 30%.

My advice is to do it online, much easier as the figures you enter on each section are automatically transferred on the Net amount on line 420: Resultat- Result. And on the 2042. Not the 2047 and 2042C if you have rental income from the UK.

If you are in deficit meaning your rental income is lower than your expenses, then the extra expenses are forwarded to the following year- For the next 10 years. If you sell the rented house, you can’t offset it on other income, it must be rental income.

You must fill it in for each property your rent out. You can fill it in up to 8 properties. For each property, you must enter the address, date of purchase and name of tenant. And for each, the expenses and rental income.

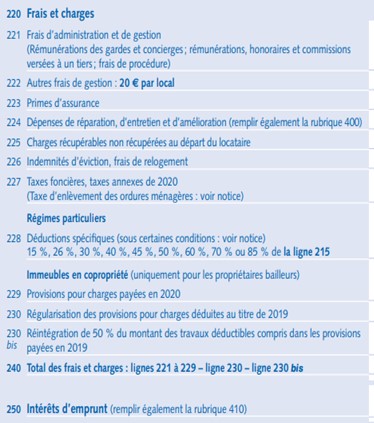

What cost can you offset your rental income on the 2044:

I only translated the one you are most likely to use:

-Management fees if you use an agency

-Other costs- 20€ max per rental

I-nsurance cost

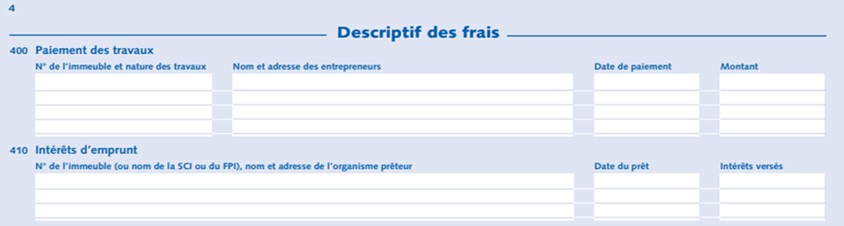

-Repairs cost- must fill section on page 4

-Cost of getting rid of tenant

-Taxes Fonciere

If the building are apartments, you can claim cost taken by the syndicate running the building Interest on mortgages- Must fill in section on page 4.

On page 4, you must detail who did the work, when you paid it and the amount

Ah yes, you can only offset the cost of repairs if those repairs are done by a registered artisan/ workman, and you have an invoice (so not on the black).

For the interest on Mortgages, name and address of the bank, date of doing the mortgage and the amount of the interest paid for the year.

When you have filled in all of this, you follow the instruction on the form if you do it on paper, so you arrive on page 4 and your end result (rental – cost). If you are doing it online, it is all automatic. So, if you can, do it online!

Good luck!

This month’s recipe

COUGERES

Those little things are excellent for the aperitif!

Ingredients for 4-6 people:

150 g of flour

4 eggs

100 g of butter

25cl of water

150g of Gruyeres cheese or Cheddar (I know you can’t live without it)!! You can actualy use any cheeses. The best one I have done was with Roblochon Cheese.

First put the butter in a sauce pan alongside the water and bring to the boil. Once it is boiling, take off the heat and add the flour and stir vigorously until the pastry comes off the pan easily.

Then back on the heat for 2 minutes, still stirring.

Take off the heat, the mix the egg in one by one. Quick hard work stirring them in but worth it. Then add the cheese. Once it’s all mixed in, form golf size balls with spoon and lay them on kitchen proof paper and put in a pre-heated oven at 200 degrees for 20 minutes.

Agency news

Loads of bank holiday so all our agencies will be shut on:

1st of May

8th of May

18th of May and Isabelle Want is doing the bridge so will be off on Friday the 19th!

29th of May

Living in France

Bank holidays

The Month of May in France is famous for bank holidays!! So what a good oportunity for me to enumerate them all and how they work compare to Great Britain.

First of all, we have more than you BUT if it falls on a Sunday, tough luck!! We don’t have “in lieu”. But this year is very good and in fact this Month of May is great as 2 of them are on a Monday so a 3 day week end!! One of them is on the Thursday: Ascension on the 18th so French people do what we call the Bridge- “Faire le Pont” in French means you take the Friday off to bridge to the week end!! Note that some bridges can be bigger than others!! Especially if the bank holiday falls on the Wednesday!!

List of bank holidays in France for 2023:

1st of January: New year day.

10th of April: Easter Monday (always on a Monday), sadly no Good Friday in France.

1st of May: Fête du travail- Labour day. Yes we have a day off to celebrate work!!

8th of May: Victoire 1945-Armistice of the second world war

18th of May: Ascension (Always a Thursday)

28th of May: Pentecote (Always a Monday)

14th of July: Fête Nationale- French national day to celebrate start of French revolution when people stormed the Bastille Prison in Paris.

15th of August: Assumption. A Tuesday so we will bridge the Monday!

11th of November: Armistice 1918-celebrate end of First world war. A Tuesday also!

25th of December: Christmas.

What happened in France in april

In general, It took 5 days for the firecrew to extinguish a fire in the Pyrennées Orientales where 1000 hectares of vegetation have burnt. Happily no houses were destroyed and nobody got injured.

A building has collapse in Marseille killing 8 people. The cause is believed to be a gaz explosion. The blast was so huge than some other building in the same street are now unsafe to live in and people had to be evacuated.

6 people have perished in an Avalanches in The Alpes including 2 guides.

The consultation at the GP will increase to 26,50 euro in September. 31,50 for specialist consultation.

The French government has started an operation in Mayotte to expel illegal immigrant and destroy the slums that they have created. In Mayotte (French island near Madagascar) nearly half of the 350 000 inhabitants are not French but entered the country illegally from Madagascar, Africa and The Comoros Islands. It has created tension with the local Mayotte population who voted to become French in 2009.

France has so far evacuated 538 people of 36 different nationalities from Soudan including 209 French Nationals. The evacuation between Khartoum and Djibouti (French military base in Africa) is ongoing.

In crime, A 5 years old girl has been found dead in a big bag in a flat in The Vosges Department of France. A 16 year old boy has been arrested.

The police Department has sold more than 277 objects that had been confiscated from drug dealers(cars, jewelleries, clothes, etc) for a total of 1,3 Million euros.

PROFESSIONAL OF THE MONTH

France Services

Like many of us, some of you are lost with administration and paperwork! Especially now that it is all online. Fear not, as you can visit one of the 2 197 France services offices all over France. These offices are less than 30 KM from your house and free to visit. In there, you will find a nice person available to help you with all the followings:

-Tax (yes, not only me that does it! And it won’t cost you a bottle of wine- mind you some of you don’t bother with the wine!)

-Change of registration paperwork of cars, driving licence

-Free Access to online services (free computer, scan, printer and internet access)

-Ask for financial help like RSA or CAF, they help you fill in the forms online and found out if you are entitled to Social help.

-CPAM reimbursement and CPAM registration and sorting out problem with your ameli web site.

France services is a unique access to all those services, meaning the person inside the office can check the web site of all those:le ministère de l’Intérieur (home office), le ministère de la Justice (justice department), les Finances publiques (rench finance department), Pôle employ (unemployment office), l’Assurance retraite (retirement services), l’Assurance maladie (CPAM, French NHS) , la CAF (family support), la MSA ( agricultural department)and La Poste ( Post office).

You can see where you closest office is on this web site:

Here are the addresses of the ones close to our offices:

Ruffec: 5 Boulevard des grands Rocs 16700 Ruffec ( next to the tax office).

La Rochefoucauld: 1 Avenue de la Gare 16110 La- Rochefoucauld en Angoumois

Chasseneuil sur Bonnieure : 84 Avenue de la République 16230 Chasseneuil sur Bonnieure

Roumazieres-Loubert : 65 route nationale 16270 Roumaziere Loubert

There is always at least 2 people in each offices ready to help you for free. A computer, printer and scan is also there so they can do any of the formalities online for you.

INSURANCE FRENCH VOCABULARY

| French | English |

| Une Franchise | Excess |

| Un Sinistre | Claim |

| L’Assistance | Breakdown cover |

| Une Assurance | Insurance |

| Un Bris de glace | Windscreen cover (In France it also covers head lights and all windows) |

| Un Remboursement | Reimbursement |

| Une Cotisation | Premium |

| Une Echéance | Renewal date |

| Une Date d’effet | Contract start date |

| Une Résiliation | Cancellation |

| Un Avenant | Amendment |

| Un Devis | Quote |

| Un Incendie | Fire |

| Un Dégats des eaux | Water damage |

| Un Domage electrique | Electrical damages |

| Un Accident de voiture | Car accident |

| Pneu | Tyre |

| Un Chevreuil/ Sanglier | Roe Deer/ Wild boar |

| Un Fossé | Ditch |

| Une Clôture | Fence |

| Un Portail | Gate |

| Une Tempête | Storm |

| Un Arbre | Tree |

| La Grêle | Hail |

| La Neige | Snow |

| La Pluie | Rain |

| Le Verglas | Black ice |

| La Toiture | Roof |

| La Maison | House |

| Les Murs | Walls |

| Le Portail | Gate |

| Grange | Barn |

| Le Contenu | Content |

| Un Objet de valeur | Valuable item |

| Une Carte grise | Car registration paperwork |

| Un Permis de conduire | Driving licence |

| Un relevé d’information | No claim certificate |

Contact us !

In order to discuss and meet your need as best as possible, feel free to contact us with a mail, phone call... We can also schedule a meeting in one of our four agencies... Or directly to your home !