In this issue :

- Isabelle Want’s Article of the Month

- Product of the mont

- This month’s recipe

- Agenda for December & Living in France

- What happened in France & Association of the month

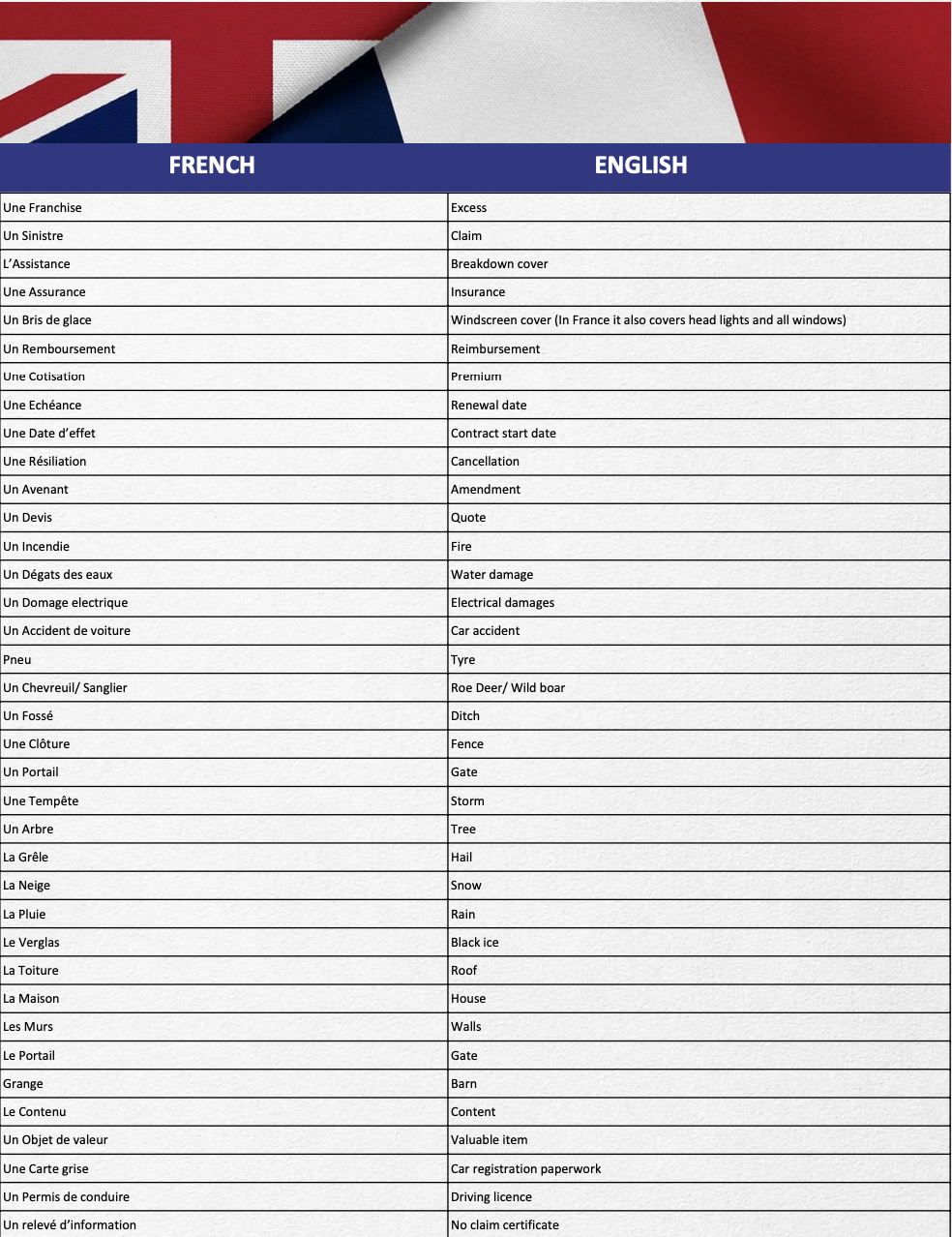

- Insurance French Vocabulary

ARTICLE OF THE MONTH

NEW LAW ON CHIMNEY SWEEPING

From the 1st of October 2023, households using wood or wood pellets for heating are obliged to have their chimney swept by a professional.

Chimney sweeping basically reduces the risk of fire by getting rid of soot and creosote build up present in the chimney. This prevents fires and carbon monoxide poisoning, as well as ensuring the best performance of your heating system.

Before this new law, the commune (your town) used to set the rules (so could be different depending on where you lived). Now, the law is national : https://www.legifrance.gouv.fr/jorf/id/JORFTEXT000047867286

You must sweep your chimney once a year;

It must be done a by a qualified professional. You must get a certificate and keep it safe.

Moreover, this professional is obliged to give you information on the maintenance and best practice regarding using your heating system, to reduce the emissions of fine suspended particles which are responsible for adverse health effect for humans. Basically, this qualified professional should tell you if your heating system pollutes too much!!

The sweeping must be organized by the person using the property, i.e. either the tenant or owner living at the property.

To summarise, you cannot do it yourself anymore and you cannot use those wood logs you used to be able to buy at the supermar- ket which gave you a certificate. It must be done by a qualified Artisan.

And to finish, note that Allianz is asking that your chimney is swept once a year. If you have a fire and it aspires that the cause of the fire is due to the absence of sweeping for more than 2 years, the excess for the claim will be multiplied by 5 with a minimum of 380€. So, if you have an excess at 225€, the excess will be 1 125€. If you have no excess on your contract, the excess will be 380€.

PRODUCT OF THE MONTH

LIFE INSURANCE

Most of us insure our house, cars but not often do we think of what will happen to our closest ones if we die. Life insurance contracts are made for that. So, here is what you can get with the Allianz Prevoyance contract:

Death insurance: Well, that is the main purpose of this type of insurance. You can have cover for any amount above 15 000 euro. For death by accident only or for death by any cause.

Note that you must be below 74 years old when you take out the contract and that the cover stops when you reach 76 years old (the day before in fact). Yes, if you don’t die before you reach 76, you would have paid the premium for nothing. Just like if your house does not burn down or if you never have a claim on your car insurance. But that is the point of insurances. They are made to protect you in case something happens which you hope won’t!!

You are covered straight away (there is a health questionnaire to take it out).

PTIA: That is the loss for good of your autonomy. And this is an option you can add to the life insurance so that if you become non compos mentis, we give you the amount you are insured for.

Rente education: If you die or are PTIA, a yearly income is given to help provide for the children. The amount can go from 900 to 50 000 euro per year and per children. You can choose this option instead of the life insurance or on top of it.

The amount can be different for each child.

Rente Spouse: If you die or are PTIA, a yearly income is given to help provide for your spouse. You can choose this option instead of the life insurance or on top of it. The amount can be between 1 800 and 50 000 per year.

Dreaded Diseases: If you are diagnosed by one of the diseases on our listing, you get an amount of money to enjoy before you die! Disease such as Parkinson, Alzheimer, cancer, Leukaemia, ect (ask for the detailed list if you are interested). You can choose this op- tion instead of the life insurance or on top of it.

Daily Compensation: If you have an accident and/or without a disease you can choose to be covered for a daily amount to compen- sate your loss of earning. This only works if you have actually an earning by working (self-employed or salaried)!!

Hospital cover: You get an amount of between 15 and 100 euro per day you are in hospital. Only works if you are in hospital for more than 2 nights and limited to 730 days or 100 nights per year for Psychiatric or re-educations.

Rente invalidity: Payment of a yearly amount to compensate the loss of earning if you become invalid following an accident and/or without disease. Minimum 7 500 euro per year. You can only take out this option if you also take out the daily compensation option.

Invalidity insurance: You get a capital lump sum if you become an invalid following an accident and/or without disease. Minimum 15 000 euro. Excludes Back and psychiatric problems.

Exclusions: If you have taken part in a war or terrorism, in a criminal activity, having died due to Alcoholism or drugs, following dy- ing from taking part in a stupid bet or suicide the first year of the subscription.

Premium: For someone aged 44, non-smoker, it would be 18 euro per Month to be insured for 100 000 euro in case of death (any causes). If you add 100 000 euro cover for the Dreaded diseases option, it is 44 euro per Month. 59 euro per Month if you do life insurance of 100K and Rente Spouse option of 12 000 per year.

For someone born in 1972, non-smoker, it would be 24 euro per Month for a life insurance of 100K, 39 euro per Month if you add the Rente education option of 4 000 euro per year. 185 euro per Month if you also add the Rente spouse option of 12 000 euro per year.

Obviously premium can vary depending on what type of work you do, if you smoke, do any dangerous sport, etc so please contact me for a quote.

Conclusion: Well, why put it off any longer. If you love your family and want to make sure they will be fine if something happens to you, you should ask for a free quote so contact me!

INSURANCE FRENCH VOCABULARY