There are a number of French governments regulated saving accounts available in French banks so here is a sum up of all of them so you can choose which one is best for you and your financial situation. All those accounts are similar to ISAs in the UK in the way that they are not subject to income tax or social contributions. In short, they are earning interest and those interests are TAX FREE.

It is the French government who set the interest rate on all those type of saving accounts and the government reviews them twice a year (1st of February and 1st of August). So the interest rate is the same in every bank (apart from Livret Jeune). Interest is calculated every 2 weeks (on the 1 and 16th of each month) so if you decide to make a withdraw, it is best to do it either on the 2nd or the 17th of the month so you don’t miss out on 2 weeks interest.

The interest is paid on the 31st of December each year.

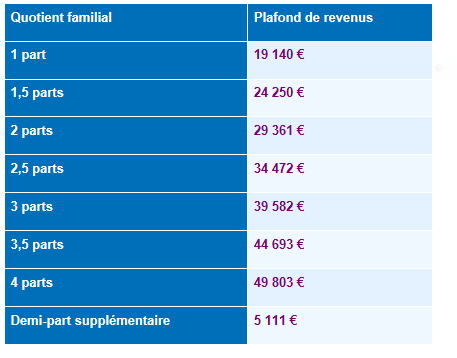

LIVRET EPARGNE POPULAIRE (LEP): Only available to people over 18 who have a “revenue fiscal inferior to the ones according to the figures below (for a couple, 29361 euro of revenue fiscal). The “revenue fiscal is written on your income tax form you receive in September. So you need to be a French resident otherwise you won’t have a French income tax form. The bank asks for a copy of your income tax form to be able to open this account. At the moment interest is 1% tax free. Minimum of 30 euro on it and maximum of 7700 euros. Do note that the compound interest can make it go over the 7700 limit but you can’t add to it and make it go over that limit. Only allowed ONE per person.

LIVRET A (or Livret Bleue): Probably the most popular one in France as it is available to people under and over 18 as well as associative clubs. Minimum of 10 euros and maximum of 22950 euros (76500 for associative clubs). Same thing with the compound interest here as the LEP so you can have a Livret A with more than 22950 on it. At the moment, interest rate is 0.75% tax free. For under 18, they can only take the money from 16 years old, otherwise they need their parents or legal representative. You don’t need to be a French resident but then you will have to declare the interest you earned in the country where you are resident so therefore they won’t be tax free. Only allowed ONE per person.

LIVRET DEVELOPEMENT DURABLE (LDD): With some banks, you have this saving account automatically with your current account. Basically you have no choice! Minimum of 15 euros and maximum of 12000 euros. Same thing again with the compound interests so you can end up having more than 12000 on it. At the moment interest rate is at 0.75% tax free. Only ONE per person. You must be a French resident and over 18 years old.

LIVRET JEUNE: As its title indicate, it is only for young people (French resident) between the age of 12 and 25 years old. Maximum of 1600 euros. Same things with compound interests. The account must be shut on the 31st of December of the year of your 25th birthday otherwise the bank shuts it for you and transfer the amount on an account not earning anything while you decide what to do. You can only take some money out after you are 16 years old otherwise you need one of your parents or legal representative. The minimum interest set by the government is 1% but banks do a better rate than that and it is different from bank to bank. Usually between 2.5% and 3%. Only ONE per person.

Those saving accounts are very good for treasury as they are available straight away. You can even do wire transfer online from the saving account to your current account so they are brilliant for the time when the boiler breaks down or the car repairs are due! However they do come under the French inheritance law so make sure if you are in a relationship (or married) that you have one each and with roughly the same amount on each as if one of you dies, the account of the decease is frozen until the notaire sort out the inheritance (usually takes 6 months). I usually advise my customers to have about 2 to 3 times what they need in a month on one of these in case of emergency (boiler, car repair, etc.) so if you spend an average of 2000 per month, you should have 6000 euros on a tax free saving account. I would then advise to invest in a more long term saving account like the Assurance Vie (please contact me for that) as the interest rate is higher and the amount on it is protected from French Inheritance law. The money is not blocked either but you need at least 2 weeks’ notice to get it.

If you are confused by all this, feel free to contact me as my advice is FREE!

Don’t hesitate either to contact me for any other subjects such as inheritance law, tax, savings, funeral cover or quote on insurances. And check out our web site www.bh-assurances.fr for my previous articles on the “practical pages” of the English page.

Contact us !

In order to discuss and meet your need as best as possible, feel free to contact us with a mail, phone call... We can also schedule a meeting in one of our four agencies... Or directly to your home !