As all of you have received their avis d’imposition, I have noticed two things that could be of interest to you all! And could save you money!

- New information on Social charges:

The French government has changed the law regarding social charges. Before last year, the global rate for social charges in total was 17.2%. It was then composed of 5 different type of tax). One of them is called Prelevement de solidarité and it was at a rate of 2%. This social charge is to help for French pensions so nothing to do with French health system.

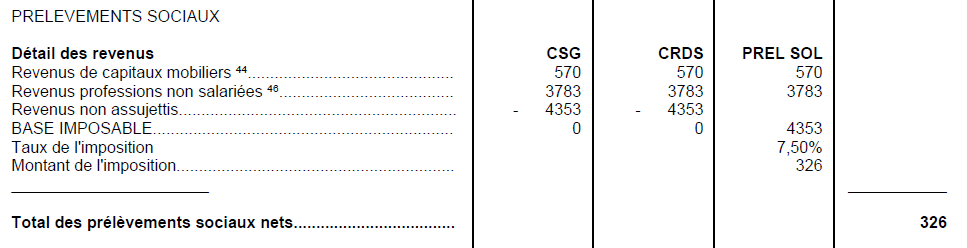

Therefore, even if you are under an S1 and therefore should not pay social charges, you will have to pay the “prelevement de Solidarité- Prel Sol. However, now the rate is 7.5% instead of the 2% is was last year!! Good measure for French people as this tax is only applied to capital gain/interest/rental income and not on income from pension or salary but bad news for people who are not affiliated to the French health system or are under the S1 system (meaning the UK reimburse CPAM for your health expenses in France). Now the rate is CSG at 9.2%, CRDS at 0.5% and Prel Sol at 7.5%.

Some of you are therefore not charged CSG/CRDS but would have been charged 7.5% as per below on your income tax form bill called “avis d’imposition”:

If you are under the S1 system and are paying CSG/CRDS, you can claim it back! To avoid being taxed CSG/CRDS you should have ticked boxes 8SH and 8SI on form 2042-C or online:

If you did not do it, you can claim it back by writing to the French tax office. See previous newsletter on social charges or use the letter below changing the box to tick.

- The Flat tax on interest and capital gain:

Last year our new President had introduced the flat tax meaning our interest or capital gain could be either taxed at source at a rate of 30% (12.8% of income tax and 17.2 of social charges)or be added to our other income on our income tax form and be taxed accordingly (best if your income tax is lower than 12.8%). So, you could choose to be taxed at source at 12.8% income tax or add your gain to the rest of your income and be taxed at the appropriate rate (you choose by talking to your bank and insurance provider for investment and tell them what you prefer).

I have found out that for income outside of France (so, not taxable at source) the French government has automatically applied the rate at 12.8%!! See below what it looks like on your income tax form:

If your total income is below the threshold of 15154 for single or 28275 for couples, you are better off not being taxed at 12.8% as you probably would not have been taxed at all!! Even if you are not above the threshold you are probably better off claiming back as well!!To see if it is worth it, you need to look at last year “avis d’imposition” and check your average tax percentage called “taux d’imposition” like below:

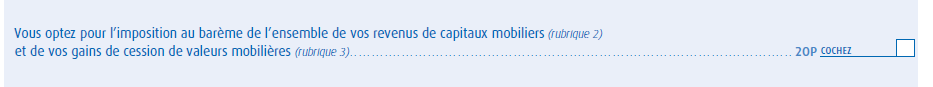

What you should have done is tick box 2OP on the income tax form (page 3 on the 2042).

So, if it is your case, you simply need to write to your local tax office asking them to rectify it.

Here is an example letter below:

Madame, Monsieur,

Nous venons par la présente demander la rectification de notre impôt sur le revenu 2019 sur nos revenus de 2018.

En effet, nous avons fait une erreur lors de notre déclaration et tenons à vous présenter nos excuses. Nous sommes de Nationalité Britannique et les formulaires sont dur à comprendre pour nous.

Nous avons omis de cocher la case 2OP sur la page 3 du formulaire 2042. En effet, nous voulons opter pour l’imposition au barème pour l’ensemble de nos capitaux mobiliers.

Nos numéros fiscaux sont (add your fiscal reference number and FIP number).

Dans l’attente d’une réponse favorable de votre part, veuillez agréer Madame, Monsieur, nos salutations les plus sincères.

Cordialement

If you have done your tax online, you can go back to your declaration online to rectify it and tick the appropriate box.

Contact us !

In order to discuss and meet your need as best as possible, feel free to contact us with a mail, phone call... We can also schedule a meeting in one of our four agencies... Or directly to your home !