When you received your “avis d’imposition” back at the end of August, some of you would have to pay some Monthly amount September to December to make up the tax for the year 2020.

If this was your first tax form, from September to December you are paying the tax for the year 2020 in 4 installments.

If this was not your first tax form, then those 4 Monthly installments are to make up the payments not made or not enough when you paid Monthly from January to December 2020. As you know now, we pay the tax the same year. So the Monthly amount you are paying since January 2021 are for the income tax 2021 based on what you declare the previous year or you are taxed at source on your salary if you are an employee.

This means that some of you will pay the 4 installments to make up 2020 and also the 2021 Monthly tax amount. But do note that if you have had an exceptional income in 2020, then the tax office will not only charge you 4 installments to catch up BUT ALSO increase your 2021 Monthy deposit based on what you declared back in May for year 2020. So if you had cashed in a pension lump sum or had a great bonus in 2020, the tax office has no way of knowing it is a one off so will charge you for 2021 according to this new amount.

Note also, that the tax office does not take into account your tax credit (money given to charity, employment of someone at home, etc) nor the revenus taxed in the UK and therefore given a tax credit in France (teacher, civil servant pensions). For those tax credits, they give you 60% of the 2020 credit back in January (you will see it on your bank statement as “avance credit d impot”). You can change the amount given to you by also going to your personal page.

But worry not! You can change those Monthly amounts (the 2021, not the 4 installments to make up the tax of 2020) yourself by going onto your personal impots.gouv page as per below:

Go to your personal online account and click on “prélèvement à la source” on top.

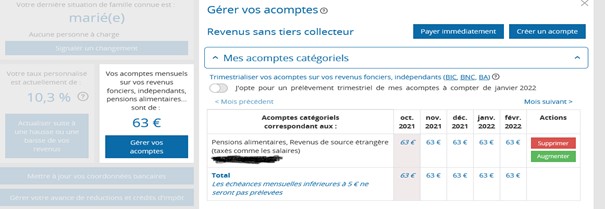

You can then see the Monthly amount, here 63 euros. Click on “Gérer vos acomptes” underneath the amount you want to change.

Then you can either erase, lower or increase the amount by clicking on the red or green button.

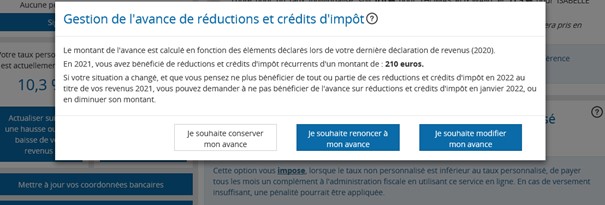

To change the tax credit amount, do the same as per above but then click on “Gérer votre avance de reduction et credit d’impots”.

This window then pops up and you can either delete the credit by clicking on “je souhaite renoncer à mon avance” or change the amount by clicking on “je souhaite modifier mon avance”.

If you are in receipt of a civil servant pension, teacher, etc, may I suggest you change the Monthly amount according to your actual French tax due or erase it completely if you do not pay tax in France. But please do also check that the French tax is not going to give you money back so also erase the tax credit if you erase the Monthly deposit.

Conclusion: Hopefully this was quite clear!! Basically, this article is only important for people who have had an exceptional income in the past year, have a civil servant pension or have a big change of circumstances and know their tax will either increase or decrease. Good luck!